August 18, 2021

The New Child Tax Credit Provides Historic Amounts of Support to Families––It Shouldn’t Stop After This Year

Congress has another opportunity in December 2022 to help families by including the improved Child Tax Credit in year-end legislation. Read more here on how the 2021 CTC helped families.

At the heart of the COVID-19 pandemic lie equity issues that have troubled Virginia and the nation for generations––lack of access to health care, unstable housing, low wages, and unemployment. Black, Latinx, and low-income people in Virginia have long faced these barriers, which were only worsened by the health and economic crises of the pandemic. Policy measures that have been most effective in supporting families in Virginia through these crises are those that advocates have been supporting for decades––strong anti-poverty measures that deliver direct cash payments to those who need them most.

The American Rescue Plan Act (ARPA) has provided much needed relief to Virginians. One of the significant provisions of the law is the newly improved Child Tax Credit (CTC), which has been temporarily expanded to include more families and grant larger amounts of assistance that reached over 59 million children and 60 million children in July and August, respectively. In Virginia specifically, this includes over 1.5 million children who received $377.5 million in support as part of July’s payment, and nearly 1.6 million children who received $388.1 million as part of August’s payment. The expanded credit is expected to help reduce poverty, bolster the economy, and help Virginians recover from the economic stress caused by COVID-19, according to a new report by the Niskanen Center. Millions of American families are receiving support from the new CTC, but as of right now the expansion is only a temporary solution to a long-term problem. Once families receive their final payments in 2022, the credit is set to return to a lower amount that reaches fewer families. Low- and moderate-income families need Congress to take action, and further extend the credit. In the wake of a pandemic that has highlighted the systemic failures and inequities that have left so many people in Virginia behind, federal lawmakers have a unique opportunity to make long-term changes that will make this a place where all of us can thrive, no matter our color, background, or zip code.

How Has the Child Tax Credit Changed?

This year, the newly expanded CTC will provide families with a total of $3,600 per child 5 years old or younger and $3,000 per child ages 6 to 17, up from $2,000 per child previously provided. Half of the credit will be paid in advance each month through December 2021, and the remaining half will be paid once families file their 2021 federal taxes in 2022. The credit begins to phase out at a family income of $150,000 for a couple, or $112,500 for a taxpayer filing as “head of household.”

Under the temporarily improved credit, no family’s income can be too low to qualify, ensuring that millions of families will benefit. The credit is now also fully refundable, which means that families with low incomes are newly eligible for the full amount of the credit. Prior to its expansion, about 530,000 children in Virginia were either completely ineligible or only partially eligible because their families’ incomes were too low.

New Evidence Suggests That The Improved Child Tax Credit Will Bring Stability to Families and the Economy

The expanded CTC will provide much needed support for families who are still dealing with the economic instability caused by the COVID-19 pandemic. Expanding child allowance programs has been shown to help low- and moderate-income families make ends meet and pay for essentials such as school supplies and child care expenses, as well rent, food, and transportation costs. This will likely help to reduce stress and improve family stability, and early evidence from July’s payment suggests immediate improvements to household finances and food security.

Many of America’s peer nations, such as Canada, Australia, the U.K. and most European countries already have robust child benefit programs similar to the expanded credit. Studies of Canada specifically show that credits similar to the CTC help to promote investments in children and family stability while also providing a powerful boost to a nation’s economy, due to the greater level of economic activity. This is especially true for economic policies that are focused on lower-income communities that are more likely to use their newly available resources to make essential purchases.

It’s estimated that the temporarily improved CTC alone will boost consumer spending by approximately $27 billion, generating $1.9 billion in revenues from state and local sales taxes, and supporting 500,000 full-time jobs at the median wage nationwide. Overall, the CTC improvement will provide an additional $2.3 billion to Virginia households, helping about 1.6 million children with a net benefit of $1,648 per household. A significant portion of this will be pumped back into Virginia’s economy and support more than 11,000 jobs.

Evidence shows that an increased child benefit may be useful in supporting employment in other ways as well. In 2016, after an expansion of its child allowance amount, Canada saw an increase in its total employment. This was partially due to the fact that single mothers were able to put additional funds toward child care and work in the formal economy.

The improved CTC will also serve as a powerful tool to reduce child poverty. The new report by the Niskanen Center estimates that the expanded credit will lift nearly 4.5 million children in the United States out of poverty, and reduce the national child poverty rate, which far exceeds that of peer nations, by 39%. In Virginia alone, an estimated 89,000 children will be lifted out of poverty. Direct payments and stimulus efforts, such as the CTC, have already proven to be very effective in combating poverty during the COVID-19 pandemic. Despite job losses and economic turmoil, the poverty rate actually fell during the summer of 2020, due to CARES Act payments, and during early 2021, due to tax credits and another round of stimulus payments, which provided many families with enough support to stay afloat.

Lawmakers Can Extend CTC Improvements to Benefit All Virginians

ARPA’s improvements to the CTC will undoubtedly provide support to millions of families across the country, and lawmakers can build on this and extend the policy, which is currently slated to expire at the end of December. Once filers receive the second half of their payments in 2022, the credit is set to reduce back to its previous amount of $2,000 and exclude about 530,000 children in Virginia due to the lack of full refundability and other restrictions. An abrupt return to the previous restrictions of the CTC would be detrimental not only to the well-being of families who would lose their credits, but to the commonwealth as a whole.

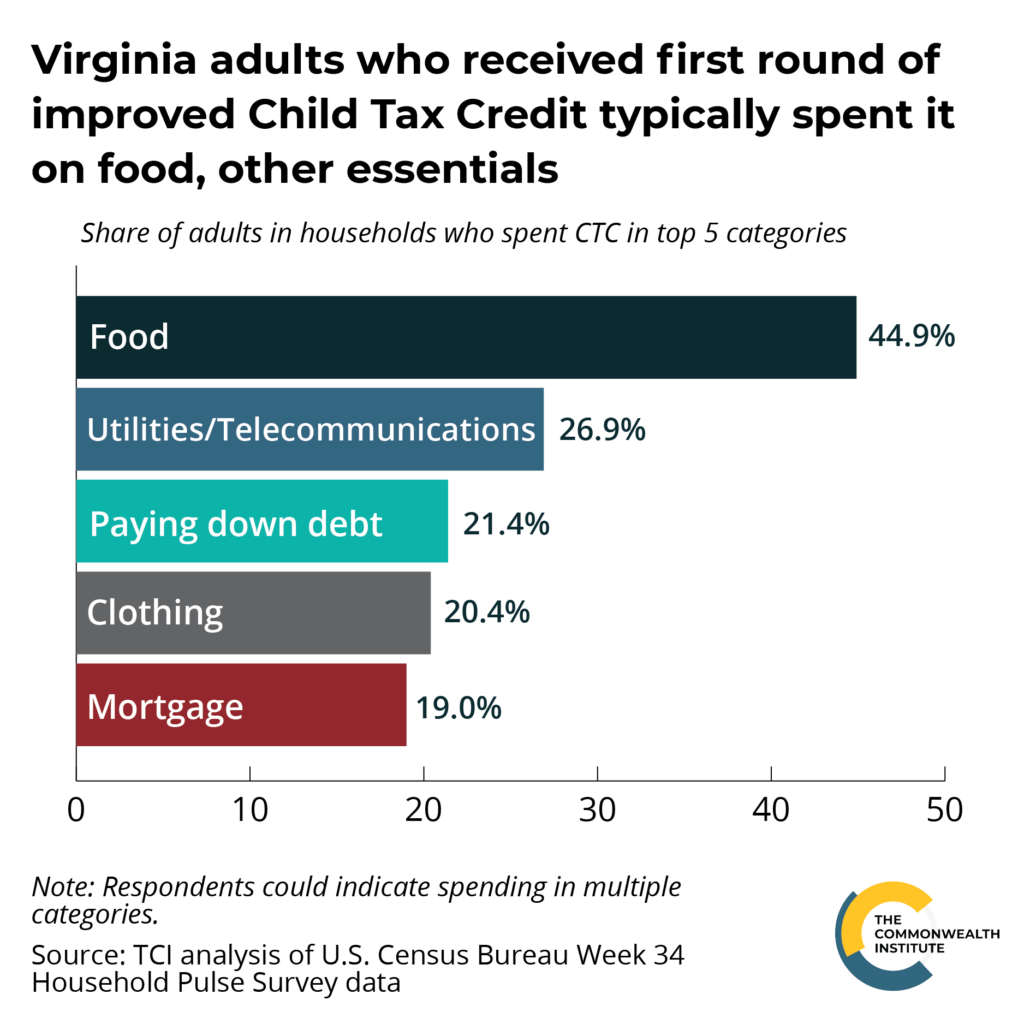

If the pandemic has taught us anything, it’s that Virginians need more help, not less, in order to recover from the pandemic and gain economic security. An expanded child benefits program is likely to support those who are struggling to make ends meet, improve public health outcomes for low-income communities, and stimulate the economy. Preliminary data from the first round of CTC payments show that families are already benefiting from the extended credit. Since the rollout of CTC payments, adults in families with children have experienced a 3 percentage point decline in food insufficiency, as well as a 2 percentage point decline in struggling to pay expenses. Evidence also suggests that families are using their CTC on the things they need most. In Virginia, 45% of adults in households that received the CTC reported that they used part of their credit to pay for groceries, 27% used part of their credit to pay a utilities or telephone bill, and 21% used part of their credit to make a mortgage payment.

And people who would benefit most from an expanded CTC are those who are typically sidelined from economic progress. Single mothers, Virginians who live in rural areas, and Black and Latinx Virginians would all benefit from the economic support that is needed to return to the workforce, rejuvenate their communities, reduce poverty, and access greater economic opportunity.

A commitment to extending the CTC would also be accompanied by all of the proven public health benefits that a reduction in poverty is known to provide. When poverty rates decrease, health outcomes at birth tend to improve, households tend to reduce their spending on tobacco and alcohol, rates of disease are reduced, and long-term health outcomes tend to be better. Investing in long-term improvements such as the CTC would also be an investment into the health and well-being of millions of people in Virginia with low incomes.

Conclusion

ARPA provides greatly needed funds to help alleviate the financial burden that COVID-19 has placed on families. Yet as barriers to economic opportunity existed before the pandemic, families will need the assistance that the CTC provides even in the aftermath of the pandemic. Ultimately, extending improvements to the CTC would benefit everyone in Virginia. Federal legislators have a unique opportunity to invest in children, families, and the economy. Without action on the part of lawmakers, many of the benefits provided by the CTC will be significantly reduced. Unless the credit is further expanded, the CTC will return to serving fewer families and providing less aid. Supporting families and reducing poverty requires commitment that goes beyond one year or payment. American families need a long term commitment to the extended CTC. It’s important that lawmakers dedicate themselves to making the historic improvements provided by the American Rescue Plan last and commit to extending the improved Child Tax Credit.

Category:

Economic Opportunity