October 4, 2023

Virginia Families Can Now Claim an Improved EITC, and Policymakers Can Build on its Success

Originally published Feb 3, 2023; Updated Oct 4, 2023

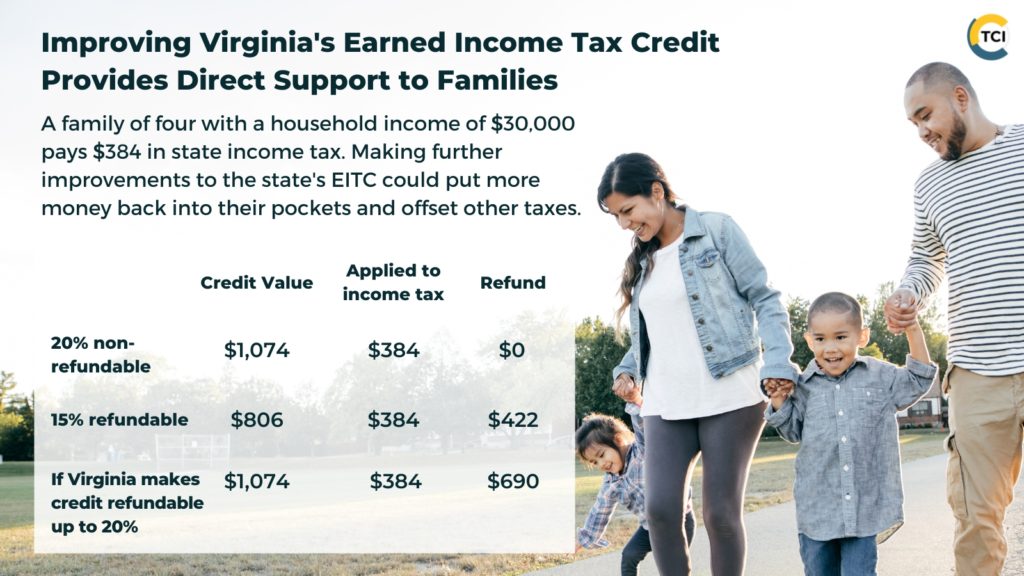

Qualifying families could claim more of the Virginia work credit that they earned when filing their tax returns this most recent tax season, which put hundreds of dollars into the pockets of Virginia families who needed it most. During the 2022 legislative session, lawmakers improved the state’s Earned Income Tax Credit by making it refundable at 15% of the federal credit. This was a policy victory over 15 years in the making, and one that made sure families with low incomes were not excluded from the tax conversation. It’s critical that qualifying families claim the improved EITC and that lawmakers continue to improve the credit in order to provide greater, direct support to Virginia families.

Impact of Virginia’s Current EITC Options

As families continue to navigate the rising costs of food, gas, and other essentials, policy choices that provide direct support will be critical to helping families make ends meet. Improving Virginia’s Earned Income Tax Credit in 2022 will help do just that. That’s because qualifying families now have an option: claim a state EITC up to 20% of the federal credit, not to exceed any income tax owed, or claim a state EITC at 15% of the federal credit and receive a refund of the amount that exceeds any income tax owed. Prior to improving the state EITC, a married couple with two children and a household income of $30,000 filing their tax return in 2022 would have a state EITC of $1,074 (20% of federal credit), but because the credit was non-refundable and their income tax liability was $384, they would miss out on $690. By taking the option of a state EITC refundable at 15% of the federal credit, this same family would have a state EITC of $806, apply it toward their income tax liability of $384, and get the remaining $422 refunded to them.

This refund gives families the freedom to purchase what they and their children need most. And not only does the improved state EITC provide an income boost today, but it also improves outcomes tomorrow as refundable tax credits are linked with a range of long-term benefits, including better health and education outcomes. And it helps to flip Virginia’s upside-down tax code as families with low incomes pay more in taxes as a share of income compared to higher-income households

Claiming the Newly Improved Benefit

Many households who are eligible for the state EITC may not be required to file taxes in Virginia and are at risk of missing out on the improved EITC. The filing threshold for single filers is $11,950, and $23,900 for joint filers. Even if a household is not required to file or does not owe income taxes in Virginia, they could qualify for the new 15% refundable EITC and should file a tax return. The Virginia Department of Taxation provides a list of resources that allow families who meet certain criteria, such as lower incomes, to file their taxes for free. These resources can be found at www.tax.virginia.gov/free-file.

A social media toolkit to raise awareness on claiming the improved credit, including graphics in multiple languages, is available through the Tax Fairness for Virginia Coalition. Please reach out to Rodrigo Soto (rodrigo@thecommonwealthinstitute.org) to access the toolkit.

Opportunities to Further Improve Virginia’s EITC

A survey released in August 2023 showed that voters’ #1 concern is the rising costs of essentials and making further improvements to the state EITC would directly respond to this concern. During the 2023 legislative session, a bill and budget amendment were proposed that would have allowed families to claim a refundable state EITC up to 20% of the federal credit, which would put another few hundred dollars in the pockets of families who need it most. The family of four with a household income of $30,000 would have seen a refund of $690 this past tax season — $268 more than they would with a 15% refundable credit. Unfortunately, neither the bill nor the budget amendment to strengthen the EITC passed in 2023.

Making Virginia’s EITC refundable at 20% of the federal credit would have only cost $36.5 million in general fund resources — a cost that paled in comparison to other tax proposals that the governor and some lawmakers championed and that would have primarily benefited profitable corporations and the wealthy.

Rather than rehashing costly proposals that would drain our shared resources in budget and policy discussions ahead of the 2024 legislative session, policymakers should focus on a more fair tax code that lifts up families who were excluded in the 2023 tax conversations. Further strengthening Virginia’s Earned Income Tax Credit would provide targeted economic relief to help families who need it most, while protecting resources that could be invested in our communities.

Category:

Economic Opportunity