December 20, 2019

Proposed Tax Increases Would Be Regressive and Only Partially Offset

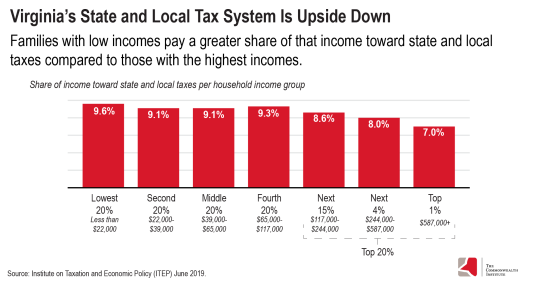

When it comes to investing in our state and communities, our state lawmakers have often turned to regressive taxes and fees as their preferred funding source. Regressive taxes take up a larger share of the incomes of families with low and moderate incomes compared to high-income households. That’s one of the reasons why Virginia’s state and local tax system is upside down. How lawmakers choose to fund our state’s investments has real implications for people across the state. That’s why it’s important to look closely at the tax policy choices included in Gov. Northam’s newly introduced 2020-2022 budget and think about how the General Assembly can improve on them.

Among the proposals are two regressive tax increases (to the gasoline tax and the tobacco tax) that are only partially offset by other proposed changes. To reduce the impact on families with low incomes, the General Assembly should look to offset these increases with refundable tax credits, such as the Earned Income Tax Credit for families with low and moderate incomes.

The governor’s budget includes new funding across several policy areas using state budget savings and revenue growth due to the growing economy. However, the budget proposal also includes two major regressive tax increases: an increase to the state gasoline tax (a 4-cent increase over each of the next three years and subsequent increases tied to inflation) and tobacco taxes (doubling the state cigarette tax to 60 cents per pack and a tax of 20% of manufacturer’s sale price for other tobacco products). As introduced, the governor’s budget would only partially offset these impacts for families with low and moderate incomes.

According to one of the principles that has traditionally guided transportation funding decisions, the people and businesses who use and benefit from the transportation system should generally be expected to pay more of the costs. That’s why transportation funding is often tied to revenues from fuel taxes, motor vehicle sales taxes, and other vehicle fees. Yet, as vehicle fuel efficiency has improved, fuel consumption and fuel tax revenues have declined. Virginia has adopted fuel tax and transportation-related fee increases in recent years, including on a regional basis, to make up some of the shortfall.

Gasoline taxes are widely viewed as regressive taxes. The Northam administration also recognizes this impact and has proposed to pair the gasoline tax increases with two offsetting changes: reducing the annual auto registration fee by half and eliminating required annual vehicle inspections. Virginia’s vehicle registration fees vary by type of vehicle and by weight. For example, the state registration fee for a passenger vehicle that is 4,000 lbs. or less is currently $40.75. State law has set the maximum amount for an annual vehicle inspection at $20. These two changes would likely offset much of the impact of the proposed gasoline tax increase for many families with low to moderate incomes.

Meanwhile, tobacco and cigarette taxes are often proposed to both raise revenue and discourage smoking. Yet one of the main problems with these taxes is their regressivity. In 2015, people in the lowest 20% of the income spectrum spent 0.8% of their income, on average, on cigarette taxes, compared to less than 0.1% among the highest 1% of households. The proposal does not include any offset to minimize this impact on the budgets of households with low incomes. In addition, health advocates have often called for even higher tobacco taxes, because amounts below $1 per pack have a lower impact on smoking rates. If the conversation eventually moves in that direction, it would become even more important for lawmakers to include offsets.

These regressivity concerns could be addressed through a refundable tax credit for families with low and moderate incomes. One of the best policy options is to strengthen Virginia’s state Earned Income Tax Credit (EITC). In fact, Virginia first created its current EITC as part of the 2004 tax reform package that included sizable increases to the state cigarette tax. Improving the state EITC would allow all 600,000 working families who currently receive the federal EITC to also receive their full state EITC. This improvement would help to offset the proposed tax increases and also increase the fairness of the existing state and local tax system – rather than making it worse.

Take Action

Category:

Budget & Revenue