October 29, 2019

Healthier Virginia Families: A Refundable EITC Means More Than A Check

Health care ranks as one of the top issues of importance for people across our state. Discussions around health often focus on the health care system: doctors, nurses, hospitals, and insurance providers and coverage. Yet we know that health is about much more than that. The health of our families and communities is shaped by where we live, learn, work and play; socioeconomic circumstances; and a number of other considerations.

A growing body of research has established a strong link between health outcomes and economic security.12 As Virginia policymakers think about policy solutions to address health disparities, the public health literature shows that refundable tax credits — like the Earned Income Tax Credit (EITC) — are one of the most promising public policies to improve a range of health outcomes.3

What is the EITC?

Working families tax credits like the EITC help families who are paid low wages meet basic needs. For families struggling to make ends meet, these tax credits make a difference in terms of putting food on the table, staying current on utility bills, and covering other necessities.

The federal EITC lifted about 6 million people out of poverty, including about 3 million children, in 2017.4 Here in Virginia, it helps to support about 600,000 working families across the commonwealth.5

To build on the success of the federal EITC, 29 states, D.C., and Puerto Rico have also enacted their own EITCs.6 Virginia created its own state EITC, which began in 2006, and is available to workers who claim the federal EITC on their tax returns. The Virginia EITC is equal to 20% of the value of the federal EITC. That means a family who receives a $2,500 federal EITC could receive a $500 state EITC.

Like the federal credit, Virginia’s credit rewards work and boosts families.

However, the current restrictions around Virginia’s state EITC mean families are missing out on about $200 million combined each year.7 That is because it is not refundable, and families with lower incomes often do not get the full value of the credit that they would otherwise be able to claim on their tax return. If Virginia’s EITC became refundable, hundreds of thousands of families across Virginia would receive an income boost.

Where Health & Income Meet

The home where an individual lives, the condition of our neighborhoods, the education system we participate in, and a host of other factors impact our health. Poverty has been shown to be directly correlated with health outcomes8 and can lead to lack of access to preventive care,9 higher incidence of long-term health concerns, long-term stress,10 and worse maternal and child health outcomes.11

Issues like lead, mold, and pollution in the home and around one’s community can be harmful to a family’s health. Likewise, lack of reliable family transportation may limit grocery options, which caps the amount of fresh produce available to a child. And putting off preventive or needed health care because it is too expensive also has long-term effects on a family’s health. A family struggling to make ends meet may not have the money for home or auto repairs or the opportunity to move to a healthier environment.

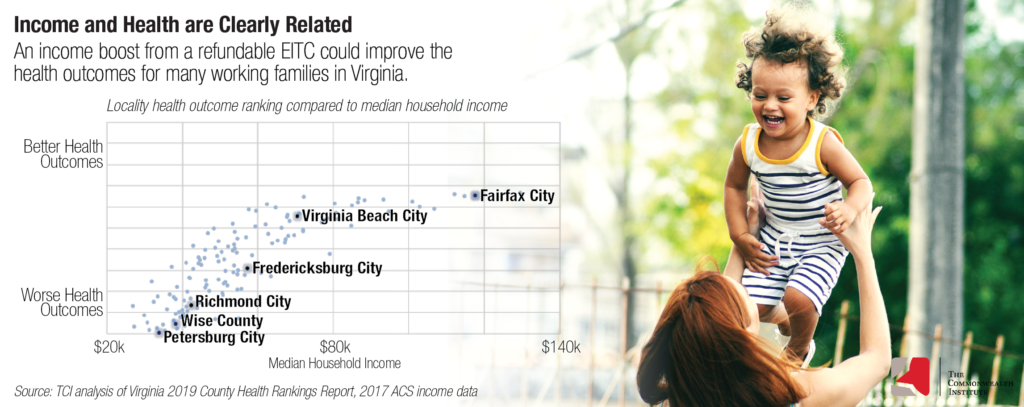

When considering the health outcomes in Virginia localities, the connection between income and health becomes much clearer. The 10 lowest ranked Virginia localities in health outcomes are also all in the bottom 30 localities in median household income.12 The reverse is also true: the top 10 localities in health outcomes all rank in the top 25 localities in median household income.13 Increasing household income can be a major lever to improve long-term and short-term health outcomes for Virginia families.

A refundable EITC would allow working families the flexibility to make improvements in their lives that could also vastly improve their health.

The Impact of a Refundable EITC on Health

There is a growing body of research that underscores the health benefits of not only having more access to income, but more specifically, the impact that a refundable EITC has on a family’s health. From the first moments of life, to long-term benefits of an individual’s physical and mental health, the measurable health improvements gained by a more robust EITC should warrant its consideration as good health policy. The strong research literature is why the EITC is among the evidence-based interventions recommended by the Centers for Disease Control and Prevention’s Health Impact in Five Years initiative.14 The EITC also was rated as “scientifically supported” — the highest possible rating — by the County Health Rankings & Roadmaps project.15

A refundable EITC can be crucial to ensuring a healthy start for Virginia’s children.

A refundable EITC can be crucial to ensuring a healthy start for Virginia’s children. As of 2017, Virginia experiences a slightly higher prevalence of low birthweight (8.4%) than the nationwide average (8.3%).16 The rates of low birthweight for Black families in Virginia (13.4%) are even higher than the state average. Babies born with low birthweight are at greater risk for infant mortality, long-term health concerns, and physical and cognitive developmental delays.1718

A recent study found that enacting a more generous state EITC would decrease the number of children born with low birthweight. If Virginia were to adopt a refundable state EITC at a 10% match, an additional 179 babies could avoid being born with low birthweight annually.19 A refundable EITC could have a significant impact for both the short- and long-term health of the youngest residents of Virginia.

There is also evidence that the EITC has mental health benefits for parents and their children. A more generous EITC has been linked to a reduced number of days in which mothers self report “poor mental health.”20 Children have been found to have fewer behavioral health issues — including anxiety and depression — for every $1,000 their family receives through the EITC.

An improved, refundable EITC should not only be considered good tax policy, but also an important health policy intervention for Virginia’s families.

What Virginia Can Do

Virginia lawmakers have an opportunity to help the state’s working families by strengthening the state EITC and making it refundable. Doing so would make sure families get the full credit they have earned. The research is clear: the EITC is linked to improved health outcomes. The governor and legislators should act by including a refundable EITC in the next state budget and passing companion legislation to remove the restrictions that are currently in state law.

Endnotes

- Artiga, S. and Hinton, E., “Beyond Health Care: The Role of Social Determinants in Promoting Health and Health Equity,” Kaiser Family Foundation, May 2018

- Khullar, D. and Chokshi, D. A., “Health, Income, & Poverty: Where We Are & What Could Help,” Health Affairs, Oct 2018

- Simon, D., McInerney, M., and Goodell, S., “The Earned Income Tax Credit, Poverty, And Health,” Health Affairs, Oct 2018

- “Policy Basics: The Earned Income Tax Credit,” Center on Budget and Policy Priorities, Jun 2019

- TCI analysis of tax year 2017 IRS data

- Center on Budget and Policy Priorities, 2019, https://www.cbpp.org/twenty-nine-states-dc-and-puerto-rico-have-enacted-eitcs-as-of-2018

- Fiscal Impact Statements for “HB2160 (2019)” and “SB1297 (2019),” Virginia Dept of Taxation. (About $206 million in the first year and increases in subsequent years.)

- Khullar, D. and Chokshi, D., “Health, Income, & Poverty: Where We Are & What Could Help,” Health Affairs, Oct 2018

- Cunningham, P., “Why Even Healthy Low-Income People Have Greater Health Risks Than Higher-Income People,” The Commonwealth Fund, Sep 2018

- Khullar, D. and Chokshi, D., “Health, Income, & Poverty: Where We Are & What Could Help,” Health Affairs, Oct 2018

- “Maternal, Infant, and Child Health,” Office of Disease Prevention and Health Promotion, https://www.healthypeople.gov/2020/topics-objectives/topic/maternal-infant-and-child-health

- TCI analysis of 2019 County Health Rankings Report and 2017 America Community Survey data

- Ibid.

- “Earned Income Tax Credits,” Centers for Disease Control and Prevention,https://www.cdc.gov/policy/hst/hi5/taxcredits/index.html

- “Earned Income Tax Credit (EITC),” Robert Wood Johnson Foundation,

https://www.countyhealthrankings.org/take-action-to-improve-health/what-works-for-health/policies/earned-income-tax-credit-eitc - “Births of Low Birthweight as a Percent of All Births by Race/Ethnicity,” Kaiser Family Foundation, Nov 2018

- Strully, K., Rehkopf, D., and Xuan, Z., “Effects of Prenatal Poverty on Infant Health: State Earned Income Tax Credits and Birth Weight,” American Sociological Review, Aug 2010

- “Low Birthweight,” March of Dimes, Mar 2018, https://www.marchofdimes.org/complications/low-birthweight.aspx

- TCI communication with Dr. Sara Markowitz, Professor of Economics at Emory University and Research Associate at the National Bureau of Economic Research

- Evans, W., and Garthwaite, C., “Giving Mom a Break: The Impact of Higher EITC Payments on Maternal Health,” American Economic Journal: Economic Policy, 2014