March 29, 2022

Gas Tax Proposal Misses the Mark: Majority of “Savings” Would Flow to Oil Industry and People Who Don’t Live in Virginia

Note: The wording in the first paragraph was revised to clarify that Gov. Youngkin’s proposal seems to refer specifically to the retail gas tax and would not apply to the additional distributor tax rate.

Earlier this month, Gov. Youngkin announced a new policy proposal to suspend the state’s 26-cents per gallon retail gas tax for three months and to cap retail gas tax rates in future years. If enacted, this policy is likely to miss the mark on helping families in Virginia who are struggling with higher costs, while preventing the state from catching up on its backlog of outstanding transportation needs and hurting the state’s ability to make critical investments in the future. Supporting families who are affected by rising costs is an important policy goal, but temporary gas tax changes will do little to achieve this aim. Lawmakers have other tools available that will more directly support Virginia families.

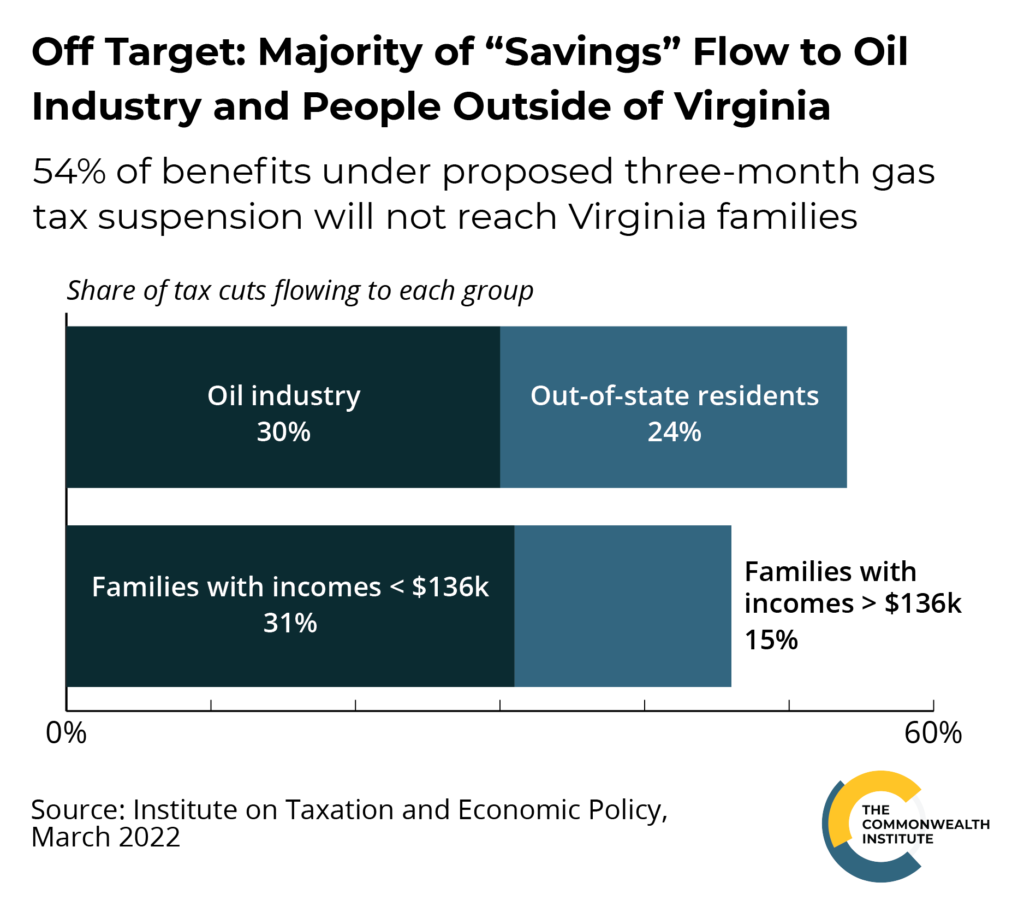

Based on new analysis from the Institute on Taxation and Economic Policy, 30% of the projected “savings” from this plan would likely flow to oil producers, rather than fully passed onto motorists. In addition, the trucking industry and out-of-state residents, including tourists, currently account for a large share of fuel consumption in Virginia and would stand to receive substantial benefits from this plan. Less than a third of the benefit from suspending the state gas tax would flow to Virginia residents with incomes below $136,000. The majority would be received by industry or people who don’t live in Virginia.

While costs have increased in recent months due to the ongoing economic recovery and global supply chain disruptions, other policies would be better suited to directly helping families. As part of budget negotiations, state lawmakers are considering a targeted economic relief measure to strengthen the state’s Earned Income Tax Credit (EITC) for working families, as well as broader relief policies like one-time rebates for many state tax filers. Both policies would provide economic support more directly. Yet the current rebate proposals would provide no extra help for families with children. Lawmakers could improve the rebate by including taxpayers with low incomes who would not be eligible under the current proposals and to account for children and other dependents. Potential models have emerged in other states as well, such as providing direct payments to vehicle owners and allocating additional funding for zero-fare transit ridership. These kinds of policies would help ensure the benefits would flow to hard-hit residents, not the oil or trucking industries.

Because Gov. Youngkin’s proposal would also permanently cut the gas tax rate over time, his proposal would also partly reverse the bipartisan progress made over the past decade to invest more — not less — in maintaining and improving state transportation systems.

These recent changes include the 2020 transportation law that updated Virginia’s gas tax and transportation funding formula. The General Assembly’s nonpartisan research arm, the Joint Legislative Audit and Review Commission (JLARC), recently found that these changes “will help to strengthen the state transportation system” and will make it “less likely the state will experience [transportation] revenue shortfalls,” at least for the next 10 years, despite the continuing declines in fuel consumption that are expected in future years.

Given that the General Assembly appears likely to eliminate the state sales tax that applies to groceries and personal hygiene products, which will also reduce state transportation revenue, it is critical that state lawmakers safeguard the other transportation funding sources like the gas tax.

State policymakers must carefully evaluate their options for supporting families who are struggling to afford gas and other essentials. The new gas tax proposal would likely provide little benefit to families who need help, at significant cost to the transportation and infrastructure needs of the state. State lawmakers should consider other ideas like making the state EITC refundable and strengthening the one-time rebates that are already under consideration. These policies would more directly help families in the commonwealth.

Category:

Budget & Revenue