November 3, 2016

Critical Care, Critical Contributions

Health Care Sector’s Challenges, Untapped Potential for Virginia’s Economy

Ongoing deliberation in Virginia about the need to expand Medicaid coverage, opportunities to leverage provider assessments to support health care access, and policies to revamp the certificate of public need process in the commonwealth all draw attention to the health care sector’s pivotal role in our economy.

This report provides a close examination of key trends in Virginia’s health care sector, assesses the stimulative effects health care jobs have on the state’s economy, and identifies potential implications of health care coverage expansions.

Virginia’s hospitals and health systems are critical community institutions, availing families and patients of access to care in times good and bad. Supplementing the network of hospitals are providers including physician offices, clinics, and others. The impact of these providers extends well beyond the primary function of delivering health care services. These institutions also serve as important anchors for local economies. Hospitals and health systems often are the largest employers in their communities, providing an array of good-paying jobs to thousands of Virginians.

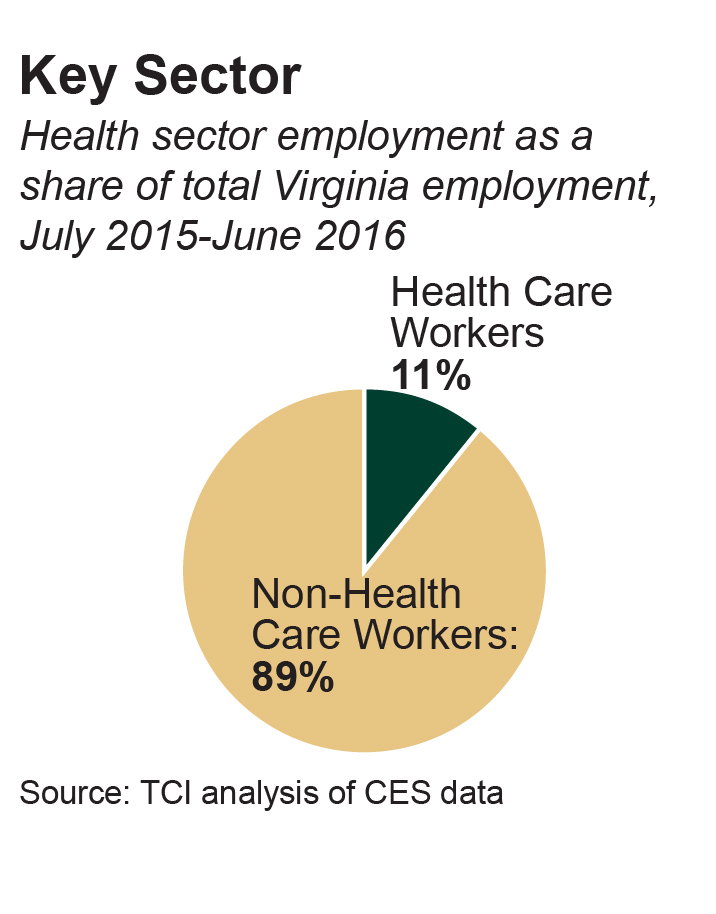

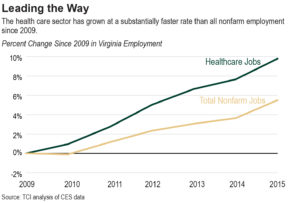

The positive economic impact of health care in Virginia is considerable. Statewide, about 11 percent of all jobs are in health care and social assistance. Of those about 32 percent are hospital jobs. According to our analysis, the hospital sector’s 124,000 employees generate around $585 million each year in local and state taxes, making it a key pillar of the state economy. Even as job growth in Virginia’s hospitals has been relatively flat since 2009, the health care sector as a whole has grown rapidly.

Virginia’s Hospitals Face Challenges

While recent health care sector job growth in Virginia has outpaced most other industries – a trend that is projected to continue for at least another decade – more can be done to boost health care jobs and the commonwealth’s economy through funding of critical services and treatment for Virginians. An added benefit of that public policy is that it can promote health care access throughout the commonwealth by financially supporting practitioners in areas of the state, including in medically underserved communities, where socioeconomic and demographic factors can be impediments to health care service availability.

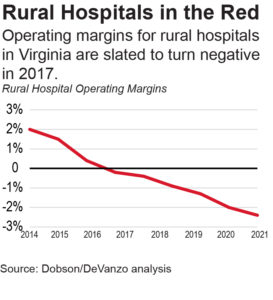

Considering that health care generally, and hospitals particularly, provide some of the best paying jobs in the state, increased employment in that sector could provide a substantial boost to the state’s economy. Unfortunately, signs of trouble loom on the horizon, particularly among rural hospitals. Many of these facilities have struggled with operating losses in recent years. And some projections indicate rural hospitals as a whole could begin losing money as soon as 2017. Several already face serious financial headwinds. While these challenges are more prominent among rural hospitals, they are not exclusive to them – several hospitals in more populous communities have also dealt with financial troubles in recent years.

One reason some hospitals in Virginia are struggling is that they are shouldering significant uncompensated care costs. One available option to partly offset these costs would involve Virginia accessing federal resources its tax dollars are supporting to fund expanded health care coverage to the uninsured through Medicaid.

Virginia hospitals provide nearly $1.2 billion in annual care each year for uninsured and underinsured patients who cannot afford to pay for medical treatment received. In 2013, roughly 6.9 percent of hospital costs were attributable to covering uncompensated care. Year-over-year uncompensated care costs create significant challenges for Virginia hospitals, which are also facing substantial federal funding cuts.

Significant Medicare Disproportionate Share Hospital (DSH) cuts have already occurred and are likely to increase, while Medicaid DSH cuts that have been temporarily delayed are expected to take effect soon. There is a way to offset those cuts, however. Absent that, an already dire situation for rural hospitals very well could worsen.

Shoring up Virginia’s Hospitals Would Boost Virginia’s Economy and State Revenue

One way to address the challenges hospitals are experiencing would be to reduce uncompensated care costs by expanding Medicaid in some way. States that have taken that step have seen a 30 percent average reduction in uncompensated care costs, which has strengthened hospitals’ balance sheets and long-term stability. In the minority of states, like Virginia, that have not expanded Medicaid, hospitals remain responsible for footing the bill for a much larger amount of uncompensated care costs.

The economy benefits when hospitals are financially stable and people can afford needed care. Bringing more people into the health system by closing the coverage gap would not only increase the need for more workers, it would also draw down federal funding to support an average of over 20,000 good-paying health care jobs a year over the next five years. These jobs, in turn, would generate $101 million in state and local revenues annually.

Using available headroom in Virginia’s provider payment rates is another way Virginia can bring additional federal dollars into the state and provide a much-needed boost for communities. In 2013, Virginia lost out on nearly $200 million in federal government reimbursements by not taking advantage of the gap between Virginia’s current payment rates and the federal upper payment limits. The state could cover all or part of the costs of raising payment rates through a modified provider assessment program that hospitals have conditionally supported. Virginia currently has provider assessments for intermediate care facilities, and could also apply them to nursing facilities, hospitals, and managed care organizations. Broadening these assessments could raise more than $460 million in state revenue annually.

Another option for using provider assessment is to apply a portion of those possible hospital payments to cover Virginia’s net costs for Medicaid expansion. Other states have relied on similar approaches to defray state coverage expansion costs. Indiana will fund 60 percent of its Medicaid expansion costs in 2017 with hospital provider assessments. Arizona is also using provider payments to pay for its expansion. When new tax revenue generated from the jobs that would be created through expansion is also factored in, the fiscal case for Virginia policymakers to explore these options for accessing federal resources is too compelling to dismiss.

Looking for Solutions, Looking to Private Option

In assessing opportunities to expand Medicaid and strengthen its health care sector, Virginia could also consider the approaches Arkansas and New Hampshire have taken. Those states negotiated a waiver with the federal government allowing them to enroll Medicaid expansion beneficiaries in private health plans offered through the health care Marketplace. The experiences of these states offer examples of how Medicaid expansion could work in Virginia to boost the economy and enhance public health.

Arkansas’s Experience

As part of Arkansas’s Medicaid expansion, the state in 2014 began enrolling some people qualified for Medicaid in plans offered in the health care Marketplace. At present, there are 245,000 Arkansans who access health coverage through this “private option”

Similar to the experience of other states that have closed health care coverage gaps by expanding Medicaid, Arkansas has seen significant benefits.

Arkansas hospitals’ uncompensated care costs have dropped substantially 55 percent, partly driven by a 38.8 percent decrease in emergency room visits by the uninsured.

Arkansas hospitals have experienced a 5.8 percent growth in outpatient services. This indicates newly insured people are using more cost effective preventative medical services, which in turn can reduce future demand for expensive emergency services.

There is also evidence that enrolling Medicaid beneficiaries in private plans has stabilized Arkansas’ health care marketplace. For example, enrollment in the health care marketplace has tripled, expanding the number of insurance providers from two to six, increasing the pool of healthy and young subscribers and driving down premium costs.

Medicaid expansion is estimated to have saved the state nearly $90 million and generated roughly $30 million in new revenues in 2015.

New Hampshire’s Experience

New Hampshire hospitals were struggling in 2014, before the state expanded Medicaid. Operating margins were less than half the national average. Not-for-profit state hospitals faced less than a 2 percent operating margin, a rate that was in decline.

One year after the state expanded Medicaid in August 2014 through existing managed care plans, uncompensated care costs for hospitals decreased 35 percent. These savings are largely due to a reduction in hospital uninsured visits and admissions that dropped a combined 29 percent after expansion. When uncompensated care costs drop, some hospitals savings are passed on to patients, leading to lowered costs for all health care consumers.

More recently, New Hampshire policymakers have shifted to using a “private option” for most state residents who benefit from Medicaid expansion. New Hampshire now covers nearly 50,000 low-income people in the state with private insurance purchased on the marketplace.

Like all states, New Hampshire next year will begin paying a very small portion of the cost of covering the expansion population. Between July 2017 and July 2019, $816 million will be injected into the state’s economy from federal spending. New Hampshire will be responsible for covering the remaining $51 million.

A sizable chunk of this cost – roughly $12 million – will come from the insurance premium tax revenue generated through the purchase of health plans in the market.

The bottom line is that the hospital sector is a cornerstone contributor to Virginia’s economy that provides strong, middle class jobs capable of supporting families across the commonwealth. By taking advantage of opportunities to close the coverage gap and finding a creative way to expand Medicaid in Virginia, as 31 other states have, policymakers can further strengthen this critical sector and bring much needed health care coverage to 230,000 Virginians who are currently in the coverage gap.