July 28, 2017

Health Care Update: Time to Move Forward, Come Together, and Shore Up the Marketplace

This past weekend, many of Virginia’s state and Congressional lawmakers took a trip out to Wise County to visit the Remote Area Medical clinic, which offers free health care to thousands of families over a three day period. The lines started early and went late into the evening. Lawmakers present at the event also took the opportunity to reflect on the incredible need of the people coming from all over the region and to comment on the health care debate going on in Washington.

With the recent collapse of efforts to repeal and replace the Affordable Care Act in the Senate, the time seems ripe for both our Congressional representatives and state legislators to come together to strengthen our insurance marketplace. Federal policymakers can do so by protecting existing health insurance cost-sharing reductions for moderate-income families. This is one of the few areas of agreement where both Democrats and Republicans have indicated they are willing to work together.

Around 6 million people nationally and 326,000 in Virginia rely on cost-sharing reductions to purchase usable health insurance on the exchange. But these supports face an uncertain future, and that means moderate-income families are at risk. Cost-sharing reductions currently help lower health insurance deductibles and co-payments for moderate-income families with incomes between 100 and 250 percent of the poverty line – thereby lifting the constant worry that a medical crisis will become a financial crisis.

Strikingly, uncertainty about the continued funding of cost-sharing reductions – and not the way they are actually funded – is a major contributor to marketplace instability. The Trump administration has signaled its intention to undermine it by not continuing to pay the federal government’s share of the cost-sharing reduction costs. And the growing uncertainty has been cited by many insurers across the country in recent months as a chief concern for remaining in the marketplace.

For example, Aetna has said: “based on [the] financial risk, and growing uncertainty in the marketplace, we will not offer on- or off-exchange individual plans in Virginia for 2018.” Earlier this year, Anthem cited an “increasing lack of overall predictability [that] simply does not provide a sustainable path forward to provide affordable plan choices for consumers” when choosing to pull out of Ohio’s marketplace. The insurer cited the unpredictability in cost-sharing reduction payments as the main driver leading to the exit.

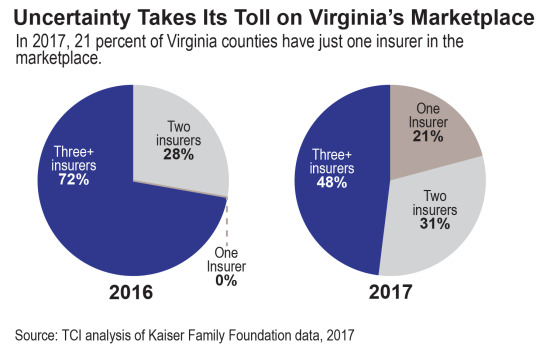

This year, 21 percent of the Virginia’s cities and counties, home to 5 percent of the state’s population, have only one insurer for non-group coverage. Although new insurers may join Virginia’s marketplace in 2018, continued uncertainty creates risks that some Virginians may have few choices of insurers.

Without the administration’s continued threats to stop paying the federal government’s $7 billion share of cost-sharing reductions costs, the marketplace would be significantly more stable today. Evidence shows that if there was no uncertainty around cost-sharing reductions, most state marketplaces would be more stable and successful next year. In 2016, insurers nationally were projected to be revenue neutral or profitable this year in the marketplace. In the same year, Standard & Poor’s found that 2018 premiums were expected to increase at a far slower rate than 2017. In North Carolina and Pennsylvania, insurers have indicated that rate increases for marketplace plans would be about a third less if they had assurance that cost-sharing reductions would be paid.

Congress has the power to shore up insurers by providing a permanent appropriation for cost-sharing reductions. And that’s just what the recently introduced H.R.3258 and S.1462, Marketplace Certainty Act would do. This act should theoretically be easy to pass because it does not need a budgetary offset and is already fully paid for through a mechanism within the ACA. Beyond the fact that additional funds would not have to be allocated to pay for this bill, it would also save the government billions of dollars. That’s because failure to pay cost-sharing reductions would lead to higher premiums and cost the federal government around $31 billion more than simply paying for cost-sharing reductions, according to the Congressional Budget Office’s projections. And that projection assumes all insurers stay in the marketplace, which we’re already seeing is not the case.

State policymakers also have options to help support Virginia’s health insurance marketplace. The best option by far would be expanding Medicaid. States that expanded Medicaid have seen lower marketplace premiums, as low-income and less healthy people tend to enroll in Medicaid and would be pulled out of the marketplace pool. In the 19 states that have chosen not to accept federal funds to expand Medicaid, including Virginia, the population that would be covered under expansion is often more costly for insurers and contributes to higher premiums.

In addition, state policymakers can strengthen the marketplace by promoting enrollment by state residents. Overall, in states that have had Democratic governors supportive of the ACA over the past year, only 1.8 percent of their residents live in localities with only 1 marketplace insurer, compared to 20.7 percent of residents in states with Republican governors. This is not to say that all Republican governors are against every aspect of the ACA, or that all states with Democratic governors have expanded Medicaid, but promoting the program can go a long way in creating stable marketplaces.

It’s time for our Congressional representatives to step up and make the easy decision to pass the Marketplace Certainty Act. Doing so will help provide stability to the marketplace, reduce premium increases, and at the same time save the government billions of dollars. Everyone wins with this decision. In the meantime, state legislators have the tools at hand to improve our marketplace conditions and protect health care access for hundreds of thousands of Virginians. This is a rare and unique opportunity for bipartisan cooperation. Anything less is playing politics with people’s lives.

[Editor’s note: This post was edited on August 1, 2017 to provide clarification on potential volatility in the number of marketplace insurers.]

Category:

Health Care