February 13, 2014

Money Doesn’t Grow on Trees

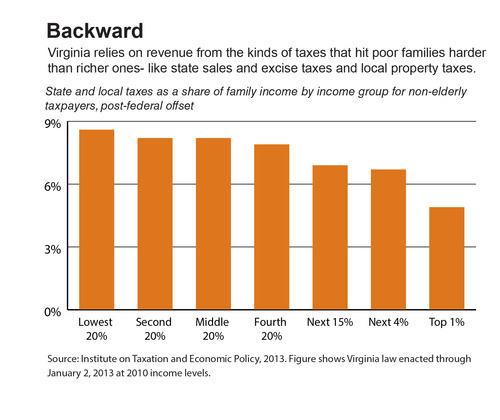

Here’s a head scratcher for you: as your income rises, the share of your income that goes toward paying state and local taxes falls.

That may sound backward, but lower-income households in Virginia actually pay more as a share of their income toward key revenue drivers like the state sales tax and local property taxes than their more affluent neighbors.

And the contrast is pretty stark. Households making under $20,000 a year pay, on average, almost 9 percent of their income in state and local taxes. But households that earn at least $479,000 a year pay under 5 percent of their income in state and local taxes.

Why is the system so upside down? Like most states, Virginia relies on a mix of taxes to invest in priorities like education, health, and infrastructure. But some of those taxes hit poor families harder than richer ones. Because low- and middle income households spend a greater share of their income buying the basic necessities that are subject to the state’s sales and excise taxes (like groceries, toiletries, clothing, school supplies, and gas), the taxes on those things eat up a greater share of their income. Property taxes have a similar effect. The state’s graduated income tax helps balance some of this out – higher levels of income are taxed at higher rates – but it doesn’t go far enough to really tip the scale.

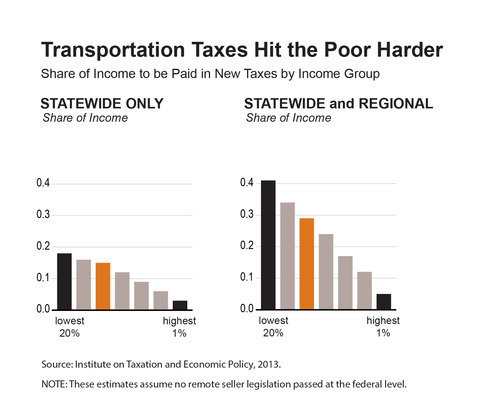

This is why the transportation package passed last year is so problematic for low-income Virginians. By raising sales taxes and fees, the transportation package that passed last year took an already lopsided way of generating revenue and made it even worse. Once fully phased-in, the very lowest-income households in the state will pay six times more of their income in the new taxes for transportation than people with incomes in the top 1 percent. And for low-income families in Northern Virginia and Hampton Roads, where the tax hikes were larger, the impact will be even more severe.

It doesn’t have to be this way. Lawmakers have at their disposal a tool that could go a long way to help level the playing field and promote upward economic mobility, with just a small adjustment. Making our earned income credit (EIC) refundable is among the most effective and targeted strategies we could use to reduce the disproportionate impact of these taxes on low-income working families. That’s why so many other states have this refundable credit.

As lawmakers hammer out the details of the commonwealth’s next two-year spending plan in the coming weeks, it’s worth remembering that Virginia’s taxes hit the poor the hardest. Including a refundable EIC in the new budget presents a unique opportunity to help struggling families not only get by, but get ahead.

–Sara Okos, Policy Director