August 14, 2015

Collecting What’s Owed: Airbnb and Virginia’s taxes

One of the largest bicycle races in the world is headed to Richmond, and it’s fueling debate about the legality of the popular lodging website Airbnb. While Airbnb navigates its way through the legal hurdles, Virginia and many of its localities are leaving millions of dollars of badly needed tax revenue on the table.

That’s because policymakers have not yet taken the steps to make sure Airbnb collects and sends to the state the required taxes that must be paid on hotel rooms and similar short-term lodging. And a big opportunity to do so is about to race right by.

Airbnb allows individuals to rent short-term lodging – from a pull-out sofa to a mansion – to complete strangers, much like Uber matches riders with drivers. Its viral popularity with travellers has allowed the Web site to prosper in the sharing economy.

From September 19-27, tens of thousands of cycling fans are expected to descend on Richmond for the UCI Road World Cycling Championships – one of the most important bicycle races in the world. Many residents in the metro-Richmond area hope to cash in on the event by leasing out lodging through the Web site. But when people use Airbnb in Virginia, millions of dollars of sales and occupancy taxes go uncollected.

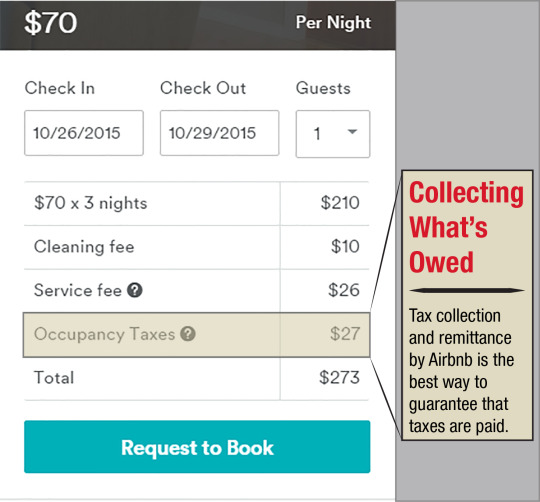

The state requires that a sales tax of 5.3 percent to 6 percent be collected by hotels, motels, and campgrounds for reservations of fewer than 90 days. One percent of that sales tax goes to localities, while the rest goes to support state services and regional transportation funds.

In addition to the sales tax, communities across Virginia are missing out on occupancy taxes. Localities set and collect occupancy taxes for reservations of fewer than 30 consecutive days. Most aren’t allowed to charge more than 2 percent unless the excess is earmarked for tourism or transportation. In Richmond, Henrico, Hanover, and Chesterfield, the entire 8 percent occupancy tax goes to repaying debt from building the Greater Richmond Convention Center. But since any extra revenue goes to the localities’ general funds that pay for other important services and any shortfalls in revenue threaten the creditworthiness of communities, occupancy tax revenues can have a profound effect on everything from education to roads.

Unfortunately, Airbnb is not collecting taxes in Virginia.

In most places around the country, Airbnb merely suggests renters charge and remit occupancy taxes on their own. But these taxes are confusing for casual Airbnb hosts to understand and a lack of enforcement means collections are unchecked and incomplete. In certain communities, Airbnb allows hosts to opt-in to a system that enables Airbnb to collect the taxes directly from customers and pay the taxes to the state and localities, but it is still optional and is far from universal in participating in communities.

Earlier this year just across the Potomac, Airbnb reached an agreement with Washington, D.C. to collect and remit occupancy taxes on all their rentals in the district. It’s too early to estimate the revenue impact there, but in six months in Portland, and three months in San Francisco, Airbnb collected and remitted a combined $5 million under similar agreements. Virginia’s revenue potential may not be as high as Portland and San Francisco combined, but $5 million in nine combined months is far from insignificant.

In May, North Carolina reached a deal making it the second state for which Airbnb collects statewide sales and occupancy taxes. At the same time it reached agreements with many cities in the Tar Heel state, including Wake and Durham, to collect local occupancy taxes.

Requiring Airbnb to collect the taxes is the only way to guarantee collection, and it shifts the burden from individuals to the company. Furthermore, Airbnb listings grew ten-fold between 2011 and 2014, so tapping into this revenue stream could become more valuable in the future as more and more people use the website.

Airbnb is likely here to stay. As our communities struggle to provide essential services like quality education, roads, and bridges, Virginia should require Airbnb to collect the sales and occupancy taxes that are already owed – preferably before another world-class event crosses the finish line.

– Aaron Williams, Research Assistant