July 24, 2017

House Budget Would Harm Families and Communities, even in Loudoun County

Loudoun County may be the nation’s highest income county, but that designation masks real problems low-income people there face. And if Congress has its way, the federal budget will make their situation even worse.

The basic structure of the House budget that was introduced this week gives away trillions of dollars in tax handouts to very wealthy individuals and profitable corporations and pays for it by making substantial cuts to entitlement spending on programs that mostly benefit low- and moderate-income families. The House proposal would also shift huge costs to Virginia, at a time when the state is already struggling to meet basic needs in key areas such as education, mental health, and addiction treatment services.

Most significantly, the House budget would cut $4.4 trillion from health care and other services for low- and moderate-income families who are struggling to make ends meet and seniors who rely on nursing care.

In parts of the state with high costs of living such as Congressional District 10 (largely centered around Loudoun County), cutting funding for entitlement programs will hit low- and moderate-income families particularly hard. The Supplemental Nutritional Assistance Program (SNAP), for example, which provides an average of just $1.40 per meal in assistance, is likely to see cuts of about 20 percent – threatening nearly 9,000 people in District 10 who rely on SNAP to help put healthy food on the table. (Statewide, the cut could hurt nearly 800,000 people.) While almost all of the households that receive SNAP benefits in this district are working, the high-cost of living in the region coupled with these cuts would leave families with hard choices when it comes to their food and other essentials.

SNAP isn’t the only program at risk for cuts. Supplemental Security Income (which supports seniors and people with disabilities), funding for foster care families, child care assistance, the child support enforcement system, Pell Grants for low-income students, and the Earned Income Tax Credit and the Child Tax Credit are all on the chopping block in this new budget. The accumulated impact from cuts to even a couple of these programs could have devastating impacts on working families in District 10, especially given that these benefits might have only been going half as far to start with in this high cost region.

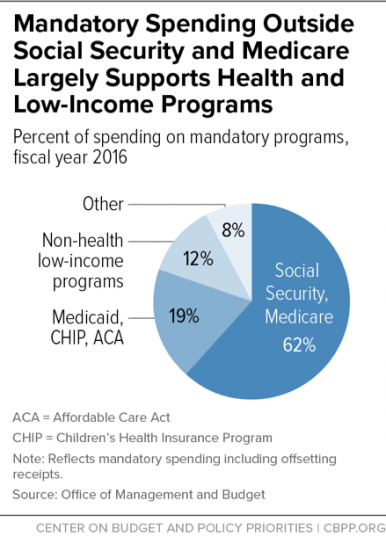

While authors of the House budget have claimed that entitlement programs have been growing out of control, spending on non-health care entitlement programs as a share of the overall budget have been and are projected to continue falling over the next several years. And while health care costs are projected to increase, that’s largely due to an aging U.S. population, not runaway spending.

Virginia’s representatives have a choice to make in this budget about priorities and values: will they sign on to a massive handout to the very wealthy (around 40 percent of tax benefits would go to the top 1 percent of households) and cut trillions of dollars in services to low- and moderate-income working families; or will they take a stand for these families, children, seniors and the disabled. While the wealthy don’t need the tax cut, a hit of even a few hundred dollars a month in benefits for struggling families would have dire and life-changing consequences.

Loudoun County’s Representative Barbara Comstock has indicated that she has concerns about attempts to make deep cuts to services for low-income families and seniors. In late June, Comstock signed onto a letter saying that using the fast-track process to make $200 billion in cuts to mandatory spending programs was “not practical.” The coming week provides her with the opportunity to show if she still believes this.

Category:

Budget & Revenue