February 14, 2019

General Assembly Weighs Incremental Progress on K-12 After the Tax Fallout

The Senate and House have named the budget conferees that will be negotiating the General Assembly’s proposed changes to the state’s two-year budget. Having negotiated away a $975 million tax deal that severely limits the resources lawmakers have to fund proposals put forward in December, they will now be weighing crucial investments against one another. One of the areas most impacted by this tax decision is K-12 education which serves as one of the primary areas of discretionary (non-federally required) spending in the state budget.

So what will they be weighing in K-12? Here is a quick breakdown of some of the K-12 proposals currently being discussed.

Teacher Pay

The proposed budget from the governor lifts the state share of an initially budgeted 3 percent raise to a 5 percent pay increase for teachers and school staff for the 2019-2020 school year. The Senate includes all of these funds and adds language allowing school divisions to provide a partial increase between 3 and 5 percent and still receive the state match. The House includes similar language, yet only provides the funds for half the year – the result is that local school divisions will either have to find the local dollars to pay for a full year or only give teachers a partial raise. The difference between the House and Senate proposals is $43.8 million.

School Counselors

The governor’s proposal starts a three-year phase-in to get to the desired ratio of one school counselor for every 250 students. The House budget takes out the commitment for future years, but includes the full investment of $36 million to increase counselors in Virginia schools. The Senate proposal only includes one-third of these funds ($12 million) for the state share of an additional 250 counselor positions.

Manageable caseloads for school counselors are crucial for proactively identifying student behavior challenges, reducing exclusionary discipline, and implementing evidence-based alternatives to school exclusion. Studies show that schools with lower student caseloads for counselors have better graduation rates, higher attendance, and fewer disciplinary incidents than those that do not, especially in high-poverty schools. Unfortunately, the average caseload for school counselors has grown from 300 students in the 2007-2008 school year to a high of 385 in the 2015-2016 school year – well above the recommended standard of 250 and above nearby states such as West Virginia, North Carolina, Maryland, and Tennessee.

At-Risk Add-On

Perhaps the most important decision in terms of equity is proposed changes to Virginia’s At-Risk Add-On program. The governor proposed a $35 million increase (in lottery revenues) in Virginia’s supplemental aid to school divisions with high concentrations of poverty to assist them with the additional services these students need when they come to school to thrive, increasing the additional aid up to 1-16 percent more per student eligible for free lunch. This amount that still lags national comparisons where most states provide every eligible student 20-25 percent more. These funds are needed to reduce the inequity of the state’s school funding distribution. Virginia is one of only six states that spends less (local, state, and federal combined) per student in our highest poverty communities than our lowest poverty ones.

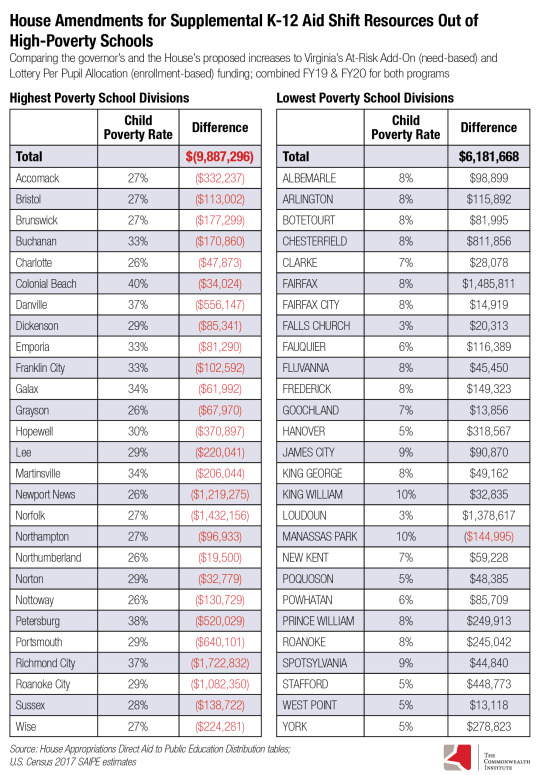

The House eliminates this proposed increase, instead shifting much of the funds into the Lottery Per Pupil Allocation (Lottery PPA), another supplemental funding stream for schools. The key difference is that these funds are not directed to schools with the highest child poverty, instead allocated mostly based upon enrollment. The impact of this proposal is that the 27 school divisions with the highest child poverty rates (combined enrollment approx. 150,000) will receive $10 million less in state funding, while the 27 school divisions with lowest child poverty (enrollment approx. 625,000) will receive an additional $6 million – furthering the inequity in the state’s funding distribution.

Meanwhile, the Senate version partially funds the governor’s proposal including approximately two-thirds of the investment ($21 million).

Virginia Preschool Initiative (VPI) Plus

The governor’s proposed budget invests state funds to cover the costs of an expiring federal grant that extended the Virginia’s state preschool program (VPI) to serve an additional 13,000 four-year olds living in low-income households. The program serves 13 school divisions in areas across the state and includes Brunswick, Chesterfield, Fairfax, Frederick, Giles, Henrico, Norfolk, Petersburg, Prince William, Richmond City, Sussex, Virginia Beach, and Winchester.

The House proposal eliminates continuing the grant program with state funds, while the Senate proposal includes about three-quarters of the funding ($7.3 million).

Virginia is 42nd in the country in state per student funding for our K-12 schools. Funding has fallen 9 percent per student from where we were before the recession adjusting for inflation. Yet lawmakers decided to prioritize a $975 million tax deal that includes about $400 million mailed to people paying state income taxes (including millionaires) in the form of a $110 or $220 check. The proposals they are weighing are not going to fix these funding problems across the commonwealth. However, they do take a step in the right direction, and lawmakers should choose to invest in important services like counseling and preschool and work to reduce the inequity in school funding, not increase it.

Category:

Education