June 30, 2016

When the Right Hand Meets the Left, A Tax Credit’s True Cost Emerges

Virginia’s Historic Rehabilitation Tax Credit is costing taxpayers twice as much as initially thought, according to a recent report to the Joint Subcommittee to Evaluate Tax Preferences.

This news – a surprise to many people in the room during the committee meeting that day – bolsters the case for improved oversight of Virginia’s costly – and largely hidden – spending through the tax system. It also shines a light on a complicated oversight arrangement by the state that obscured the full cost of this and other tax credits that are in the same boat.

The “Historic Rehab credit” is equal to 25 percent of qualified rehabilitation expenses and is intended to encourage restoration of certified historic properties in Virginia and in turn spur economic development, according to the Joint Subcommittee report. A Joint Legislative Audit and Review Commission (JLARC) study in 2012 concluded that the credit appears to effectively encourage historic rehabilitation, based on a Virginia Commonwealth University study and the commission’s own staff analysis.

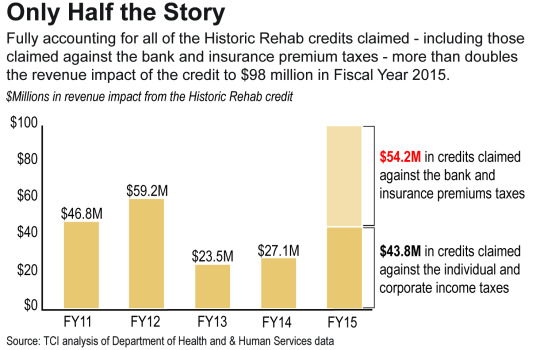

Previous estimates of the Historic Rehab credit’s annual cost by the Department of Taxation (TAX) ranged from $23.5 million to $59.2 million for fiscal years 2011 through 2014, but those estimates only included the credits claimed against Virginia’s Individual and Corporate Income Taxes. The credit, however, can also be applied to two other taxes: the Bank Franchise and the Insurance Premiums License Taxes. Until 2013, the State Corporation Commission’s Bureau of Insurance administered and collected the Insurance Premiums License Tax. At that time, TAX began to administer and collect the Insurance Premiums License Tax giving the department full access to the data on just how costly the Historic Rehab credit really is.

Once the credits applied to all four taxes were tallied, the cost more than doubled to $98 million in state fiscal year 2015, up from $43.8 million when just counting the impact on the two income taxes. And the additional impact appears to be $30 million to $40 million per year going back several years, according to TAX staff at the Joint Subcommittee meeting.

Breaking it out, credits applied to the insurance premiums tax represent most of the increased fiscal impact. Of the $54 million in additional revenue loss attributable to the Historic Rehab credit, $51 million is associated with the insurance premiums tax and slightly less than $3 million came from the bank tax in state fiscal year 2015, according to TAX staff at the Joint Subcommittee meeting. So in the case of the Historic Rehab credit, the previously unknown ended up being much larger than expected.

JLARC also provided an early warning that the impact of the Historic Rehab credit was large and extended beyond the two income taxes. “[T]he Historic Rehabilitation Tax Credit is the State’s second largest credit in terms of total reduction in taxpayer liability, in part because it can be claimed through multiple taxes rather than just income taxes,” according to the 2012 JLARC report. It goes on to note that $53.3 million of the credit’s total $114 million impact in 2008 was attributable to reductions in the bank and insurance premium taxes.

While the Historic Rehab credit was discussed at the Joint Subcommittee meeting, the other seven credits that also can be applied to the bank and insurance premium taxes were not: Neighborhood Assistance Act Credit, Enterprise Zone Business Tax Credit, Low Income Housing Credit, Major Business Facility Job Tax Credit, Worker Retraining Tax Credit, Barge and Rail Usage Tax Credit, and Education Improvement Scholarships Tax Credits. None of these credits saw a year over year increase even remotely close to the $71 million jump in the Historic Rehab credit, but these credits continue to represent a substantial cost risk for the state.

Ongoing oversight of tax expenditures remains critically important because the revenue spent in this way reduces the amount the state has to invest in making our communities safe, healthy, and productive. When asked at the Joint Subcommittee how legislators handle the cost of tax credits when it comes to figuring out how much money the state has to spend on top priorities, a key budget writer responded, “It just comes off the top.”

Category:

Budget & Revenue