October 19, 2017

Turning a Profit from ‘Charity’

We’ve written before about Virginia’s “rich get richer” tax breaks that allow high-income individuals to profit from their donations. The state’s Education Improvement Scholarship tax credit (EISTC) is one that deserves particular attention.

On the surface, it sounds great – like it’s designed to give a tax credit to people who donate money to help improve education. But this credit only funds scholarships in eligible non-public schools, and does nothing to help Virginia’s K-12 public schools. And the credit is structured so that people or businesses who donate money or securities get a tax credit of 65 percent of their donation, on top of other federal and state deductions for charitable giving. That’s “double-dipping.”

That means that the EISTC actually creates a situation where many high-income individuals subject to the federal Alternative Minimum Tax or who donate appreciated securities can actually save more money in avoided taxes than the amount that they donated.

Each year, the EISTC costs Virginia millions of dollars in forgone revenue that otherwise could go toward greater investments in K-12 public schools and other needs. In FY 2016 (July 1, 2015 – June 30, 2016), the Virginia Department of Education (VDOE) issued $6.8 million in credits. As of January 12, 2017,VDOE had issued $5.5 million in Education Improvement Scholarship tax credits for fiscal year 2017, which began on July 1, 2016. Under the current law, the amount of lost revenue in any given year could be as much as $25 million per year.

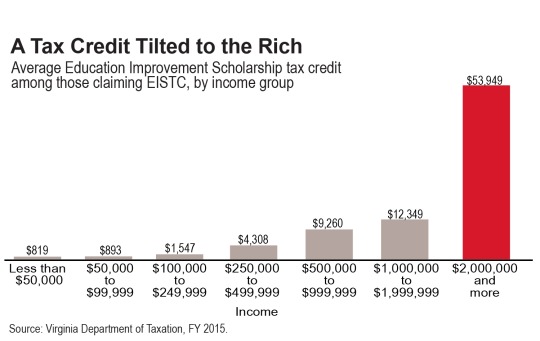

And it’s not your average person who is taking advantage of this overly generous tax credit. That’s because it’s structured in a way that gives the biggest benefit to very high income households. Most of the state tax credit money goes to households with $500,000 or more in federal adjusted gross income, and over a third of the credits are claimed by those reporting more than $2 million in federal adjusted gross income.

The ability to turn a profit from these kinds of tax credits isn’t exactly a secret in Virginia or in states with similar programs. For example, wealth management firms describe how individuals stand to profit from this tax provision. It’s time for lawmakers to take notice, too. We’ve long advocated for reforms to state tax credits and deductions, which often escape needed scrutiny. The EISTC is particularly troubling for its potential use as a tax shelter. Reducing the current credit from 65 percent to a lower amount and fixing the “double-dipping” feature could address these problems. Lawmakers want to have sufficient state revenue to build up reserve funds and invest in ongoing commitments to education and healthcare. Cleaning up costly tax credits needs to be part of the equation.

Category:

Budget & Revenue