February 19, 2013

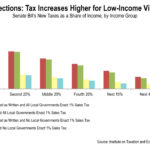

While the Senate’s version of Governor McDonnell’s transportation bill looks very different from the bill passed by the House – and it is – the two versions have one major problem in common: they rely on regressive tax increases that will have low-income Virginians paying a greater share of their income towards funding transportation.

As the conference committee works to craft the best compromise possible for Virginia’s roads, lawmakers should make sure it’s the best it can be for Virginia’s families, too. To do that, conferees should include targeted relief mechanisms – like a refundable earned income credit or a new targeted rebate program – to effectively offset the disproportionate impacts of regressive gas or sales tax increases on Virginia’s low- and middle-income families. >>Get the full report