August 27, 2020

Gov. Proposal Takes Out Almost Three Quarters of A Billion Dollars ($722 M) for PreK-12, Leaves Rainy Day Funds Untouched

Last week, Gov. Northam announced his amendments to the state’s two-year budget that began on July 1. The proposal relies heavily on stripping out new investments in education, health care, and compensation to meet a projected revenue shortfall. For early education and K-12 schools, this includes taking out $533 million in new funding approved in March (this includes funding for additional school counselors, equity enhancements, and improved early education access and school nutrition, among other investments). Yet the damage goes further than stripping out new investments. Downward revisions to sales tax estimates drop state funding an additional $189 million. Taken together, schools across the commonwealth would see $722 million less from the state than initially anticipated at a time when more resources not fewer are needed to meet the educational needs of students, and federal aid falls far short.

The Senate of Virginia and House of Delegates are reviewing the budget proposal and have the opportunity to protect schools by modernizing Virginia’s sales tax, drawing upon the state’s rainy day funds, and using resources left unspent by the governor.

Virginia designates a portion of the state’s 4.3% sales and use tax for public education. These funds are distributed to school divisions based on the estimated school-age population and reduce the total amount localities are required to pay to meet the state’s Standards of Quality (SOQ). Unfortunately, sales tax revenue estimates are more than $1 billion less than originally forecast for the two-year state budget, as presented last week by Finance Secretary Aubrey Layne. This downward revision will drop state funding for education by $189 million in the two-year budget, which localities will need to find in order to meet the state’s required funding levels. The decrease in sales tax funding is in addition to the new funding that was frozen back in April (summarized here). The suspended funds for school divisions with the highest child poverty rates are twice as large per student as they are for the lowest-poverty school divisions. Divisions with the highest percentage of students of color will lose out on 23% more per student than school divisions with the lowest percentage of students of color.

The declines in sales tax revenues and impact on school finances furthers the case for the state to eliminate antiquated sales tax exemptions. Among states that have sales taxes, Virginia is one of only 16 states that does not apply that tax to digital products generally (as of Oct. 2019). By updating the tax code to include these products, the state would put them on a level playing field with equivalent goods that have been traditionally included in sales taxes and generate an estimated $30 million in needed state revenues in the upcoming budget, as well as new revenues for localities that they can use to meet the needs of local schools.

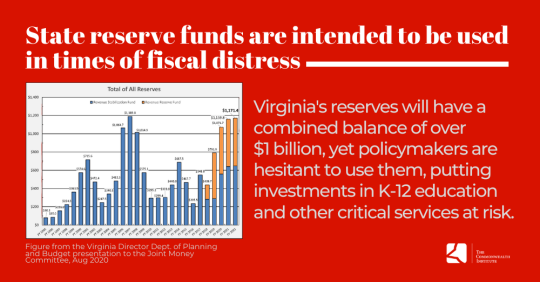

There are other resources state leaders can use during this time of financial strain. The governor did not propose using any of the state’s two main reserve funds (the revenue stabilization fund and revenue reserve fund). The two funds total more than $1 billion in 2020, equal to the second largest balance since 1995. These funds are intended to be used in times of fiscal distress. With Virginia in the midst of a health crisis and economic crisis and revenues down by $2.69 billion, now is the appropriate time to draw upon these funds to address the many challenges facing Virginia families, including protecting schools. Further, the governor left $490 million unspent in the budget. The Sec. of Finance justified this decision stressing the importance of financial liquidity for the state during this time of uncertainty, meaning a desire to have cash on hand. This is a sentiment that many Virginia families and schools share, yet a luxury they do not have in managing the challenges before them.

To meet budget challenges, states must seriously explore all available options, including rainy day funds and other reserves. The Sec. of Finance currently opposes withdrawals from the reserve funds, and General Assembly members have expressed concerns related to Virginia’s credit rating. However, in general, rating agencies have indicated that drawing down rainy day funds is appropriate during a downturn as part of a comprehensive budget strategy. While robust reserve funds are looked upon favorably by rating agencies, responsibly using these funds during a time of financial distress can be viewed as a positive in certain situations. “Rating agencies typically favor states that design their rainy day funds to align with turns in the economic cycle by depositing revenue during good times and spending those reserves when things turn bad” (Jeff Chapman, Airlie Loiaconi & Sheanna Gomes, Pew Charitable Trusts).

Virginia is not alone in facing these economic challenges and, given our reliance on federal spending, is better off than most states. Utah, for example, is also experiencing sharp revenue declines, yet Utah drew upon their reserve funds to protect school funding.

When Gov. Northam announced the proposed amendments to the budget, he asserted “cash is king” in defending the decision to leave dollars unspent and rainy day funds untouched. Virginia families and schools understand the importance of having cash on hand during this crisis. By keeping Virginia’s funds locked up in its reserves, the state will be hindering the ability of principals, teachers, and parents to have the resources to meet the new and evolving challenges they are experiencing on a daily basis. That’s why state leaders should put the state’s reserves to work and use all the resources available to them to help schools and families tackle the many challenges before them.

Categories:

Budget & Revenue, Education