May 28, 2013

What’s Really Driving Gas Prices and What It Means for Virginia’s New Gas Tax

Gas taxes are not to blame for high and volatile gas prices. Rather, the largest driver of gas prices nationwide is the price of crude oil, which accounts for nearly 80 percent of the per gallon increase between 2000 and 2013, according to a national report released last week from the Institute on Taxation and Economic Policy (ITEP).

Average combined state and local gas taxes increased by less than 5 cents per gallon over the same time period. That’s because most states with a gas tax, including Virginia, haven’t increased gas tax rates in over a decade. As a result, gas taxes are a much smaller share of the final price of gas today than they were in 2000. While gas taxes made up about 30 percent of the price of a gallon of gas in 2000, they make up less than half that amount today.

It’s no wonder that Virginia’s gas tax, which has been a steady 17.5 cents per gallon since 1987, was failing to produce enough resources to fuel adequate investment in our infrastructure. While the major transportation funding package passed this year addresses part of this problem, it creates new and different challenges for Virginians, too.

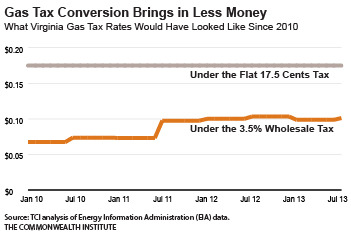

This July, the state’s 17.5 cents per gallon gas tax will convert to a 3.5 percent tax on the wholesale price of gas. This means that the amount paid will increase as the price of gas rises, but at the current wholesale prices, this change is actually a cut to the gas tax. Virginians will only pay around 11 cents per gallon when the new tax is rolled out this summer.

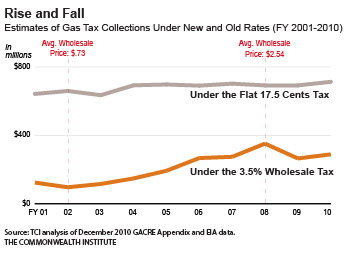

Because the gas tax will now be tied to the wholesale price of gas, which is quite volatile, gas tax collections will fluctuate more, too. When gas prices spike, Virginia will collect more in tax revenues. When prices fall, we will collect less. It means Virginians will be hit hardest when gas prices are high. The figure below shows how gas tax collections would have measured up under the new wholesale tax had it been in place over the 2001-2010 time period.

Another issue with the new gas tax is that people won’t know exactly how much the gas tax is. The 3.5 percent tax will be calculated twice a year based on the average statewide wholesale price over 6 month periods, but it’s unclear whether Virginians will know how much of their gas costs are going to taxes. This violates a fundamental principle of sound tax policy: taxes should be simple and visible to the public. And on top of that, these changes are not linked in any way to our transportation needs or the cost of building and maintaining our roads.

The transportation funding package all but ensures that a steady share of the cost of a gallon of gas will come from the converted gas tax. And as the cost of crude rises, so will the price at the pump.

–Sara Okos, Policy Director