February 18, 2019

Senate Proposes Improving Support for Low-Income Families Who Have Seen Decades of Cuts

While many of the House and Senate amendments cut the introduced budget there are some areas where one or both chambers have offered improvements. One is the Senate’s proposal to use some of Virginia’s Temporary Assistance for Needy Families (TANF) fund surplus to raise cash assistance levels for Virginia’s lowest-income children and their parents. This is a step in the right direction – toward making up for the erosion of benefits since 1996 and providing resources for low-income families with children to meet their basic needs, including rent, clothing, and school supplies.

TANF block grants from the federal government – paired with state dollars – provide a safety net for low-income families by funding child care, work-related support, and cash assistance. These kinds of services help parents get back to work and promote stability for their children.

However, the value of TANF’s benefit has significantly eroded over time compared to the rising costs of living. This has led to fewer working poor families – those who have someone working but who is not paid enough to adequately support their family – qualifying for any assistance and lower-income families having less and less ability to pay for the very basic necessities for their children.

Despite some small increases in benefits in recent years, a Virginia family of three can only receive $419 a month in cash benefits at most. That’s just $5,028 a year, which is only 23.6 percent of the federal poverty line of $21,330 for a family of three. It’s also 25.7 percent less assistance in real dollars than Virginia provided in 1996. Virginia’s maximum cash assistance now covers only a third of the Fair Market Rent for a two bedroom apartment in Virginia. And low-income families who qualify for TANF are not prioritized for housing assistance. Even combining TANF benefits with SNAP, which provides critical assistance for low-income families to afford nutritious food, only provides Virginia’s lowest-income families about half the resources needed to live at the poverty line. This is simply not enough for families to get by, let alone get ahead.

Due to barriers such as job discrimination and over-policing of Black neighborhoods leading to criminal records, families of color, particularly Black families, have a harder time than white families getting jobs that pay enough to support their children without assistance. So when cash assistance is eroded by Virginia policymakers, it’s Black families who are hit the hardest.

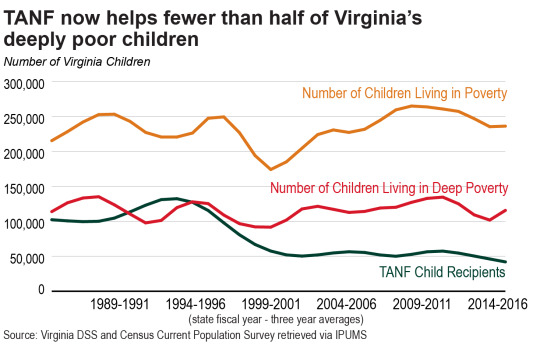

And when the maximum TANF cash assistance – Virginia’s “standard of assistance” – falls, it’s not just children whose parents are without jobs who are hurt. A lower standard of assistance means fewer poor working families qualify for help with child care and making ends meet. Compared to two decades ago, there are more poor and deeply poor families with children living in Virginia, yet there are fewer families with children receiving any cash assistance from the state. As a result, just 19 out of every 100 poor families with children received any TANF cash assistance in 2017, compared to 56 in 100 in 1996.

The reduction in the share of families who are receiving cash assistance is not a mistake. It’s the intended result of the federal welfare reform of the 1990s, which included an early pilot in Virginia. And unfortunately it’s also built on decades of racially coded – and sometimes explicitly racist – fear-mongering about the work ethic and welfare for low-income families of color, particularly those led by single mothers. Understanding this history and the impacts of federal welfare reform can help us chart a path forward to address these problems.

Money is available to restore cash assistance to more reasonable levels. In 2016, Virginia used just 61 percent of TANF and matching state funds for core TANF benefits – child care, cash assistance, and work support. Like most states, Virginia has shifted funds away from core TANF services, using them elsewhere for grants to nonprofits, tax credits, early childhood education, and other priorities. For the upcoming fiscal year that ends July 1, 2020, the introduced budget allocated over $44 million of TANF funds to nonprofit organizations and local governments. While these programs are worthy recipients of funding, by increasing support for them while allowing TANF cash assistance to wither, Virginia is supporting fewer families than ever and is weakening the safety net of cash assistance for low-income parents and their children.

The Senate’s proposed budget includes a 5 percent increase in TANF cash assistance. This will not make up for all the erosion of benefits since 1996, but it is a step in the right direction. We look forward to seeing whether the compromise budget developed by the House and Senate conferees includes this positive step forward.

Category:

Economic Opportunity