December 15, 2022

Statement on Governor Youngkin’s Proposed Budget Amendments

Youngkin’s Proposals Prioritize Corporations Over Virginia Families

Ashley C. Kenneth, President and CEO of The Commonwealth Institute for Fiscal Analysis (TCI), released a statement regarding Governor Youngkin’s Proposed Budget Amendments:

“Families in Virginia deserve great schools, thriving neighborhoods, and support during hard times. For all of the discussion about a ‘budget surplus,’ the reality in communities across the commonwealth is that too many families are struggling to make ends meet and public education — one of the true cornerstones of economic opportunity and competitiveness — remains underfunded.

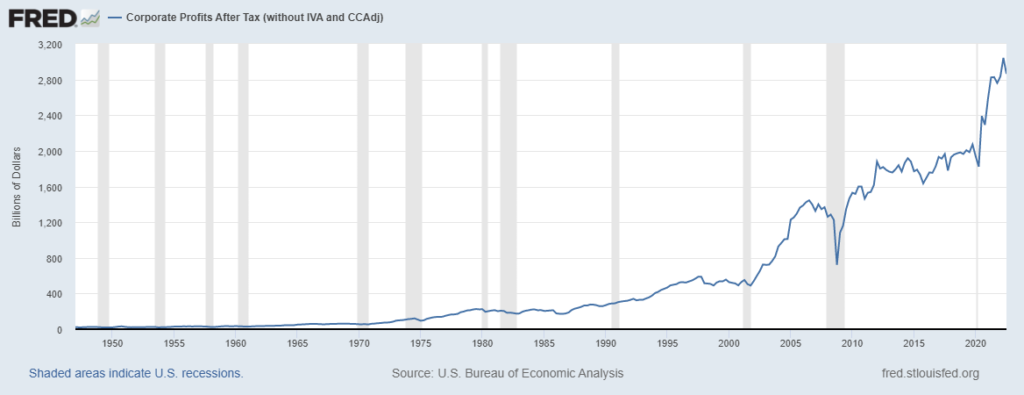

“Overall, Governor Youngkin’s proposed budget amendments prioritize corporations over families, even at a time in which corporate profits are near all-time highs and inflation is forcing everyday families to live paycheck to paycheck. Specifically, the governor’s tax proposals unveiled today cost $1 billion and a majority of the benefit is reserved for profitable corporations. Rather than ensuring corporations pay their fair share, the governor’s plan would tax a family’s income at a higher rate than corporate profits.

Corporate Profits After Tax (Source)

“The governor’s proposals misunderstand what’s required to build an economy that works for all of us. Slashing $1 billion in Virginia’s budget — costs that will balloon to $2.9 billion for the next budget cycle — undermines our ability to invest in key priorities like strong public schools, better health care, and more affordable housing and child care. These are the building blocks of broad-based economic growth and prosperity.

“For example, for a fraction of the money the governor wants to spend on corporate tax cuts, Virginia could fund the state share of over 1,100 school counselors, 1,200 nurses and licensed mental and behavioral health providers in our schools, and 700 more instructors for students who are learning English. Nationally, Virginia ranks 41st in state support for public education and 44th in the nation in public assistance. The governor’s proposals would drain important resources that Virginia families need to navigate inflation and a potential recession. Instead, policymakers should be focused on increasing assistance through SNAP, TANF, and a state-level Child Tax Credit that would invest in Virginia’s children and families.

Moving forward, it is our hope that any final budget agreement both centers and reflects the needs of everyday families in Virginia.”