September 17, 2015

For Too Many Families, Pay Doesn’t Make Ends Meet

The Economic Policy Institute’s new family budget calculator, together with wage data, shows that wages for typical folks (those with median wages) have stayed flat, while child care and health care costs have grown.

In fact, after adjusting for inflation, wages for the typical Virginia worker have not increased in a decade. The typical Virginia worker today is paid $19 an hour. For someone working full-time, year-round, that’s $38,000 a year. The budget calculator details just how far away that wage is from what it takes to support a family.

In the Richmond area, it takes $50,815 to provide a modest but decent standard of living for a family with one adult and one child. In Hampton Roads, it’s $55,645. Even in the lower-cost Roanoke area, that family needs $45,573 to pay for rent, child care, food, health care, and other basic expenses.

Not surprisingly, it can be even tougher for larger families. A two-parent, two-child family in Hampton Roads with a stay-at-home parent – so no child-care costs – faces $61,078 in expenses to make ends meet. A working parent with a stay-at-home spouse and two kids would have to make about $30.54 an hour to make ends meet at that region, well above the typical statewide wages of $19 an hour.

There are two ways to look at the stagnant pay of America’s workers. The short-term story is that too many still are unemployed, competing for too few jobs. In that situation, employers don’t feel they need to raise wages to compete to get workers.

The longer-term story is that, for several decades, wages haven’t kept up with profits. The rising productivity of American workers means they are helping to boost corporate earnings. But working folks are taking home a smaller slice of the economic pie than 35 years ago. Meanwhile, business owners and shareholders are getting a bigger slice. This increasing concentration of the fruits of economic growth in the hands of a relatively few people actually hurts the overall economy because if ordinary families aren’t able to purchase goods and services, that crimps demand.

There are many reasons why wages for American workers aren’t keeping up with rising productivity. For the lowest paid, at least part of the story is the eroding value of the minimum wage. For middle-class working people, financial deregulation, changes in corporate governance that have allowed executive pay to soar, and the eroding bargaining power of unions appears to have contributed.

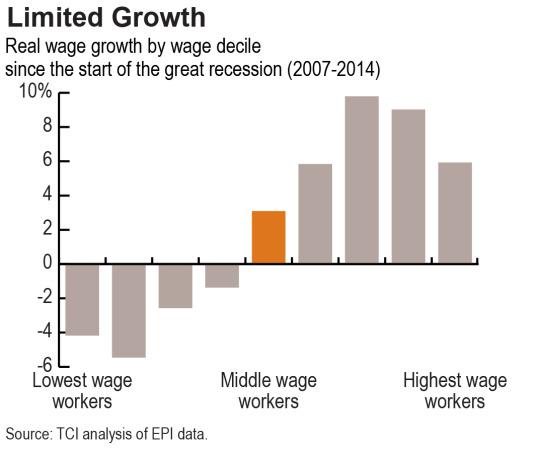

Meanwhile, for those at the top, income has increased rapidly, making ordinary folks feel like they can’t keep up. Typical Virginia workers now make just 39 cents for every dollar that the highest-income Virginians bring home. That’s down from 42 cents on the dollar a decade ago, and 47 cents in 1979.

And for many workers and families, it’s even harder to make ends meet because they make less than the typical wage. A full-time, year-round minimum wage worker in Virginia is paid just $14,500 a year. And 3 in 10 Virginia workers make under $13.24 an hour, or just $26,480 a year. Pay that low won’t support even a single adult in any region of Virginia, not to mention a family.

Paying workers enough to make ends meet, making sure everyone can afford quality, dependable childcare so parents who need to work can, and closing the coverage gap that keeps so many working adults from being able to afford medical care would help everyone. The economy is stronger when more people prosper.