June 19, 2014

The Story Behind the Shortfall

Virginia closed the books on 2013 with nearly $300 million more than expected in revenue from income taxes people paid on stocks, bonds and other investments. This is called “non-withholding” revenue since, unlike other tax revenue, it is not withheld from people’s paychecks.

But we’re likely to close the 2014 fiscal year, which ends this month, with non-withholding revenue not just below forecast, but below last year’s level.

Last year’s boost was largely the byproduct of wealthy taxpayers collecting bonuses or selling stocks at the last minute in 2012. They did this to avoid the higher tax rates they were anticipating in 2013 because of a federal budget dispute. The tax shifting by wealthy residents meant that states felt a one-time bump.

Combined with a strong 2013 stock market, this bump created challenges for forecasting non-withholding revenue in 2014. Forecasters got it wrong, and as a result the state has less revenue than it expected to pay for schools, health care and other needs for the current fiscal year that ends June 30.

Virginia is not alone in this boat. Of the 38 states that have an income tax and for which data is fully available, 33 had revenue declines over the winter and spring. They range from 31.1 percent in Ohio to 0.6 percent in Pennsylvania.

Beyond the problems with non-withholding forecasting, Virginia’s policymakers are concerned that growth in payroll withholdings – the state income tax that is withheld from workers’ paychecks – will continue to be very slow in the next two years. They’re probably right.

During a typical economic recovery, we’d see robust job growth as businesses began rebuilding and rehiring. And as employment rebounded, we’d see a tighter labor market lead to rising wages. More employed workers and higher wages would mean higher withholding tax revenues.

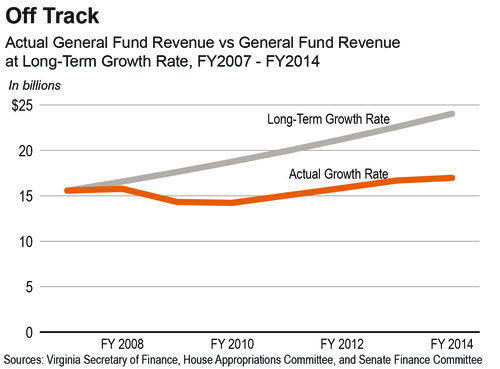

But this recovery has not been typical. Instead, for the last few years Virginia has seen relatively slow employment growth and stagnant-to-declining wages for most workers. As a result, revenue from paycheck withholdings has been growing at a relatively slow 3 percent per year . The revenue forecast for the upcoming fiscal years anticipated that the recovery would finally pick up steam over the next few years, leading to faster job growth and more robust increases in payroll withholding taxes.

But the number of jobs in Virginia in April – the most recent month for which data is available – was actually slightly below last year’s levels. The recent employment stagnation in Virginia has actually put us behind most other states and the country as a whole in recovering from the recession. That’s an economic reversal that Virginia cannot afford while too many workers are still searching for work after the Great Recession and state revenue is still off track.

This slow employment growth has tempered the expectations of faster employment and payroll withholding growth over the next two years. If payroll withholding continues to grow at the slower 3 percent pace in the 2015 and 2016 budget years, state revenue will be another several hundred million dollars below expectations over the biennium. Virginia policymakers are now building a cushion into the state budget to account for this possible slower growth in payroll withholding taxes.

Yet while lawmakers adjust their revenue forecast to reflect these realities, their response to the shortfall can’t be just to cut investments in the things that will actually build a strong economy in the long-term – better schools, affordable colleges, healthy workers, safe communities. At best, that kind of an approach will only keep Virginia stuck in neutral. At worst, it’ll have us sliding backward.