March 3, 2016

Coal Tax Credits Aren’t Working

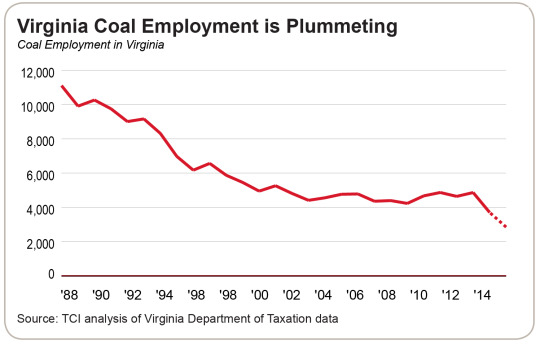

Virginia spent $737 million (in 2015 dollars) on coal tax credits between 1988 and 2014 in an attempt to slow the decline in coal employment in southwest Virginia. During that time, annual coal tonnage and employment fell 67 percent. Preliminary data show that employment continued to decline another 23 percent to 2,850 in 2015.

The decline is nothing short of tragic, but Virginia’s expensive coal tax credits have done little to slow the decline. Compared to market forces like the price of metallurgical coal, production costs, and alternatives, Virginia’s coal tax credits can’t begin to make a difference.

Legislation extending one of Virginia’s two coal tax credits and a key component of the other has passed the General Assembly and will be reviewed by the governor.

Read our full analysis, Coal Tax Credits Aren’t Working, here.

–Aaron Williams, Research Assistant