June 6, 2023

Cutting Top Personal Income Tax Boosts the Wealthy, Excludes People with Lower Incomes

With no budget compromise yet from the Virginia General Assembly, $1 billion in untargeted tax cuts that mostly benefit the wealthy and profitable corporations are still on the table. This includes the governor’s and House’s proposal to cut the state’s top personal income tax rate from 5.75% to 5.5%. Even with just a quarter of a percentage point reduction, this proposal could have substantial budget impacts for years to come. Cutting Virginia’s top personal income tax rate would primarily benefit a small subset of people with high incomes, while leaving many families in the commonwealth who need economic relief with little to no benefit. It would also drain available funding for programs and priorities that help all families in Virginia succeed.

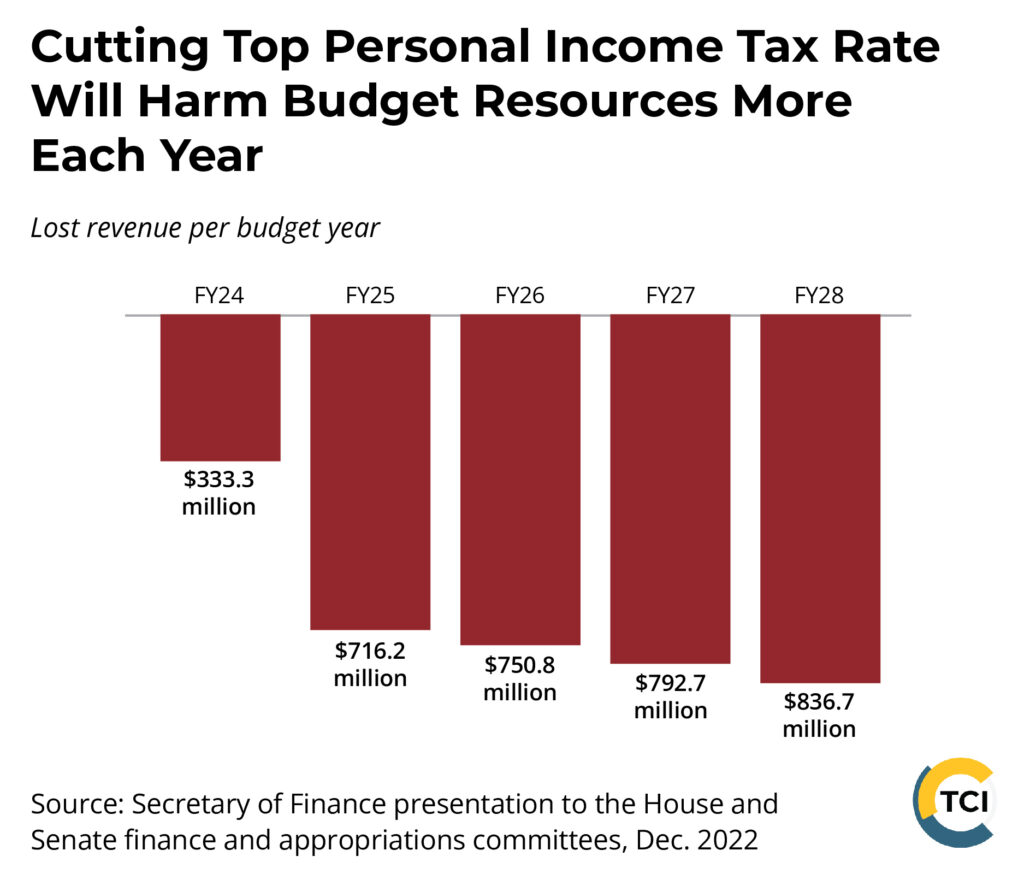

Let’s take a closer look at the numbers. Cutting Virginia’s top personal income tax rate is one of the costliest provisions in the House budget, forfeiting more than $330 million of our shared resources in the next budget year (fiscal year 2024) alone. But that’s not even the full story. The revenue loss will more than double within the first full budget cycle that the rate reduction is implemented, costing the state $1.47 billion in lost revenues for the FY25-26 budget. This large reduction in revenues must be understood alongside the $3.7 billion tax cut package in the current budget that was approved last year.

Most VA filers pay some of their income tax in the top bracket, so why won’t cutting the top tax rate benefit everyone the same way?

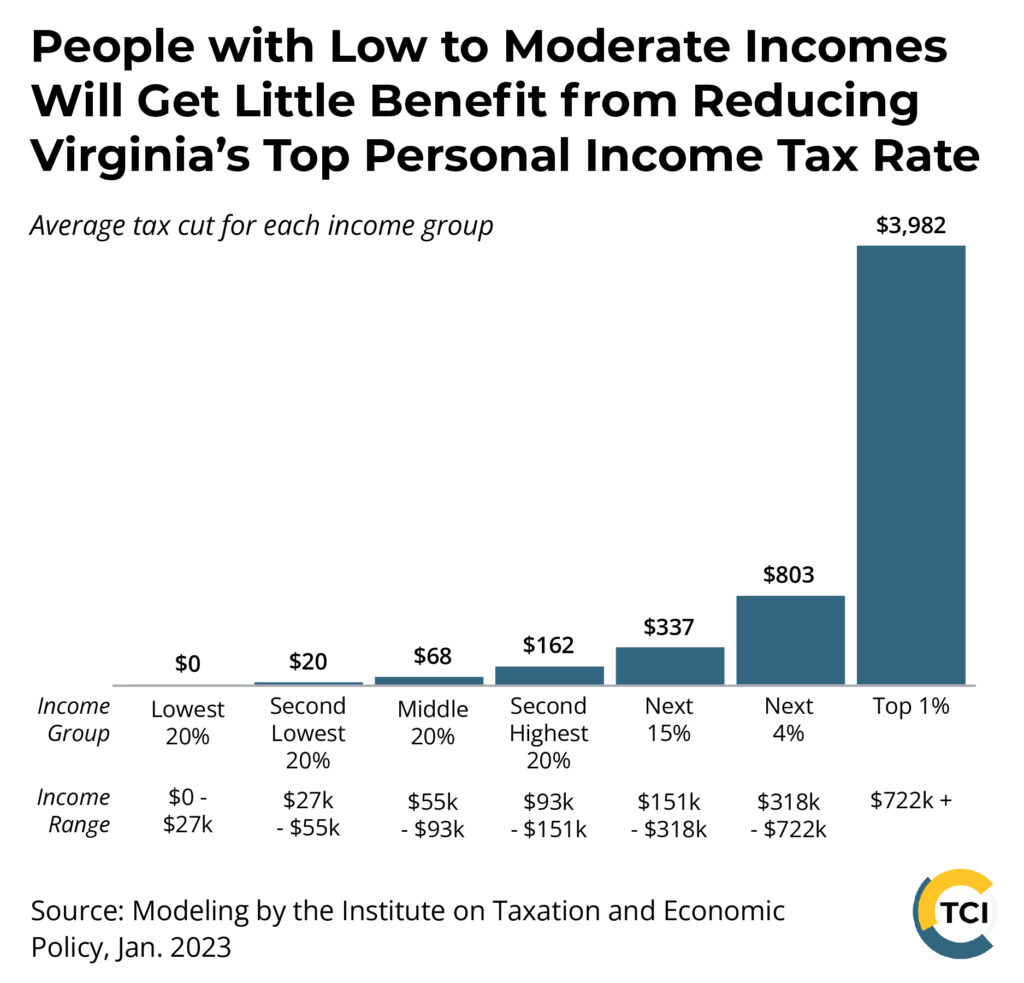

Virginia has four income tax brackets ranging from a 2% tax on the first $3,000 of taxable income to a 5.75% tax on any income over $17,000. A teacher earning $62,100, the average pay for a teacher in Virginia, would share the same tax bracket as someone with a million-dollar annual income. However, cutting the top rate would not help the teacher and the millionaire equally. If lawmakers reduce the top tax rate, the more income someone has in the top bracket, the greater the benefit they will receive. Since the millionaire has far more income in the top bracket, they stand to gain far more from a top rate reduction.

As a result, the billions of dollars lost in state revenues will flow mostly into the pockets of people with high incomes. In fact, over 70% of the tax cut will go to those making $151,000 or more — the top 20% of incomes — with the top 1% taking nearly a quarter of the benefit for themselves. Very few families who are paid the least in the state will see any tax cut, while the average cut for someone in the top 1% would be nearly $4,000. Reducing the top tax rate will do very little for the families hardest hit by the rising costs of everyday goods and services, while putting more money into the pockets of the financially well-off. This proposal would further exacerbate the state’s upside-down tax code, all while depleting resources for already underfunded services like Virginia’s public schools.

There are better opportunities to make key investments in our communities through the tax code. Lawmakers could improve the state’s Earned Income Tax Credit to provide essential support to low-income working families or establish a Commonwealth Kids Credit that lifts up families with children. Rather than tax cuts for those with the highest incomes, the people of Virginia deserve a budget that invests in all of our collective futures and a tax code that provides relief to those who need it most.

Categories:

Budget & Revenue, Economic Opportunity