May 19, 2020

Virginia Should Act to Help Immigrant Communities Stay Afloat

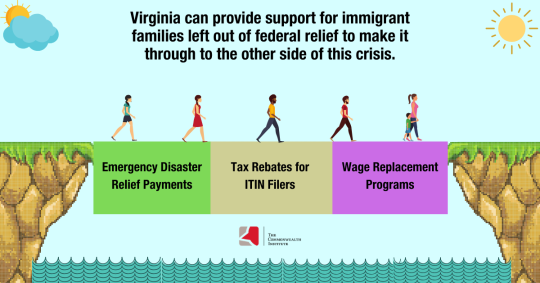

Immigrant families are woven into the fabric of Virginia’s communities and economy, and working people of every immigration status are carrying out important work to maintain critical services at this difficult time. At the same time, Latinx and Black communities are being hit particularly hard by COVID-19 and many workers of color in Virginia and the United States as a whole are losing their jobs. Unfortunately, the federal COVID-19 relief programs have left out many low-income immigrant families and communities by excluding undocumented and mixed-status families from the Economic Impact Payment (recovery rebate) and maintaining existing barriers to unemployment insurance while using that program as a primary means of directing federal dollars to out-of-work families. Leaving out many immigrant families from economic aid risks the health as well as the financial stability of our families and communities by forcing people to choose between going to non-essential jobs and being able to stay afloat financially. In order to protect our communities’ health and well-being, Virginia and its localities must work to fill these significant policy gaps.

Virginia does not need to reinvent the wheel. Policymakers in other states have been exploring and implementing a range of options, including wage-replacement programs, disaster relief funds, and refundable tax credits. Below is a brief summary of some of these efforts.

Emergency disaster relief payments

Many states and local governments are using their own funds to provide disaster relief cash assistance for undocumented and mixed-status families, either as part of broader assistance programs or targeted to immigrant individuals and families who are left out of other help.

California has established a disaster relief fund with an investment of $75 million from the state and $50 million in private funding organized through Grantmakers Concerned with Immigrants and Refugees. The program is designed for undocumented immigrants who are ineligible for federal unemployment and financial relief and provides a one-time cash payment of $500 per adult, with a cap of $1,000 per household.

Washington has activated a preexisting Disaster Cash Assistance Program to address the needs of families affected by the COVID-19 crisis. The program offers one month of assistance (in a twelve-month period) to all low-income Washington families and people without children, regardless of their status, who are not eligible for other cash programs.

Some local governments in Virginia are acting to provide emergency cash assistance without immigration-related restrictions, despite facing their own budget crises. For example, the City of Richmond provided $500,000, matched by a grant from the Robins Foundation, for grants of $500 to families who have lost income. And the City of Charlottesville and County of Albemarle have contributed to an emergency relief program established by the Charlottesville Area Community Foundation. And Fairfax County Executive Bryan Hill has recommended that $20 million of the county’s CARES Act funds be used to support basic needs of families through existing community-based organizations. These efforts are important, but the scale of the problem is such that Virginia’s revenue-constrained localities and the philanthropic community cannot be expected to meet the majority of the need.

Tax rebates for ITIN filers

The federal CARES Act excluded all families where even one of the spouses files their taxes using an Individual Taxpayer Identification Number (ITIN) from the tax rebates of $1,200 per adult and $500 per child. This excluded about 323,000 Virginia residents, including about 221,000 undocumented immigrants who do not have a social security number and 103,000 family members of undocumented immigrants (65,000 of whom are children). Of these excluded Virginians, about 136,000 are a part of families who filed federal income taxes using ITIN numbers. If this barrier had not been in place, an additional $122 million would have flowed to Virginia families, communities, and economy.

A number of states are considering using their own funds to provide some replacement relief for their residents who file taxes using an ITIN. In New Jersey, the Senate President Pro Tempore and Assembly Majority Leader have proposed $35 million in direct assistance for residents of the state who file their taxes using an ITIN and therefore were excluded from the CARES Act. In Massachusetts, legislators have proposed replacement state rebates of $1,200 per adult and $500 per child.

Wage replacement programs

Employers are required to pay into the unemployment insurance system on behalf of their workers no matter the immigration status of the employee. Since 2010, employers of undocumented immigrant workers in Virginia have contributed an estimated $215 million to the Virginia and federal unemployment insurance systems on behalf of those undocumented workers. Despite these contributions, out-of-work Virginians who lack work authorization are unable to receive assistance from standard unemployment insurance or the new unemployment program for self-employed workers and others who are left out of traditional unemployment systems. This leaves undocumented and mixed-status families whose breadwinners are out of work with no replacement income.

Although many states are providing or exploring providing relief through general grants or tax rebates to ITIN filers as discussed above, Oregon has taken a step to target aid to out-of-work immigrants by providing $10 million of its state emergency funds to the Oregon Worker Relief Fund, which is seeking to replace up to 60% of lost wages for Oregonians who, due to their or a family member’s immigration status, are disqualified from receiving unemployment insurance or stimulus benefits.

Additional considerations

There have been some legal challenges from conservative organizations to the actions of other states to provide disaster assistance to undocumented immigrants, yet courts have allowed these programs to move forward in all recent rulings. Virginia could have further confidence in the legal standing of assistance provided to undocumented families by making it clear in authorizing legislation or budget language that the program is available regardless of immigration status. Making it clear that the program is in response to the COVID-19 disaster also provides some protection for immigrant families from being targeted by “public charge” assessments.

Undocumented immigrants and their family members are an important part of communities across the commonwealth. Local governments recognize this and are acting to help families stay afloat, regardless of immigration status. Virginia has the capacity to act on a larger scale to fill some of the holes that have been left by federal exclusions. There are many options for how to do so. In addition to those discussed above, Virginia could consider providing rental assistance regardless of immigration status for families at risk of eviction, additional support for food assistance, and hazard pay and free child care for essential workers who must continue to work at this challenging time and may be supporting family members who are out of work. Virginia state policymakers can’t fix the federal immigration system that excludes so many families, but it can act to help excluded Virginia families in every way possible.

Categories:

Economic Opportunity, Immigration