March 29, 2013

Of Potholes and Donut Holes

(Updated 3:15 p.m. 3/29/13. We fixed an error in the table.)

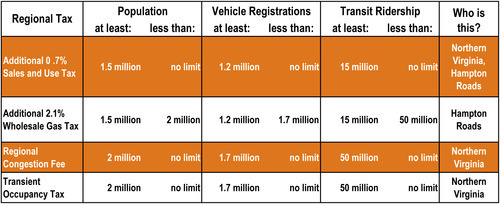

Something missing from all the coverage of the governor’s transportation amendments caught our attention: the conditions under which the taxes in the transportation package are imposed through the Regional Planning Districts (RPD) aren’t uniform. They’re different depending on the particular tax. And, they set up an odd “donut hole” of sorts by which a growing region of Virginia may find that they soon fall in (and eventually out) of the particular hole, and thus are subject to (and then maybe exempt from) the different taxes.

Here’s how it breaks down:

So what do these new taxes and the criteria around them actually mean for Virginia’s 21 Planning Districts? Let’s use one of the regions that is affected by these changes as an example: Hampton Roads.

Currently, Hampton Roads, along with Northern Virginia, fits squarely within the criteria for the additional sales tax. Once a Regional Planning District hits the threshold levels of population, vehicle registrations, and transit ridership set up for that tax by the governor’s amendments, they are then subject to the additional 0.7 percent sales tax. The same is true for the regional congestion fee and the transient occupancy tax.

The additional gas tax is treated differently, however. Instead of simply establishing a threshold level, this tax provision has both upper and lower bound limits for the population, vehicles registered, and ridership criteria.

So Hampton Roads also fits within the criteria for the additional 2.1 percent wholesale tax on gas. But based on the upper bound limits placed on the three criteria for this tax provision, it will only be subject to this tax until its population hits 2 million OR vehicle registrations hit 1.7 million OR transit ridership hits 50 million. Once the region grows beyond any of those limits, the additional gas tax will vanish! Then once it grows beyond all three of those limits, it will suddenly be subject to the regional congestion fee and transient occupancy tax that currently only apply to Northern Virginia.

So in the governor’s efforts to avoid constitutionality concerns over how the regional taxes were imposed in the original legislation, his amendments create a sort of donut hole of tax policies that Virginia’s 21 Regional Planning Districts may fall into – or out of – in the future.

Something to chew on.

–Sara Okos, Policy Director