January 19, 2024

Digging Deeper: How the Governor’s Proposal Increases Taxes for Low-Income Families, Gives Significant Cuts to the Wealthy

When we all pitch in our fair share, we can invest in the programs and services that help everyone to thrive, like public education, affordable housing, and more. But Virginia’s tax code is upside-down, where those with the most pay the least taxes as a share of income. A more fair tax code can lift up families with low incomes and raise the shared resources we need to achieve our shared goals. Unfortunately, Gov. Youngkin’s tax proposal would hinder our ability to fund important investments in our communities and make the cost of living even more expensive for families with low incomes. A key question of any policy proposal is “Who benefits?” And in the case of the governor’s tax proposal, it’s primarily the wealthy. Thankfully, lawmakers have an opportunity to right the course by advancing policies that provide direct support to families who are struggling the most to make ends meet and, on the other end of the spectrum, ask the wealthy to pay their fair share so that we can all thrive, no exceptions.

Overall impacts

To begin to understand the impacts of the governor’s proposal, it’s essential to understand “Who pays?” In Virginia, families with lower incomes pay a greater share of their income in state and local taxes than those with the highest incomes. And the top 1% pay the least taxes as a share of income compared to all other income groups. Looking closer, families in the bottom 20% of incomes pay 8.7% of income on state and local taxes, while the top 1% pay just 7.2%. Rather than flipping Virginia’s upside-down tax code, Gov. Youngkin’s tax proposal would worsen it.

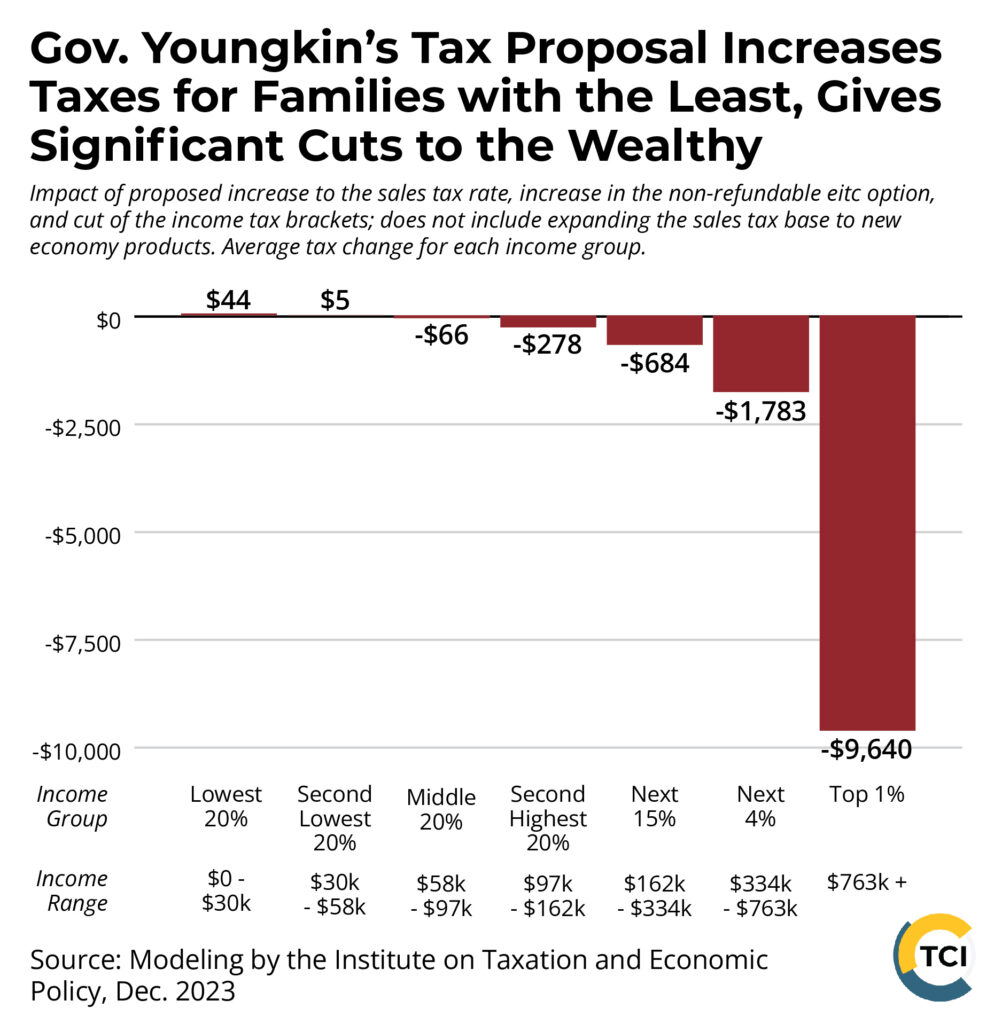

At its core, Gov. Youngkin’s proposed tax package would reduce individual income tax bracket rates, increase the sales tax rate, and increase the state’s non-refundable Earned Income Tax Credit (EITC) option. The combined impact of these policy choices would result in families who make less than $30,000 (the bottom 20% of incomes) facing an average tax increase of $44. This is because the average benefit for families in the bottom 20% of reducing income tax rates will be wiped out by the increase in the sales tax, and very few will see any help from increasing the non-refundable EITC. Meanwhile, households in the top 1% (earning more than $763,000) will see an average cut of $9,640.

Breaking down the impacts of individual policy proposals

Reducing individual income tax rates

Reducing the individual income tax rates is the costliest of the governor’s tax policy proposals, with a price tag of $3.46 billion. Despite cutting rates in each bracket, TCI analysis of Institute on Taxation and Economic Policy (ITEP) modeling data shows that two-thirds of this tax cut will flow to households in the top 20% of incomes, with the top 1% getting 20% of the benefit of cutting the income tax rates alone, with an average cut of $10,625. Families in the bottom 60% of incomes will see just 15% of the tax cut from reducing the individual rates. On average, families in the bottom 20% of incomes will see just a $25 cut.

While cutting rates in each bracket gives the impression of benefiting all families, the rate cuts in the first three brackets are limited in impact, as the brackets are narrow. In total, the maximum tax cut from reducing the first three brackets is $86.50. With a low threshold of just $17,000 in taxable income, most Virginians pay the top income tax rate on some of their income. And the more income someone has over $17,000, the bigger their tax cut will be.

For example:

- A high-end corporate executive with an income of $2 million would have their income taxes go down by about $12,853 under this proposal.

- But a firefighter making the average Virginia salary of $54,180, with a similar tax situation, would see a tax cut of only $206. That means the ultra-wealthy executive would see a tax cut 62 times bigger than the firefighter’s.

Increasing the non-refundable Earned Income Tax Credit (EITC)

Despite some claims to the contrary, the governor is proposing to increase the non-refundable EITC option from 20% to 25% while leaving the refundable option at its current level.

When it comes to Virginia’s EITC, qualifying families have two options:

- Option 1: Claim a state EITC up to 20% of the federal credit, not to exceed any income tax owed (also known as a non-refundable credit). For example, a family of four with a $30,000 income could claim a $1242 state EITC (20% of federal credit) to apply toward their income tax, but because this option is non-refundable and their income tax liability was $384, they would miss out on $858.

- Option 2: Claim a state EITC at 15% of the federal credit and receive a refund of the amount that exceeds any income tax owed (a refundable credit). The family of four above could claim a refundable state EITC of $931 (15% of the federal credit), apply it toward their income tax liability of $384, and get the remaining $547 refunded to them.

While the refundable credit is smaller, many lower-income families are able to benefit more from it. By getting cash back at tax time, it helps to offset the other state and local taxes that take up a larger share of their income.

The governor’s proposed budget only increases the state’s non-refundable EITC, leaving out the many families who have low or no income tax liabilities and otherwise qualify for the credit. Just 4.5% of the cut will go to families in the bottom 20% of incomes, earning below $30,000. While 85% of this cut would go to households with incomes between $30,000 and $58,000. If the governor had proposed to increase the refundable EITC option from 15% to 20%, a family of four with a $30,000 income would see another $310 at tax time.

Increasing sales tax rate

The governor is also proposing to increase the state sales tax from 4.3% to 5.2%, a 0.9 percentage point jump. These are taxes we pay for things like shoes, clothes, and tires, among other essential goods. Sales taxes are known to be regressive, asking more of low- and middle-income families who spend greater shares of their income on necessary goods and services, and thus spend greater portions of their income on sales taxes. Increasing the sales tax rate increases the cost of living for low-income families in particular. Families in the bottom 20% of incomes in Virginia would see sales tax as a percent of their income increase by 0.4% from increasing the sales tax rate.

Lawmakers should consider other tax options

There are better ways to raise resources and make needed investments for Virginia’s families than by shifting more taxes to families with less. While special interests have manipulated the tax code for their own benefit, lawmakers can take critical steps this legislative session to clean up our tax code and support families who are struggling the most to make ends meet. Asking the wealthiest Virginians — those making above $1 million in income annually — to pay their fair share (HB865) could raise $1 billion in state revenues that could go toward needed investments in education, housing, and child care — investments that would benefit all of us. Lawmakers should also choose to put money back in the pockets of families that most need it through refundable tax credits, like improving the state’s refundable EITC (HB621 and SB183) and establishing a Commonwealth Kids Credit (HB969). Now is the time to fix Virginia’s upside-down tax system and raise revenue for critical and long-needed investments in our communities. The Virginia General Assembly should reject Gov. Youngkin’s tax proposal and implement better options that will actually benefit working families instead of hurting them.