April 29, 2020

State Reserves Are Crucial for Dealing with COVID-19 Budget Impacts

As state policymakers continue to address the wider health and economic impacts of the COVID-19 pandemic, including the pressures on the state budget, they need to use the many resources that are available to them. The demand for health and other services is increasing, while state and local revenues are expected to decline. Offsetting the drop in revenues means tapping into the state’s reserve funds, which were established for times like this. Carefully using these funds will be critical for successfully navigating the COVID-19 state budget impacts. While the governor and state legislators have already taken some actions, policymakers should also consider making further tweaks to the rules that govern these funds to increase their flexibility during this moment.

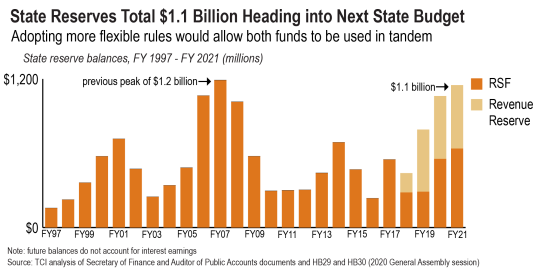

State “rainy day funds” are one of the key tools that state governments have to respond to revenue shortfalls. In Virginia, the state has two main reserve funds: the Revenue Stabilization Fund (RSF), which is the traditional rainy day fund, and an additional Revenue Reserve. Fortunately, state officials and legislators have been working to grow state reserves over the past several years. Under the enrolled state budget that passed last month, the combined balances of these two funds would have reached about $2.1 billion. The additional deposits would have put Virginia’s available reserves above their levels before the last recession (after adjusting for inflation).

Recent Actions Will Provide Near-Term Cushion

One of the primary purposes of state reserve funds is to use them when state revenues unexpectedly decline. Two recently approved budget amendments related to the state’s Revenue Reserve will provide about $900 million in additional funding for emergency measures and to minimize the depth of cuts in other parts of the budget.

- During the current fiscal year, which ends June 30, the Northam administration and state legislators approved a change to free up about $600 million in planned reserve deposits to deal with the rapidly changing economic and health situation.

- The amended state budget also “unallotted” another $300 million in planned deposits for the next two-year budget, which runs from July 1, 2020 to June 30, 2022. The General Assembly and governor would need to later agree to restore this money for the deposit to go forward.

Rules for Future Withdrawals

After accounting for the recent budget amendments, Virginia will enter the next two-year budget with balances of about $630 million and $500 million in the RSF and Revenue Reserve, respectively.

Current language in the state code could limit the ability of the state leaders to access the Revenue Reserve in tandem with the RSF. The ability of lawmakers to use funds from the RSF is governed by relevant sections of the state constitution and state code, while withdrawals from the Revenue Reserve are governed only by state code. The RSF is available when a downward revision to the General Fund (GF) revenue forecast compared to GF revenues appropriated in the budget is greater than 2% of prior-year revenues, while in general, the Revenue Reserve is available when a downward revision is less than 2% of prior-year revenues. Transfers from either fund cannot exceed half of the fund balance. In addition, the RSF transfer cannot exceed half of the projected shortfall.

State law does grant additional spending authority to the governor during a state of emergency, yet this authority is related to “disaster service missions and responsibilities.”

Future Actions

Later this year as the economic and budget picture becomes clearer, state policymakers will be in position to make additional decisions around the state budget, including whether to use additional funds from the RSF or the Revenue Reserve to plug budget holes. For example, after the state’s fiscal year ends on June 30, the governor may be required to produce a new revenue estimate. State law requires the governor to provide a reforecast of state GF revenues by September 1 if end-of-year collections for the state’s major revenue sources (individual and corporate income taxes and sales tax) are 1% or more below the official budget estimate for those revenue sources.

Secretary of Finance Aubrey Layne has indicated that, based on current information, state revenues are expected to decline by about $1 billion between April 1 and when the state’s fiscal year ends on June 30. A decline of this magnitude would trigger the reforecast requirement. The size of the shortfalls that result from that re-estimation process would determine which of the two reserve funds lawmakers would be able to access.

The governor and General Assembly should consider adopting provisions to provide additional flexibility around the use of the Revenue Reserve. Lawmakers could amend the rules to allow the fund to be used in tandem with the RSF. Under current law, lawmakers only have access to one fund when faced with a revenue shortfall. This change would provide up to about $250 million to further cushion any large revenue shortfall in the near term. Combined with federal stimulus funding, this change would help to minimize budget cuts to core public services.

Category:

Budget & Revenue