October 17, 2019

Rising Costs on ACA Marketplace: A Blueprint for State Leaders to Reduce Cost and Increase Access to Health Care Coverage

Good health is essential to thriving communities, yet Virginia families are struggling to pay for health coverage and other medical needs. A July 2019 report found that more than half of Virginia families (55%) had some difficulty affording health care in the 12 months prior. And a greater majority of people in Virginia (63%) believe government should prioritize health care access in the upcoming year — far more than any other issue listed — according to a survey conducted by Altarum, a health care research organization.

Gov. Northam recently directed the Virginia Secretary of Health and Human Resources to increase access to affordable, quality health care coverage for more people in Virginia. One area that state leaders are uniquely positioned to make a difference is in the individual insurance marketplace. There are multiple policy options at hand that state leaders and lawmakers can use to help bring down the cost of insurance and increase access to comprehensive health care in the state. These options range from standing up a state-based health insurance exchange, to creating a reinsurance program, to regulating skimpy health plans, among other options. This issue brief explains what those options are and how Virginia lawmakers can take action to implement them.

A key place where people get their health plans is through the individual marketplace — also known as the exchange — that was created by the Affordable Care Act (ACA) and began operating in Virginia in 2014. The ACA marketplace is where over 300,000 people in Virginia access their health coverage. In order to keep out-of-pocket costs down, the ACA marketplace offers subsidies in the form of tax credits for individuals and families earning between 100% and 400% of the federal poverty limit (FPL), which is between $12,490 and $49,960 for an individual for coverage in 2020. But for people who do not qualify for subsidies — families earning more than 400% FPL — monthly premiums on the marketplace have skyrocketed in recent years and have become a legitimate barrier to accessing health coverage.

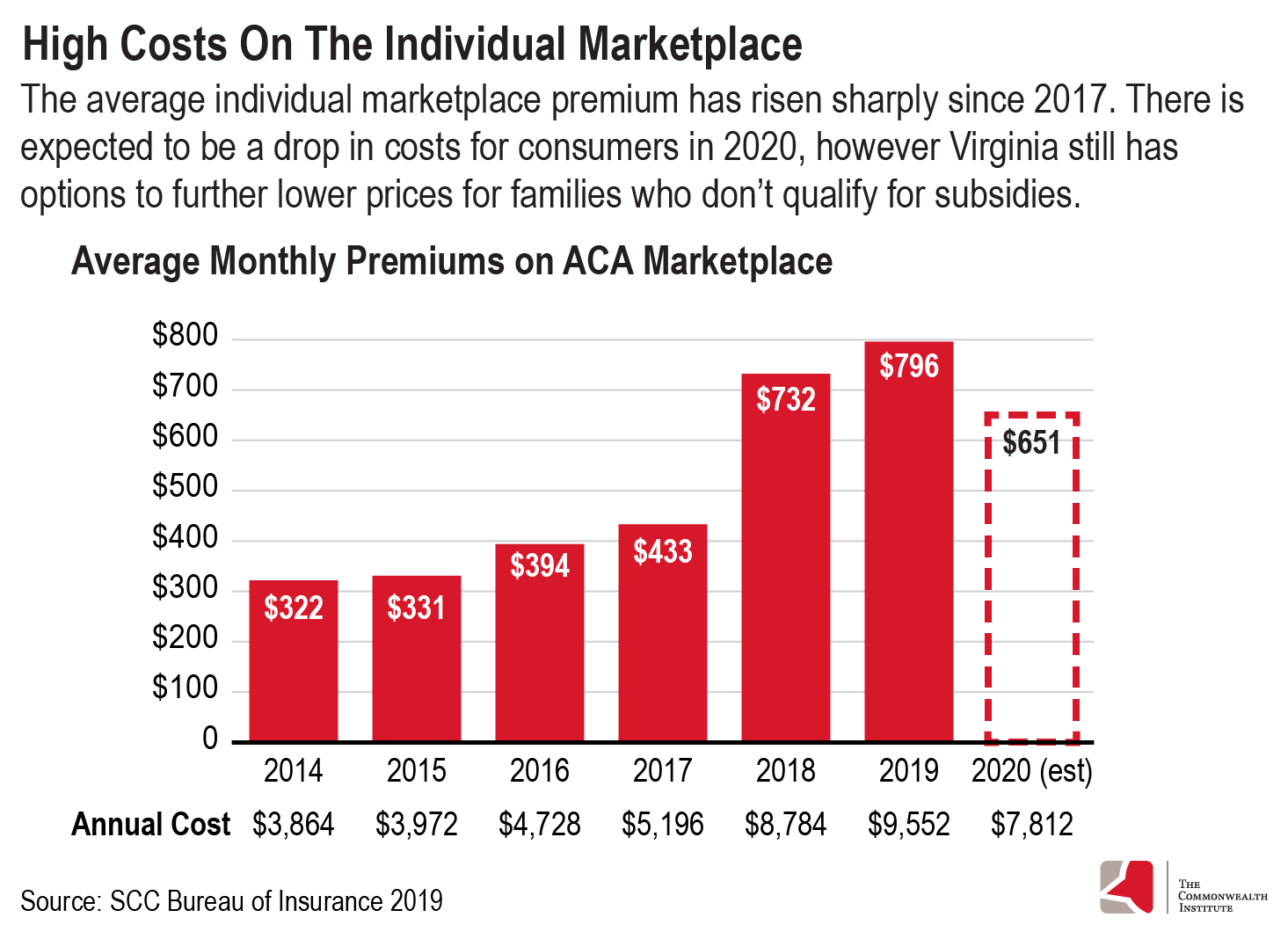

The average health insurance premium in 2014, when the ACA marketplace began offering coverage, was $322 per month. Since then, premiums have increased almost 2.5 times that amount to an average premium of $796 in 2019. The largest single year increase — from $433 in 2017 to $732 in 2018 — could be attributed to insurers’ uncertainty about the viability of the ACA due to the Trump administration’s position on repealing the act, repeal of the individual mandate, and a change at the federal level that stopped federal reimbursement for a mandated cost-reduction plan.

Insurers responded to these concerns by raising premiums. Due to the way subsidies are structured, families with lower incomes on the marketplace have been mostly spared from these premium increases, but those who do not qualify for subsidies have not been shielded from this jump in costs. However, there does appear to be some consumer relief expected for 2020 with average premiums expected to drop to about $650. While this is welcome news for consumers, this still amounts to $7,800 annually, which is still out of reach for many families.

The decision by state lawmakers to expand Medicaid is expected to bring down the cost of premiums on the marketplace anywhere from 0% to 2.3%. This could be because individuals earning between 100% and 138% FPL that previously sought coverage from the marketplace may have health conditions with a higher cost of care. By moving this group — an estimated 44,300 to 70,400 over the next three years — to Medicaid coverage, the average health care costs of the risk pool, or the group of people left in the marketplace, could be lower and therefore considered a lower risk by insurance companies, leading to a possible drop in monthly premiums across the board.

Still, the reduction in premiums, if any, from Medicaid expansion is not enough to make a significant difference for those who get health coverage on the marketplace. There are several options that Virginia lawmakers can consider when attempting to make coverage more affordable for those who do not get subsidies on the marketplace.

State-Based Exchange

Virginia does not fully operate its health insurance marketplace. Virginia conducts plan management for its exchange while the federal government runs everything else that remains, such as operating the enrollment website, marketing the exchange, and determining eligibility. This has a number of implications: Virginia residents must enroll through the federal portal (healthcare.gov) instead of a state-specific site, the state does not have full access to enrollee information, and the state must abide by the federal open enrollment window without flexibility to extend it.

Due to the federal government facilitating Virginia’s marketplace, insurance companies must pay a fee of 3.5% annually, an estimated $91 million for 2019. Other states that have gone from a federally facilitated marketplace to a state-based one have found that they can run these exchanges at a lower cost than the federal government. Nevada and New Mexico — who are moving to a state-based exchange in the coming years — forecast savings of $18 million and $8 million respectively over the next five years. Meanwhile, insurers in Pennsylvania are expected to pay $98 million in fees to the federal government in 2019, while a state-based exchange in the state is estimated to cost $30 million a year beginning in 2020. The shift to a state-based marketplace would require an upfront investment from Virginia.

Additionally, with full access to marketplace data and additional outreach and enrollment funds, the state could do a better job at enrolling more individuals in the marketplace. We know that healthier individuals who would lower the expected costs of the marketplace risk pool may choose to forego coverage due to their current health status and the absence of a coverage mandate. Targeted outreach to people who are eligible but not currently participating in the exchange and the customization of marketing and enrollment tools, along with the ability to extend the enrollment period beyond the federal cut off, could also yield higher participation in the marketplace — all of which could lead to lower costs.

Access to demographic data is even more important given the fact that Latinx and Black individuals who earn more than 400% FPL are overrepresented in the uninsured population. Latinx and Black individuals make up a small share of the population that earn above 400% FPL in Virginia, 6% and 13% respectively. However, Latinx and Black individuals make up a combined 40% of the population that are uninsured and earn more than 400% FPL. Through more targeted outreach and enrollment methods, more people of color with moderate incomes would be better able to consider their health coverage options.

Reinsurance

Reinsurance is an option that allows insurers to offset high-cost medical claims through a combination of federal and state funds. The state, using a federal match, would repay insurers for high-cost claims or for enrollees likely in need of more expensive treatments and considered high risk; insurers would then be left with a healthier population or less expensive claims on which to base their premium prices. This option would require the state to submit a 1332 State Innovation Waiver application to the Centers for Medicare and Medicaid Services (CMS) for permission to implement this program. Reinsurance programs have been approved in seven states so far and five additional states have applied to implement the program in 2020. Pennsylvania is also planning to apply for a waiver to implement a reinsurance program beginning in 2021. Reinsurance plans have successfully lowered premiums in other states: Oregon’s premiums have dropped 17% in the last two years, and Maryland’s reinsurance program led to a 13% decline in premiums for 2019.

A 2018 work group convened by Gov. Northam to study ways to stabilize the individual marketplace estimated that Virginia would likely be responsible for funding 31% of a reinsurance program, with the federal government likely to chip in the remaining amount. Reinsurance allows for flexibility in state funding and can be designed for a specific reduction in premium cost. The state essentially lowers overall premiums by the amount they refund insurers. In Virginia, a 5% reduction in premiums would cost the state approximately $40.5 million dollars. For a 10% and 20% reduction, the state share is estimated to be around $81 million and $162 million respectively. The cost to the state of implementing a reinsurance program can be greatly reduced or completely eliminated if Virginia also chooses to switch to a state-based exchange.

With a switch from a federally facilitated marketplace to a state-based exchange, Virginia could continue to tax insurance companies at the same or a slightly smaller rate and use some of those funds to pay for the state share of a reinsurance program. This is what Pennsylvania will do when it simultaneously makes the switch to a state-based exchange and applies for a 1332 waiver to implement a reinsurance plan. The state plans to tax insurance companies at the same rate as the federal government and use the funds to cover the cost of a state-based exchange and use the rest, in combination with federal dollars, to implement a reinsurance program. Similarly, New Jersey has chosen to use funding from fees of a state individual mandate to pay for its reinsurance plan.

Virginia’s General Assembly would need to introduce and pass legislation in order to direct the Department of Medicaid Assistance Services (DMAS) to submit a 1332 waiver application and implement a reinsurance program. As part of this application, the state would need to hire an outside organization to estimate costs and outcomes — in the form of premiums costs — of a reinsurance program prior to applying for permission from CMS. Since this process has been done in several other states, there are now nationwide firms that have significant reinsurance modeling experience.

Regulation of Skimpy Health Plans

The Trump administration has loosened regulations nationally on health plans that function outside of the marketplace. The two types of plans that have been deregulated by federal changes are known as short-term, limited-duration (STLD) and association health plans. Both of these types of plans are inadequate and put consumers at risk of being underinsured and subject to medical bankruptcy due to high out-of-pocket costs.

Virginia should not expand access to these types of plans. STLD plans can refuse to cover individuals due to pre-existing conditions and have been regularly found to not include services such as prescription drugs, substance abuse and mental health treatment, and maternity care. These plans are able to offer lower prices due to providing substandard coverage of basic health services and by discriminating against those with chronic illness. Furthermore, these plans are especially attractive to individuals who consider themselves healthy, and would leave a sicker, more expensive risk pool in the marketplace. This not only leads to higher premiums for those in the marketplace, but leaves those who sign onto these skimpy plans at risk.

Association health plans have similar consumer and market concerns. Premiums for these plans can be based on gender, age, or other non-health related factors at the employer level. Insurers can also charge groups of employees different premiums based on occupation. Like STLD plans, association health plans are not required to offer essential health benefits, as required by the ACA. Benefits such as mental health treatment and prescription drugs can be excluded, and maternity services may be excluded for smaller employers.

Virginia should take action to implement consumer protections. Several states have banned STLD plans, while others have passed legislation in order to further regulate them. Proposals to expand the availability and access to association health plans should be rejected. Over one-third (36%) of Virginians believe that preserving consumer protections — such as not being denied coverage or charged more if you have a pre-existing medical condition — should be one of the top healthcare priorities of the government.

Other Options to Help Consumers Afford Coverage

Other states have taken further action with the intention of strengthening their individual marketplace that Virginia lawmakers could take into consideration. For instance, Maryland will leverage its state tax system in order to get more people enrolled. The Easy Enrollment Health program allows uninsured Marylanders to check a box on their state income tax return that will allow the state to determine if they are eligible for Medicaid or subsidies on the individual marketplace. If the individual is found eligible for Medicaid they will be auto-enrolled, and if they qualify for insurance on the marketplace the state will reach out with more information in order to help individuals choose the right plan for them. This method will streamline health insurance enrollment and is expected to lead to significant coverage gains.

A state individual mandate, which would result in a fee at tax time if an individual fails to have health insurance throughout the year, is meant to help incentivize participation in the marketplace. Five states and the District of Columbia have instituted this type of policy or have passed legislation to do so, and as previously mentioned, New Jersey is using funds collected from this fee to pay for its reinsurance program.

Some states have introduced targeted state-enhanced subsidies in order to make health coverage more affordable to families with moderate incomes. California will provide subsidies to those making up to 600% FPL ($74,940 a year for an individual and $127,980 for a family of three for 2020) for coverage years 2020 and 2021. And Washington has passed legislation that will provide state-enhanced subsidies for people making up to 500% FPL ($62,450 a year for an individual and $106,650 for a family of three for 2020) to ensure no one pays above 10% of their household income on monthly premiums.

The Way Forward

People of all walks of life are struggling to afford health coverage and are eager for state lawmakers to help alleviate these affordability concerns. The shift to a state-based exchange in addition to the implementation of a reinsurance program would be a welcome respite for those in Virginia having faced growing premiums on the individual insurance marketplace. Skimpy health plans that attract younger and healthier individuals with lower monthly premiums, due to discriminatory practices and lack of services in the fine print, are detrimental to all health insurance consumers. Doing away with or severely limiting STLD plans and not expanding access to association health plans would be a step in the right direction for protecting the needs of people with pre-existing conditions in Virginia. These steps — and more — taken together can help state leaders and legislators ensure access to affordable, quality health care coverage for many more people in Virginia.

Health services will be needed by everyone at some point of their lives and making sure all families can afford them is a worthwhile investment.