November 27, 2018

The EITC Boosts Opportunities for Communities of Color

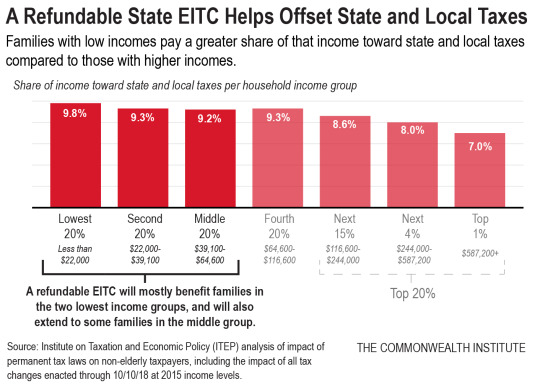

State and local taxes play an important role in shaping economic opportunity. These tax revenues pay for the schools, roads, parks, and libraries that create a foundation for thriving communities. Yet we know that Virginia’s state and local tax system is upside down. In Virginia, households with low and modest incomes pay a higher share of their incomes toward state and local taxes than the highest-income households. In tax policy terms, this is known as a regressive system. And since historical and present-day barriers for communities of color have resulted in stark differences in income by race, this means these taxes particularly hit Black and Latinx families who are more likely to be paid low wages and struggle to make ends meet.

Public policy created the current situation, and public policy can help address the harm. A refundable earned income tax credit (EITC) is a working families tax credit. And it’s an effective tool for offsetting the impacts of regressive taxes and would particularly help Black and Latinx Virginians who bear the brunt of the current situation.

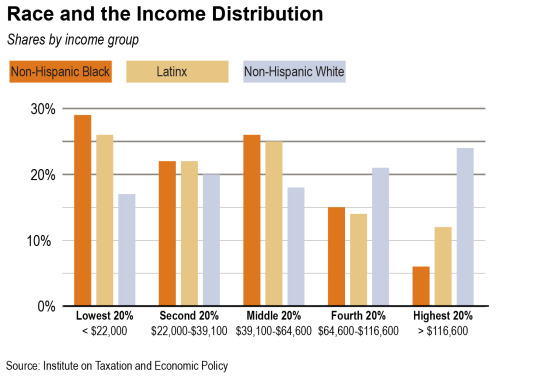

Black and Latinx households in Virginia are more likely than non-Hispanic white households to be in one of the low- and moderate-income groups with incomes up to $64,600. These are the working families who are hit hardest by the current regressive tax system and would be most helped by making the EITC refundable. The reverse is also true. Black and Latinx households are less likely to be in the highest income groups. Meanwhile non-Hispanic white households are less likely to be among the lowest income group and relatively more likely to be in the two highest-income groups. In some ways, it’s getting even worse: Black and Latinx workers saw their median real wages decline between 2007 and 2017.

Fortunately, lawmakers can address these harms by improving the state’s existing EITC. The EITC helps working families with low and moderate incomes, especially those with young children, afford the basics like child care and putting food on the table. Over 600,000 families in Virginia currently receive the federal EITC, and in general, families in Virginia who qualify for the federal EITC also can claim a state EITC.

But Virginia unnecessarily restricts its current credit, preventing many families from receiving the full value that they’ve earned and leaving many hardworking families less economically secure. Governor Northam has proposed strengthening Virginia’s EITC, which would give a targeted boost to families, mostly benefiting those families in the two lowest income groups and also extending to some families in the middle group. This proposal would go a long way to boosting the economic prospects of working families, especially for communities of color. In Virginia, people of color and their families are 38 percent of the total population, but represent nearly half of the families who receive the federal EITC and would likely benefit from an improved state EITC.

The positive impacts of the EITC are well documented. State EITCs have been shown to reduce poverty in communities of color. Research finds that the average state EITC benefit for non-white- or Hispanic-headed households was $120 greater than for non-Hispanic white households, and state EITCs reduce poverty for a larger share (relative to their share of the population) of the non-white and Hispanic population.

State EITCs also are associated with educational benefits for children of color. Studies show that young children in low-income households who get the state or federal EITC tend to see increased educational achievement and attainment.

The situation is clear. Virginia has an upside-down state and local tax system that hits Black and Latinx families harder. Adopting a stronger state EITC would give a boost to many of these families. Tell lawmakers to give these families the full credit they’ve earned: bit.ly/My-Lawmaker

Category:

Budget & Revenue