June 27, 2014

From Bad to Worse

It’s called the “single sales factor,” an obscure corporate tax provision that lets manufacturers lower the amount of tax they pay on corporate profits. First enacted in Virginia in 2009, it gets fully phased in this year.

Simply put, the provision allows multistate corporations with operations in Virginia to use the share of their nationwide sales occurring in the state as the sole basis for determining how much tax they owe to Virginia on their profits.

It was sold as a way to boost manufacturing jobs in the state. But it doesn’t work.

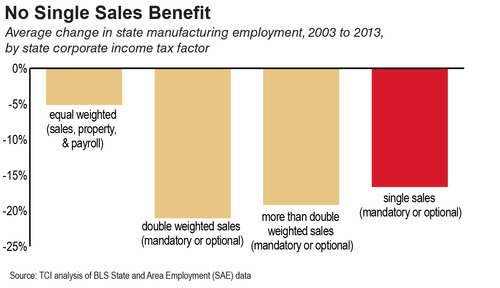

Looking at the experiences of all 50 states over the past 10 years, it’s clear that the way corporate income taxes are calculated doesn’t determine the rate of growth (or loss) in a state’s manufacturing employment. Only three states have even had job growth in the manufacturing sector since 2003, and of those, two – Alaska and North Dakota – use a more traditional method of calculating their corporate income tax called “equal weighting.” It is based on the share of a corporation’s total property, payroll, and sales in the state, giving equal weight to each.

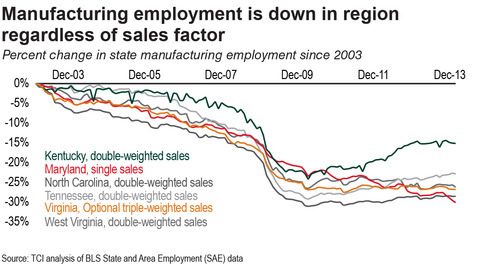

Just looking at Virginia and its neighbors shows how factors other than the corporate income tax calculation influence the strength of manufacturing. All the states in our region have lost manufacturing jobs since 2003. But the best performer – Kentucky – counts the sales factor twice in corporate tax calculations, while the worst performer – Maryland – has a single sales factor. Virginia, which had used a method that counted the sales factor twice but also considered the corporation’s payroll and property location before it started phasing in its single-sales factor, is in the middle of the pack.

The fact is, there are lots of things businesses take into account when they’re considering where to build, expand, or shut down facilities: access to roads, rail lines, and ports; the availability of a skilled workforce; the condition of the power grid, water lines and other infrastructure; and proximity to markets all play a role.

What doesn’t appear to play a big role is the method used to calculate income tax on company profits. For Virginia to be giving up much-needed revenue, when there’s no evidence that doing so promotes economic growth, is wrong-headed and irresponsible.