May 10, 2016

Medicaid Reduces Financial Stress

One of the main benefits of health insurance is that – like other insurance – it protects families from financial ruin when they are most vulnerable. A growing body of research shows that Medicaid reduces excessive debt, bankruptcies, and catastrophic medical costs, and provides families with quality health care. Despite these benefits, Virginia lawmakers continue to withhold them from thousands of our neighbors. By refusing to close the Medicaid coverage gap, lawmakers are denying access to affordable health insurance options – and the financial protection they offer – for up to 400,000 Virginians who struggle to make ends meet. Here are three studies that show just how much Medicaid helps to prevent financial stress in states that have expanded eligibility.

Medicaid is a proven way to help families reduce debt. A working paper released last month by the National Bureau of Economic Research estimates a reduction of $600 to $1,000 in debt for each individual who gained Medicaid coverage due to the Affordable Care Act.

The study, by researchers from the Federal Reserve Bank of Chicago, University of Illinois, and University of Michigan, shows that Medicaid expansion under the ACA significantly reduced the number of unpaid bills and the amount of debt sent to third-party collection agencies by those residing in the zip codes with the highest share of people who lack health insurance and have low incomes. The researchers found this by comparing 8 million credit records in 8,100 zip codes in 14 states that expanded Medicaid under the ACA to the 24 states that have refused to close the coverage gap.

The Oregon Health Insurance Experiment

Medicaid can also help families reduce other kinds of financial burdens, including catastrophic medical expenditures, medical debt, and out-of-pocket medical expenses. In 2008, Oregon randomly offered Medicaid-style coverage to about 30,000 of 75,000 people who applied for a rebooted program called Oregon Health Plan Standard. This created a randomized experiment. Research based on interviews found statistically significant reductions in the shares of people with out-of-pocket medical spending, catastrophic medical expenditures, medical debt, and who borrowed to pay or skipped bills.

Access to Medicaid reduced the share of Oregonians with out-of-pocket medical spending by 26 percent. It reduced catastrophic medical expenditures – out-of-pocket health expenditures in excess of 30 percent of household income – to 1-in-100 people from 1-in-18 people. It reduced the number of people with medical debt by 23 percent and the number of people who borrowed to pay or skipped bills by 58 percent. All of these improvements occurred after just one year.

Health Insurance and the Consumer Bankruptcy Decision: Evidence from Expansions of Medicaid

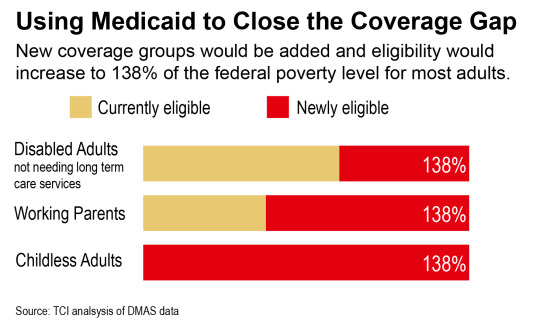

Research showing that Medicaid protects families from financial ruin has been around since before the ACA. A study in the Journal of Public Economics by researchers from Columbia University and the University of Chicago found significant reductions in personal bankruptcies by looking at cross-state differences in Medicaid expansions from 1992 through 2004. They found that a 10 percentage point increase in Medicaid eligibility generally reduces personal bankruptcies by 8 percent. As How Medicaid Works shows, Medicaid expansion in Virginia would boost eligibility for working parents to 138 percent from 52 percent and for childless adults to 138 percent from 0 percent.

Closing the coverage gap in Virginia would help 400,000 people get quality, affordable health care. And, as this growing body of research shows, it would also protect them from financial ruin for reasons often beyond their control: illness and injury.

Category:

Health Care