May 8, 2015

A Gift That Matters

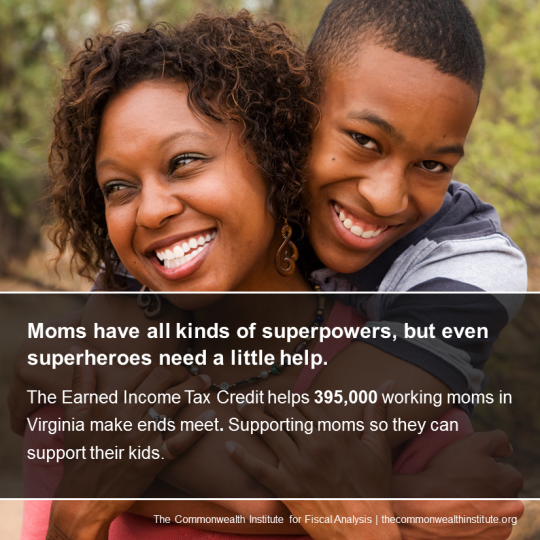

This Mother’s Day, let’s show hard-working moms how much we care by giving them something they can really use – a little breathing room – by supporting the Earned Income Tax Credit (EITC).

In Virginia, our state’s earned income credit works in concert with the federal EITC, which helped 395,000 mothers who work hard and struggle to make ends meet boost their income, climb out of poverty, and build a better life for their kids.

The credits help reduce these moms’ taxes and, in the case of the federal credit, actually puts money back in their pockets. This effectively increases their income and helps them meet basic family needs, essentials like rent and groceries. But the extra income also allows them to pay for the very things that allow them to keep working and improve their family’s situation, like child care and transportation. In fact, women who received the extra help from the EITC in recent years saw their wages grow faster than similarly situated women who did not.

The EITC has been hugely successful at lifting people out of poverty. Nationally, the EITC – along with the federal child tax credit – lifted 9.4 million people out of poverty in 2013. That’s because the EITC boosts the incomes of low-wage mothers struggling to make ends meet and gives them just a little bit of breathing room to help build a brighter future.

And this has benefits that ripple throughout their families and into our communities and economy.

The EITC helps keep families healthy and helps kids do better in school and beyond, so families can build a better life for themselves. Mothers eligible for the EITC are more likely to do healthy things like get prenatal care, which leads to healthier babies. And children who benefit from the EITC perform better in reading and math and are more likely to graduate from high school and go on to college. All of this sets up the next generation to be more successful than their parents and help strengthen our economy.

Still, there’s one more step state lawmakers should take to make sure hardworking mothers can make the most of the state’s version of the EITC.

Currently, the state allows low-wage workers to claim a portion of their federal EITC on their state taxes. But unlike with the federal credit, which gives taxpayers the full value, taxpayers in Virginia who claim the state credit can’t get back what they don’t use. That means families can use the state credit to reduce the state income tax they owe, but it doesn’t help them deal with the other state and local taxes they pay.

And that’s a problem because state and local taxes – like sales and property taxes – weigh more heavily on low-wage families than better-off families, eating up a larger portion of their income. So for hard-working mothers struggling to make ends meet, just reducing their state income taxes doesn’t go far enough towards treating them more fairly.

As lawmakers think about what they can do for the moms in their districts, they should hold off on the chocolates and flowers. Instead they should consider fixing this flaw in the state’s earned income credit.

–Massey Whorley, Senior Policy Analyst