December 1, 2017

GOP Tax Bills Threaten Revenues for Schools while Benefiting Wealthy and Corporations

The GOP tax proposals in Congress are a windfall for rich heirs, wealthy individuals, and corporations. The latest analysis on the Senate version shows that the highest 1 percent of Virginia’s income-earners receive the largest average tax cut, while the bottom 60 percent of Virginians will actually see a tax hike on average by 2027. That’s even less fair than the House version. Both proposals will also add over a trillion to the deficit over the next 10 years, jeopardizing public services in the future.

These unfair and irresponsible aspects of the proposals have been well publicized. Less well known, however, is that these proposals take indirect aim at public education – not in the distant future, but right now.

The Senate proposal eliminates the state and local tax deduction (SALT). The House version eliminates the deductions for income and sales taxes and places a cap of $10,000 on property tax deductions. This means that people who itemize their deductions will now have to pay federal income tax on money paid in state and local taxes. This will put significant pressure on state and local governments to reduce their taxes, thereby reducing state and local revenue. Meanwhile, the federal government will be using this revenue increase to help pay for the massive tax cuts for the rich and corporations.

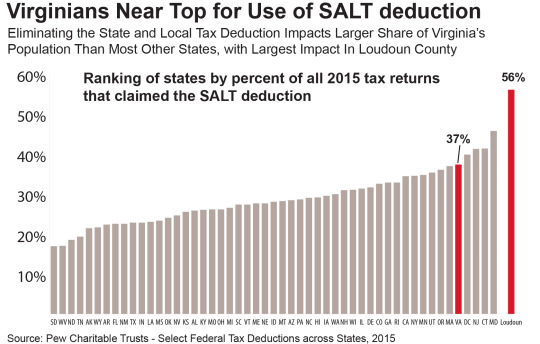

And Virginia will be one of the states most impacted by eliminating this deduction.

How does this impact schools? Well, state and local governments fund 93 percent of school costs in Virginia, and K-12 education is one of the largest line items in state and local budgets. If there’s less money collected in state and local taxes, there will be less money to invest in schools.

The National Education Association estimates that eliminating federal tax deductions for state and local income and sales taxes puts 250,000 education jobs at risk across the country including over 9,000 jobs in Virginia over the next 10 years. Those lost teaching and school support jobs would compound existing problems for Virginia schools, which already employ 2,800 fewer staff than they did in 2009 despite growing student enrollment. If staffing had kept pace with enrollment, Virginia schools would have 10,400 more instructors and staff.

Eliminating the SALT deduction is a particularly bad deal for Virginians. While media coverage has highlighted the impacts in New York and California, a larger portion of tax filers in Virginia will be impacted here. In Virginia, 37 percent of filers claimed the SALT deduction – that’s the fifth highest in the entire country – compared to 30 percent nationwide. That’s particularly true for Northern Virginia, which has some of the highest median incomes in the country. In Fairfax County, 51 percent of tax filers will be impacted by eliminating the SALT deduction, and in Loudoun County it’s even higher–56 percent.

The GOP tax proposals in the House and Senate are a bad deal for most Virginia families. They’re also a bad deal for Virginia’s communities and a bad deal for Virginia’s schools.

Category:

Education