November 2, 2018

Short Term Health Plans A Short-Sighted Option for Virginians

State lawmakers have an opportunity to protect individuals in Virginia against the bait and switch of short-term, limited duration (STLD) health insurance plans. Recent changes to federal rules mean insurers can now offer 364-day STLD plans that will be renewable for up to three years (previously a 90-day limit), without having to meet important patient protections that are required for regular health insurance plans. With the extended time frame, these flawed coverage plans may be marketed as a long-term and cost-effective health coverage option. Yet the reality is many plans lack protections for those with pre-existing conditions, fail to cover frequently used services, can lead to exorbitant out-of-pocket costs to consumers, and are likely to undermine comprehensive health insurance plans.

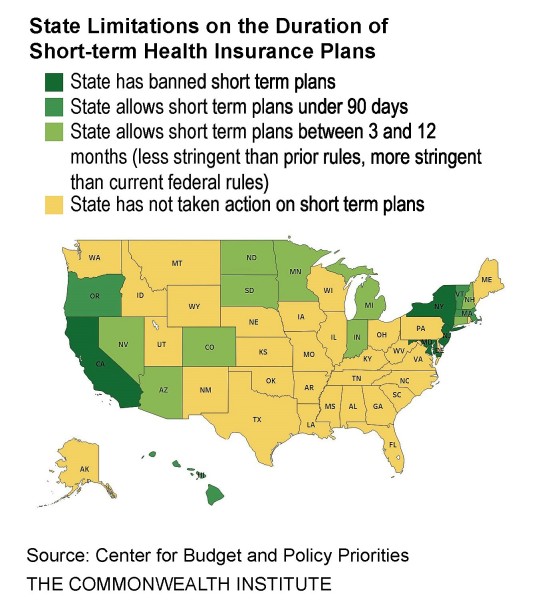

In response to these concerns, 14 states have limited the duration of these plans while four other states have outright banned them from being sold. Virginia should join these states and implement legislation to limit short-term plans and mitigate the harm they could do to consumers throughout the commonwealth.

Short-term insurers use a number of tactics that undermine Affordable Care Act (ACA) consumer protections and these tactics could greatly impact Virginians.

Insurers may simply deny coverage to people who report having a pre-existing health condition. Over 1.3 million Virginians – 26 percent of the non-elderly population in the state – are estimated to have a pre-existing condition and could see ACA protections deteriorate. Short-term plan contracts typically include a broad exclusion for any care related to a pre-existing condition. If a person has a condition the application didn’t ask about (or that the enrollee didn’t know about), care related to that condition may not be covered.

Also troubling, the insurer may choose to investigate a patient’s medical history after they receive care for evidence that the care is related to a pre-existing condition. This practice is known as “post-claims underwriting,” and could carry great costs for patients and their families.

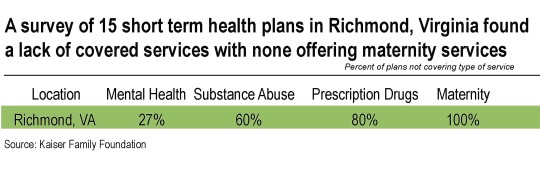

Insurance companies that offer STLDs can elect to not cover services required by the ACA. An April 2018 study of the short-term plans available through two major online broker sites found that 43 percent of plans didn’t cover mental health services, 62 percent didn’t cover substance use disorder treatment, 71 percent didn’t cover outpatient prescription drugs, and none covered maternity care. The study listed results by city and found these services also had limited availability in Richmond, Virginia (see table).

The scarcity of covered services is troubling as the state grapples with mental health access issues and opiate misuse and the need for mental health and substance abuse services is high.

Unlike ACA-compliant plans, short-term health plans can charge higher premiums to people based on their gender and can charge far higher premiums to older people based on their age. For example, a National Health Insurance Company short-term plan with a $5,000 deductible would cost $109 per month for a 40-year-old woman, compared to $90 per month for a 40-year-old man, according to data submitted to Wisconsin insurance regulators. The same plan would cost a 60-year-old man $297 per month, while a 60-year-old woman would pay $270 per month.

Short-term plans can also charge high deductibles and cost-sharing for the benefits they do cover. For example, an enrollee may need to pay a $5,000 deductible for a policy that lasts only three or six months before the insurance company would pick up the costs. Or, the plans include strict dollar limits on how much they will pay out for a given service or in total for benefits over the life of the policy. A recent review of select short-term health plans available in Philadelphia showed that the amount insurers would pay for some procedures, like an appendectomy, was less than 20 percent of the cost, leaving patients to pay large medical bills out-of-pocket.

These flaws could have real consequences for Virginia health care consumers if these plans are allowed to be marketed as a long term option. The ACA was instrumental in implementing protections for those with pre-existing conditions, and short term health plans would undermine this progress.

Short-term plans serve a purpose for those experiencing a temporary loss in coverage for example, a newly hired employee who must complete a probationary period before becoming eligible for group health benefits might benefit from a short-term policy during that time. But these types of plans were not meant to replace traditional long-term health care coverage options. The perception of low upfront costs gives way to high deductibles, premiums based on individual demographic information, and services that will have to be paid out of pocket. These financial factors can lead to medical bankruptcy for an individual who experiences a sudden illness, diagnosis, or accident.

Earlier this year, a proposal to extend the duration of STLDs to 364 days was vetoed by Governor Northam, who stated the legislation “would place consumers at risk of being underinsured and would fragment Virginia’s federal Marketplace risk pool, leading to rapidly increasing premiums.” Northam also noted that extending the duration of STLDs “would undermine efforts to make sure all Virginians have access to quality, affordable health care”.

Now with the changes at a federal level, this is exactly what will occur in Virginia without state legislative intervention. State legislators should institute a 90-day limit on short-term plans. The alternative – the possibility of denying coverage to those with pre-existing conditions, failing to cover services when consumers need it most, and leaving Virginians to pay a lot more for health care than expected – puts Virginians at great risk.

Category:

Health Care