January 26, 2018

EITC Awareness Day: A Tax Credit That Gives an Extra Boost to Workers and Families

When it comes to helping working families, the federal earned income tax credit (EITC) is one of the biggest success stories we have, lifting three million children out of poverty each year. The credit provides extra support to millions of workers and their families, including over 600,000 working households across Virginia. For families struggling to make ends meet, the EITC helps them put food on the table, pay utility bills, and provide opportunities for their children. And research shows that the positive impacts of the credit can last a lifetime, extending even into adulthood for the children of families who received the credit.

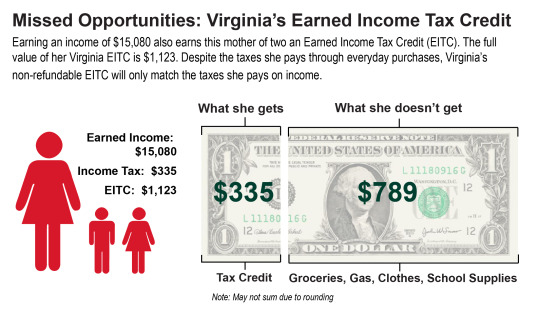

Virginia workers who claim the federal EITC on their tax returns are also eligible for the state EITC, which equals 20 percent of the value of the federal EITC. Soon the Virginia General Assembly will consider HB716, a proposal to enhance Virginia’s EITC by making it refundable.

Right now, low-income working families in Virginia pay more in state and local taxes as a share of their income than high-income Virginians. But, unlike the federal EITC and similar credits available in 24 states, if a family’s Virginia credit is more than the amount of income taxes they owe, they don’t get the full value of the credit. HB716 would allow families to keep the full amount of the credit, which would help low-income working families offset the other state and local taxes they pay.

The bill is currently in the House Committee on Finance and will likely be assigned to a subcommittee soon. If you claim the EITC on your federal or state taxes – or you work with people who do – you know first-hand how important this working credit is to helping make ends meet. Take a moment to tell your lawmakers how much the EITC helps foster economic security and what making it refundable would mean for you.

You can read more about Virginia’s EITC and see how making it refundable would provide an extra boost to hardworking low-income families with our easy-to-use calculator.

As we raise awareness today of the EITC, let’s recognize all the credit does for working families across Virginia. And let’s take the next step to strengthen our state credit.

Category:

Budget & Revenue