March 22, 2017

Tax Breaks for the Wealthy, Less Access to Health Care

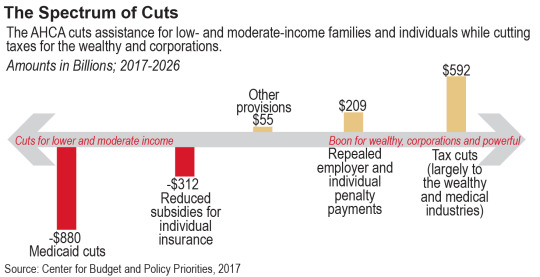

The House GOP health care plan – the American Health Care Act (AHCA) – creates an unequitable system where wealthy people and corporations catch the lion’s share of the financial breaks and families struggling to afford health care are left holding the bag.

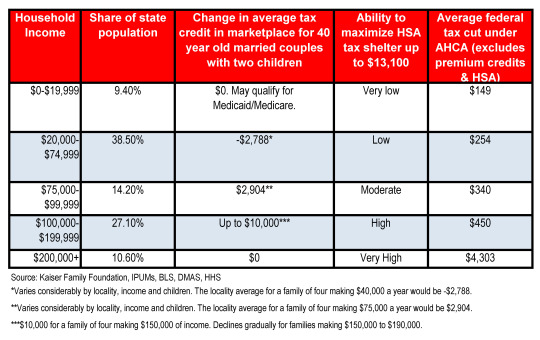

Under the proposal, the average Virginian who gets their health insurance through the federal marketplace would see the financial assistance they get to help them pay for that coverage drop by $1,128 a year. The very wealthiest Virginians, on the other hand, would receive a massive tax cut. That’s because even as the new law cuts financial assistance to help ordinary folks purchase health insurance, it eliminates many taxes on wealthy and powerful interests. Those taxes include a 3.8 percent surcharge on investment income (like stocks and bonds) for high-income individuals and couples and 0.9 percent additional Medicare tax for very high earners. Both taxes only apply to households with incomes exceeding $200,000 for single filers and $250,000 for joint filers. By getting rid of these taxes on very high-income households, the federal government would lose $275 billion over 10 years. That means less money to invest in making health care affordable for everyone else. For Virginia, these cuts would mean the top 1 percent of households would receive 81 percent of these tax breaks, averaging $14,606.

Furthermore, the AHCA would expand tax-sheltering opportunities for high-income families using health savings accounts (HSAs). Under the AHCA, certain families could put in up to $13,100 of income tax-free into an HSA to pay for future medical expenses. High-income people receive the largest benefit from HSAs as they face the highest marginal tax rates and have the most extra money to tuck away into these type of tax shelters. Nationally, 70 percent of HSA contributions are made by households with incomes above $100,000. Over the next 10 years, expanding HSAs as proposed under the AHCA would cost the U.S. $19 billion to provide tax sheltering opportunities for mostly the wealthy, while doing nothing for average Virginians who can’t afford to contribute more than the current maximum.

While many low- and moderate-income families in Virginia would see decreases in their premium tax credits under the AHCA, high-income families would see large increases. That’s because eligibility for ACA premium tax credits in 2017 ends at $47,520 for an individual and $97,200 for a family of four. The AHCA plan, however, would provide tax credits for some individuals making up to $115,000 and for couples over 60 making up to $230,000, even though increasing tax credits for high income groups is not likely to lead to more coverage. In the past, the Congressional Budget Office has found that high-income individuals are less responsive to changes in subsidies. Tax credits should be used to incentivize positive behaviors, like acquiring health coverage. These giveaways to the wealthy are a waste of limited resources which could make a greater impact if targeted towards those who are unable to afford coverage without some assistance.

To get a glimpse of what this means, even without considering the benefits of the HSAs and the restructured premium tax credits, households with incomes over a million dollars per year would receive around 37.4 percent of all tax breaks in the AHCA. Comparatively, household making less than $10,000 would only receive 1.5 percent of these tax breaks.

Lawmakers in Congress have a choice to make: will they move forward with a new scheme that gives generous tax breaks to the wealthy, or will they abandon that ill-conceived plan and get to work making it easier for average people to get health care.

Category:

Budget & Revenue