May 13, 2014

Virginia’s Evaporating Gas Tax

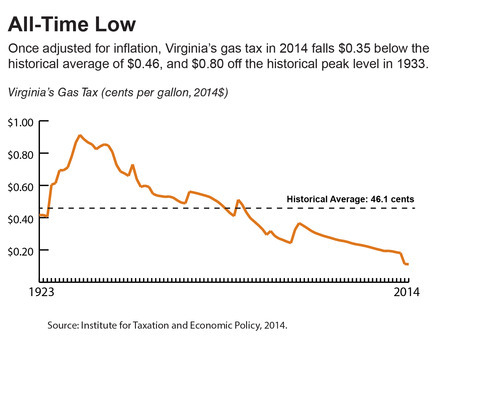

Virginia’s gas tax is at an all-time low, and that’s not a good thing. A new report released last week shows that Virginia’s gas tax now falls roughly 35 cents below its historical average, once adjusted for inflation. This is the largest drop of the 10 states that are at the bottom, according to the report.

Virginia’s gas tax started at 3 cents a gallon in 1923 – over 90 years ago. It was never indexed to inflation, which means that over time the money collected couldn’t pay for as much road construction and maintenance as was needed. So, to make sure the resources were available for a good transportation system, Virginia raised its gas tax semi-regularly over the last century up until the late 1980s.

In 1987, the tax kicked up to 17.5 cents per gallon with no change for 25 years. All the while inflation kept eating away at what the tax receipts could provide for Virginians. That’s one reason legislators and then-Governor McDonnell cited for passing a transportation funding overhaul in 2013.

But they revamped the gas tax in a way that reduced the rate.. By converting that tax from 17.5 cents per gallon to a 3.5 percent tax calculated on the wholesale price of gas, the rate declined to about 11 cents per gallon, which is about what you pay today.

Here’s why that’s a problem. Once you convert gas tax rates over the years to 2014 dollars, that 11 cents per gallon in place today can pay for only about a quarter of the transportation improvements that the original gas tax could. The 1923 rate of 3 cents per gallon is equivalent to about 42 cents per gallon in 2014 dollars.

Now you might think Virginia’s lower gas tax is a good thing. Think again. In order to lower the gas tax, legislators raised other taxes – namely, the state sales tax – to pay for the roads the gas tax used to cover. It’s like squeezing a balloon: one side shrinks but the other side gets bigger. And these new sales taxes mean low-income households in our state – people making less than $21,000 a year – pay a larger share of their income toward transportation than wealthier households making $221,000 and above.

But there’s likely even more trouble ahead for low-income Virginians. The transportation funding package passed last year relies on Congress to pass legislation requiring online and catalog merchants to collect state sales taxes from their customers. If Congress doesn’t do so – which is very possible – then the state gas tax jumps to 5.1 percent in January 2015, increasing another tax that hits low-income Virginians harder than high-income people.

The value of the gas tax is down, sales taxes are up, and the gas tax is poised to ratchet up higher when Congress doesn’t act. As lawmakers look ahead to the 2015 session, they should consider adopting some kind of relief for the hard-working, low-income Virginians who are paying a greater share of their income to the state’s transportation system than their higher-income neighbors.

–Sara Okos, Policy Director