July 11, 2014

Down a hole, and still digging

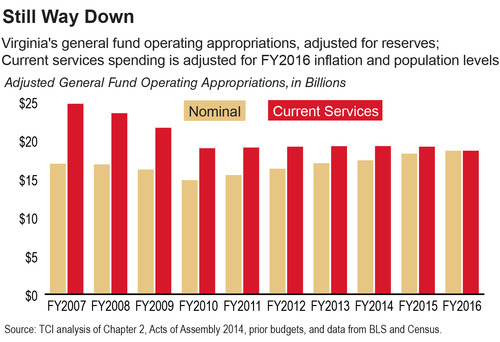

Virginia’s level of investment in our schools, communities, and future will hit a new post-recession low next year.

How can that be, when the state’s total general fund spending – the pot of money that legislators have the most discretion in spending – is higher than in past years?

Because that’s not the whole story.

Virginia’s population grows every year, and with that growth comes a need for higher levels of investment in things like K-12 education, since we now have more students in our public schools than ever before. Plus, the costs of buying goods and services goes up every year for the state due to inflation, just like it does for you and me.

After adjusting for factors like growing school enrollment, the additional need for Medicaid due to the weak economy and loss of jobs and benefits, and inflation, the real level of investment for the fiscal year 2015 – which started July 1 – is $5.4 billion below 2007 levels. And it will be even worse next fiscal year at $6.1 billion below 2007 levels, a new post-recession low point.

These reductions in state investments may lead to larger class sizes, fewer educational services, and increased pressure on hospitals as they respond to these cuts.

Education has been particularly hard-hit. State funding for K-12 schools is down by about $1.5 billion per year compared to before the recession. Other state education spending – almost all of which goes to higher education – is down by $1.4 billion this year and $1.6 billion next year.

How did this happen?

When employment and consumer spending decreased during the recession it caused a deep dip in state revenue. Virginia legislators chose to close almost all of the resulting revenue gap with budget cuts, rather than raising significant new revenue. Now, with revenue again expected to be lower than both prior projections and the amount of money needed to maintain the current level of services to Virginia’s growing population, legislators are again closing almost all of the resulting gap with cuts rather than new revenue.

It doesn’t have to be this way. When the General Assembly returns in January to revise the current budget, they need to think about taking a more balanced approach – one that includes new revenues – as opposed to this cuts only approach that threatens our economic health and prosperity.

–Laura Goren, Policy Analyst