December 23, 2019

The Deeply Flawed 2017 Federal Tax Law Turns Two

An economy that works for everyone means prosperity is shared widely: our communities can thrive, families are able to provide for themselves and their children, and opportunities are available to each person. Unfortunately, lawmakers often make policy choices that run counter to this aim. In particular, large federal tax policy changes enacted over recent decades have meant sizable tax cuts for high-income households and large corporations, while families with low and moderate incomes received only a small share of tax relief. Recent media reports have highlighted corporations, including 91 in the Fortune 500, that saw their federal tax bills go down to zero.

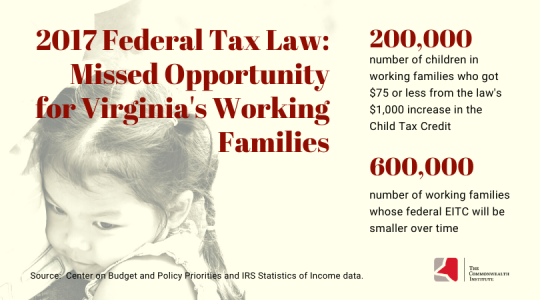

The December 2017 tax law fit this pattern. Two years ago, President Trump signed a large tax cut into law that directed large benefits to the highest-income households and large corporations. At the same time, the law provided little to nothing for many families with low incomes, who lost their personal exemptions and were largely excluded from the law’s Child Tax Credit (CTC) changes. That includes about 200,000 children in Virginia whose families did not see the full benefit of an increased CTC because of restrictions around the credit.

Earlier this year, researchers at the Columbia Population Research Center and the Center on Poverty and Social Policy at Columbia University identified large gaps in the new CTC:

- Over 50% of Black and Latinx children do not receive the full $2,000 CTC

- 70% of children in families headed by single parents who are female do not receive the full credit

- 42% of children in rural areas do not receive the full credit

In addition, the 2017 law changed how federal tax provisions are adjusted for inflation, which is eroding the value of the Earned Income Tax Credit (EITC) for many working families with low to moderate incomes, including about 600,000 families in Virginia.

Refundable credits like the CTC and EITC are among the most sensible aspects of the federal tax code. These tax credits for working people with low incomes mean an extra income boost to help them keep up with bills and afford the basics. The CTC and EITC make sense for families, our communities, and our larger economy. Rather than build upon these credits, the 2017 federal tax law went in a different direction.

On December 20, a narrow federal tax package was signed into law, primarily related to expired or expiring tax breaks that will be extended. Many lawmakers and advocates had called for the package to include improvements to the EITC and CTC, but these did not make it into the final deal. Similarly, technical changes sought by the restaurant and retail industry were not included in the legislation.

Because the EITC, CTC, and certain technical glitches were not addressed in this package, federal tax discussions likely will continue into 2020 and 2021. That means lawmakers have an opportunity to chart a new course on federal tax policy that supports families with low and moderate incomes who did not benefit much — if at all — from the 2017 federal changes. The Working Families Tax Relief Act is among the proposals in Congress that would strengthen the EITC and CTC and provide a boost to about 1.1 million families in Virginia. The Act is cosponsored by Sens. Warner and Kaine, and Reps. Beyer and Scott. Meanwhile, The American Family Act, which would strengthen the CTC, is cosponsored by Reps. Beyer, Connolly, McEachin, Scott, and Wexton. When tax policy supports more families and children, every community can thrive.

Category:

Budget & Revenue