January 24, 2019

Celebrate EITC Awareness Day By Improving the Credit This Year!

There has been broad, bipartisan support for the Earned Income Tax Credit (EITC) for decades. And for years elected officials, direct service providers, and tax preparers have worked together to make sure families are aware of this vital credit. EITC Awareness Day is an opportunity to bring attention to the benefits of this working families credit right at the start of tax filing season. This year, EITC Awareness Day is on Friday, January 25, and you can help celebrate by sharing the IRS EITC toolkit or this post on social media to raise awareness of this valuable credit.

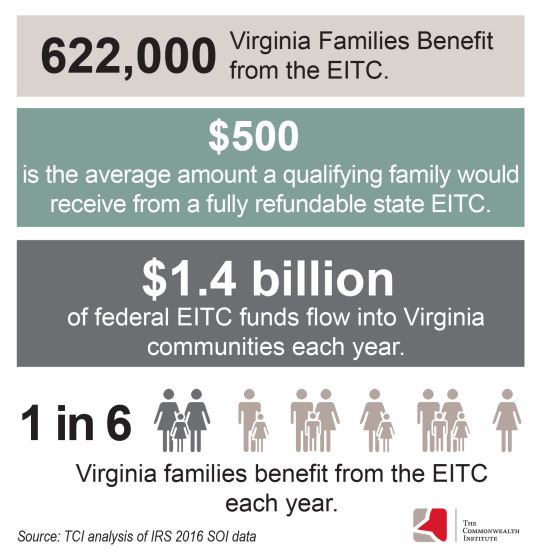

Over 600,000 families benefit from the EITC in Virginia each year. We know from an extensive body of research that the EITC is one of the most effective anti-poverty tools in the United States.

And Virginia lawmakers have many tools at hand to make sure everyone who qualifies for the credit sees the full benefit. Chief among them is their ability to make the state’s version of EITC refundable — meaning that families would receive a refund for the amount of the credit that exceeds their income tax, offsetting state and local taxes that take up a larger share of their income. Evidence shows that making a state credit refundable is a highly effective way to reduce poverty rates, boost employment, increase wages, and contribute to increased educational attainment and health outcomes for children.

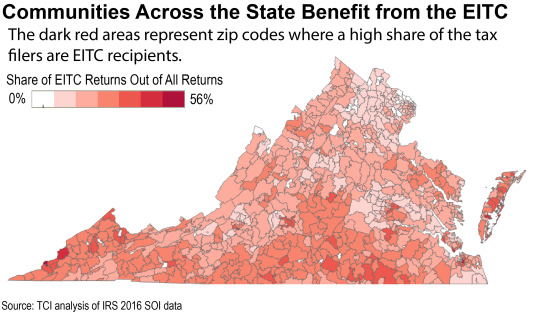

Find the interactive map here

Unlike most other states that have an EITC, Virginia has not made its state credit refundable — meaning low-income workers in the state miss out on the additional benefits that their peers in other states see. Virginia lawmakers are currently considering legislation that would unlock this benefit for our state’s working families who are struggling to make ends meet.

EITC Awareness Day is all about informing people of the significant value of the EITC. If Virginia wants to realize the full potential benefits, making our state credit fully refundable would go a long way towards this end. Lawmakers should account for the major supplemental benefits of the EITC for families as they deliberate the variety of tax options in front of them this year.

Category:

Budget & Revenue