December 20, 2017

DREAM ACT: What’s at Stake for Virginia?

Dream Act Would Boost Virginia Families, Communities, State Economy, and Tax Revenues; Revoking DACA Hurts All

On September 5, the Trump Administration announced that it would end DACA (Deferred Action for Childhood Arrivals), the program for immigrants who were brought to the United States as children. DACA grants immigrant youth temporary relief from deportation and gives them authorization to work lawfully in this country. The president then “challenged” Congress to provide a fix to the problem he created—presumably with something like the Dream Act, a pathway to citizenship for immigrants who were brought to the United States as children.

The primary impact of this debate is on the young people who face the loss of DACA status, including protection against deportation and the ability to lawfully work in the United States. An estimated 39,000 working Virginians could become eligible for conditional permanent residency under the Dream Act.

What’s at stake for Virginia’s economic and fiscal outlook?

Economy: If immigrants eligible for DACA are deported, the value of their work is lost to the American economy, not to mention the vast disruption to businesses impacted by mass deportations.

Conversely, if the Dream Act is passed, it will allow immigrant youth to work in jobs that best match their skills, and will give them an incentive to invest in further education and training.

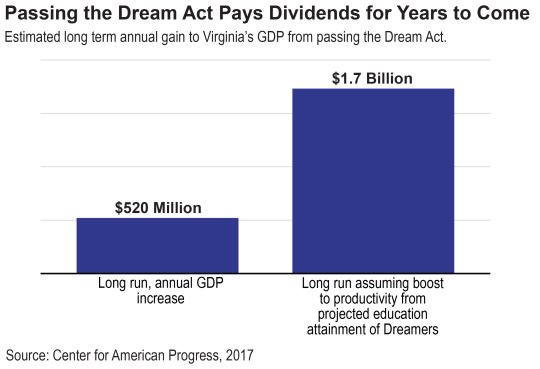

We do not have an estimate for the loss to the economy if DACA recipients are deported. But the Center for American Progress has estimated that if Congress passes the Dream Act, 39,000 working Virginians would become eligible for conditional permanent residency, boosting Virginia’s state GDP by $520 million a year.

The increase is substantially larger if the Dream Act encourages more people to invest in their own education, as is highly likely. In one scenario: if half of the people eligible to obtain lawful permanent residence met the educational requirements to do so by obtaining either a 2-year or 4-year college degree, their economic productivity and individual earnings would also go up, and their contributions would increase Virginia’s GDP by $1.7 billion every year.

Tax Revenues: Unless Congress acts, termination of DACA will not only result in a tear to Virginia’s social fabric and a disruption to its economy, it will also result in losses of the taxes paid by these young immigrants.

There are 30,000 young immigrants who were potentially eligible for DACA and call Virginia home. They currently contribute a total of $29.3 million to local and state taxes annually through sales and excise taxes, property taxes and income tax.

Without the Dream Act, Virginia can expect to lose at least $10.5 million in tax revenue. That’s the projected loss if DACA recipients stay in the state after losing work authorization, earning lower wages and becoming less likely to file income tax returns.

Virginia loses even more if those eligible for DACA are all deported. In that case, the tax losses would amount to $29.3 million, and there would be many additional costs to businesses and communities of such a drastic measure.

On the other hand, if Congress takes up the president’s challenge and passes a Dream Act, as is currently under consideration, these young immigrants would be granted work authorization and a pathway to citizenship. In that case, rather than a decrease, Virginia would see an increase in state and local taxes of $22.2 million. And that is a conservative estimate as the Dream Act would affect other individuals in addition to those eligible under the rules for DACA. If allowed a pathway to citizenship, immigrant youth would be more likely to advance in a career, buy a home, or start a business. At stake is $51.5 million in state and local tax revenue, the difference between a $29.3 loss and a $22.2 million gain.

Costs: These tax revenues would help offset costs at the state and local level. Many of these costs, it is worth noting, are in fact long-term investments.

For example, the cost of aid for college today is returned in higher economic output and tax revenue contributions by those college students when they graduate and enter the labor force. Health care coverage is an investment in public health and a healthy labor force. And, the biggest benefit will be getting permission to work, which will enable many of these immigrants to get employer-provided health insurance.

The Dream Act will put these young immigrants on the same footing as all other Virginians, paying their fair share of taxes and getting their fair share of public services.

Dreamers have shared in the investment of education, attending public schools across the state, and have friends and family in the United States. They have high rates of labor force participation and have worked hard to establish their lives in this country. The Dream Act would make it possible for these young immigrants to continue with what they’ve learned in school, work to realize their potential, and contribute fully to Virginia’s communities and to the local economy.

Category:

Immigration