November 20, 2013

Unforced Errors

Virginia lawmakers have made two big errors when it comes to making sure more Virginians have access to health insurance: refusing to create a state health insurance marketplace and creating a coverage gap that’s now claiming its first victims.

In Virginia, 42,341 people completed insurance applications through the federal marketplace Web site in October. But if Virginia established its own marketplace and pulled in the additional resources for consumer assistance that would have come with it, like Kentucky did, enrollment could have been closer to 127,000. That’s because states that operate their own marketplaces under the Affordable Care Act had vastly more success than the federal site in signing up people expected to be eligible for subsidized insurance plans.

The enrollment in Virginia represents 6.8 percent of the 624,000 people in Virginia who could be eligible for tax credits that will help them pay for their health insurance premiums. But that enrollment pales in comparison to the enrollment numbers from state-based marketplaces. In Kentucky, 20.3 percent of the 375,480 who could be eligible completed applications through their state-based marketplace in October.

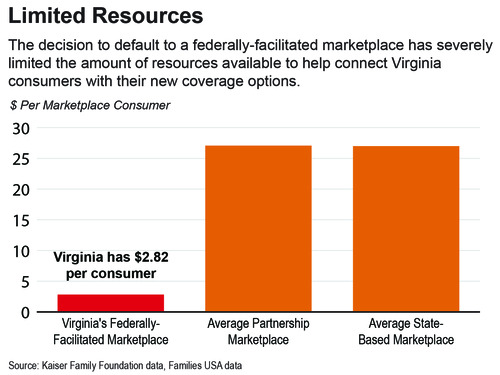

If Virginia had taken on a greater role in helping people get the coverage they need, the state could have received millions of dollars to create a state-based marketplace and to educate and enroll consumers. For example, states that agreed to help their residents get coverage have received about $27 per eligible person. Virginia got only $2.82 per eligible enrollee because of the decision to default to a federally facilitated marketplace.

While it may be too late for Virginia to get more funding this year, there is still time for the state to get additional help with consumer assistance in 2014 by moving to a partnership or a state-based marketplace.

There’s also early evidence that Virginia’s failure to offer more low-income residents coverage through Medicaid is causing some marketplace enrollees to fall into a coverage gap, stranding them without insurance. Of the 42,341 Virginians who completed insurance applications through the federal marketplace Web site in October, more than 32,000 people have been found to be eligible to purchase coverage in the marketplace. But of the 32,000 eligible, less than 10,000 of them are reported as eligible for financial assistance.

Given the profile of Virginia’s uninsured, it is likely that a substantial number of those found ineligible for assistance make too little to qualify for tax credits that would help them afford private coverage but too much to qualify for Medicaid under existing state rules. That’s because Virginia has yet to expand Medicaid as envisioned by the Affordable Care Act, creating a coverage gap for hundreds of thousands of people. For example, working parents in a family of four who make more than $12,246 and less than $23,550 will not have any affordable health insurance options available to them.

Early enrollment numbers are off to slow start, but there’s time for a rally. From Virginia’s perspective, the next move should be to expand Medicaid as soon possible to help low-income people who have fallen into the coverage gap. And then, thinking long-term, Virginia should also move towards a partnership or state-based marketplace so that consumers can get the assistance they need to get covered.

–Massey Whorley, Senior Policy Analyst