March 20, 2015

Leaving Money on the Table

Every year at tax time, Virginia’s Earned Income Credit (EIC) helps hundreds of thousands of working families reduce their taxes. But for all the good that it does, the state’s credit is missing a critical piece that forces families across the state to leave some of their credit – and their cash – on the table.

Unlike with the federal credit, which gives taxpayers the full value, taxpayers in Virginia who claim the state credit can’t get back what they don’t use.

That means families can use the Virginia EIC to reduce the income tax they owe, but it doesn’t help them deal with the other state and local taxes they pay. In fact, they often pay more of their income in state and local taxes than better-off families. That’s because sales and property taxes weigh more heavily on low-income families. So for many families, just reducing their state incomes taxes doesn’t go far enough.

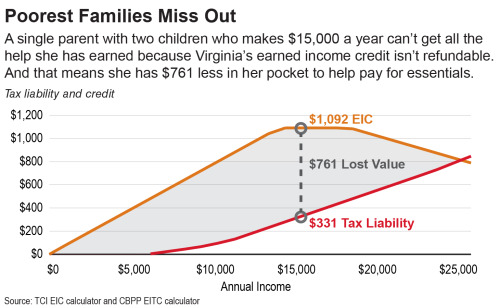

For example, a single parent of two earning $15,000 would get a credit of $1,092. However, that’s $761 more than the amount of income tax she owes. So while her income tax gets reduced to zero, she still must leave most of her credit on the table. That’s money that could be used to help pay a utility bill, buy food for the family, or pay for a car repair.

You can see this in the figure below and in our updated EIC calculator.

There’s an easy fix to this problem: Lawmakers can improve the state’s EIC by making it refundable, helping thousands of low-income, working families by giving them the full value they’ve earned.

Even just making the EIC partially refundable would be a step in the right direction. But so far, that’s too much for Virginia’s lawmakers, who voted down proposals to do just that during the last session.

So as families of all income levels file their taxes this year, many of those at the lowest end of the scale will be denied the tax credits that they’ve worked hard to earn. And that just doesn’t seem fair.

–Mitchell Cole, Policy Analyst