April 10, 2019

New Federal Proposal Would Raise Incomes and Support More Working Families and Children

Earning a paycheck should mean being able to provide for one’s family. However, many of Virginia’s low-income working families are struggling to make ends meet to keep up with rising costs like rent and expensive child care. A new federal proposal, The Working Families Tax Relief Act, would improve our nation’s tax laws, helping more working people with low-wage jobs as they support themselves and their families. The Act would strengthen the federal Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) and boost financial security for 46 million households nationally, including over 1 million Virginia families. The Act would also lift 11 million children across the country above or closer to the poverty line.

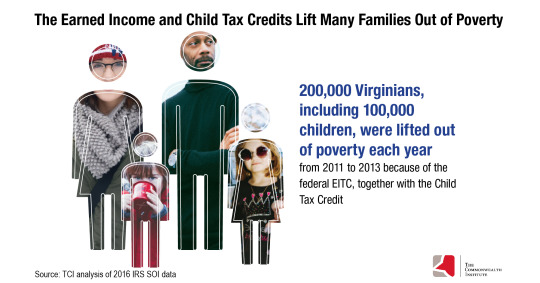

The federal EITC and CTC are two of the most effective policies for supporting working families and young children. Over 600,000 of Virginia’s working families receive the federal EITC, and over 400,000 families receive the federal Additional Child Tax Credit. Taken together, these two credits lifted over 200,000 people, including 100,000 children, out of poverty in Virginia each year from 2011 to 2013. The Act would improve these credits by extending them to more families, such as families without dependent children at home, making sure all families receive the full value of the CTC, and providing an additional CTC amount for families with children under six years old.

Working families of all races have seen small real income gains in recent decades, and many are employed in low-wage jobs that don’t pay enough to meet basic needs. This issue of low wages affects working people across our commonwealth, particularly people of color, who often face employment barriers and discrimination. Since 2001, median real wages in Virginia for Black and Latinx workers have grown more slowly than for white workers.

The new federal proposal is one way of responding to this slow growth. Under the Working Families Tax Relief Act, a single mom with two children and an income of $20,000 would get a $3,700 boost. And a married couple with two young kids and an income of $45,000 would get a $3,500 boost. This would help families afford basic necessities like home repairs, utilities, and maintaining a vehicle to get to work or their children’s school.

The Working Families Tax Relief Act would have lasting benefits for families and children across Virginia. Refundable tax credits like the EITC and CTC have a track record of improving health and education outcomes: maternal and newborn’s health, academic achievement, and college attendance. Overall the Working Families Tax Relief Act would cut child poverty by 28 percent, lifting 3.1 million children out of poverty and making another 7.7 million children less poor.

Crucially, the Working Families Tax Relief Act would give a boost to millions of low-wage working people without children at home. This group currently gets an extremely small Earned Income Tax Credit or none at all under current law. The Working Families Tax Relief Act would provide a substantial increase in the EITC for these working people and extend the credit to younger and older working people who are currently excluded from the EITC due to age restrictions.

The Working Families Tax Relief Act would begin to address major flaws from the 2017 tax law, which gave large tax cuts to wealthy households and large corporations, yet failed to strengthen the EITC and provided little to nothing for millions of children in low-income working families who were largely excluded from the law’s CTC changes. The 2017 tax law did not meaningfully address decades of stagnant wages. Instead it provided the largest tax cuts to the highest-income households. In fact, the top 1 percent will receive more tax cut dollars than the entire bottom 60 percent.

The Working Families Tax Relief Act takes a different approach: strengthening the EITC for working people not raising children, making sure that millions of children aren’t left out of the Child Tax Credit, and providing additional support to low-income families with very young children.

Helping working families to make ends meet through the Working Families Tax Relief Act provides an opportunity for families to not only get by but to get ahead, and to secure a prosperous future for our children and our communities. Senators Warner and Kaine support this measure and should continue their efforts to strengthen the EITC and CTC.

Category:

Budget & Revenue