April 19, 2013

Changing the Station: Sales Tax is Now the Leading Source of Transportation Funding

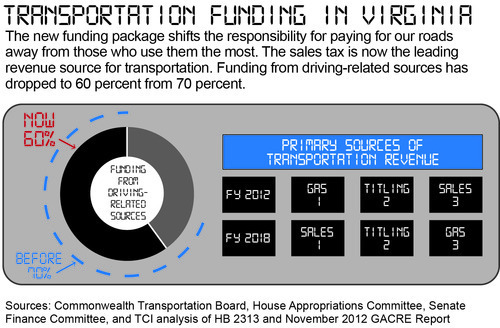

As we noted in our report on the new transportation funding package, less than 10 percent of the new tax revenue is from driving-related sources, such as the gas tax, shifting the responsibility for funding transportation away from those who use the highways the most. Just how big of a shift does this represent? Turns out, it’s pretty big.

Currently, nearly 70 percent of the state’s transportation revenue comes from driving-related sources. (See note below.) But under the new funding package, that share drops to around 60 percent.

Now that may not sound like a lot, but consider that in the process the gas tax drops from the leading revenue source for transportation to third place; and sales tax moves into first.

Here’s how it happens. While there are a lot of moving parts in the package, two components are driving this shift: the conversion of the gas tax and the changes to the sales tax.

Let’s look at the gas tax first. The new transportation legislation converts the existing 17.5 cents per gallon gas tax to a 3.5 percent tax levied at the wholesale rate. As a result, gas tax collections will be about $134 million lower per year by 2018 – when all the components of the funding package are fully phased in – than if Virginia stuck to the existing gas tax.

How does the new law make up for the lower gas tax revenue? This is where the sales tax comes in. To close the gap, three things happen. First, the law diverts more of the existing sales tax to transportation, leaving less for [education, public safety, and everything else the state pays for]. Then the law raises the sales tax three-tenths of a percent and gives ALL of that new revenue to transportation. Finally, it banks on Congress allowing Virginia to collect sales tax from online retailers and divert 3.5 percent of that revenue to transportation.

Taken together, these tax changes constitute a major change in who pays for our roads.

The bottom line is this: while the new funding package provides a needed boost for Virginia’s transportation investments, it weakens the link between costs and benefits of our transportation system by shifting the responsibility for paying for our roads away from those who use them the most.

–Sara Okos, Policy Director

Note: For the purpose of this analysis, we look solely at transportation revenues from state sources. These are the same taxes and fees included in the November 2012 GACRE report’s section on Non-General Fund Revenues. In addition to those revenue sources included here, federal, local and toll revenues also finance Virginia’s transportation program. They are not included in this analysis because, as mentioned in the GACRE report, those sources “do not determine the fiscal capacity of the state’s transportation program.”