March 6, 2025

Left in the Lurch: How Federal Cuts, Confusion, and Threats Harm Virginians

From seniors receiving assistance to pay for nursing home facilities to parents hoping their child’s food is safe, federal funding impacts everyone in Virginia. Federal initiatives and grants help protect and stabilize our communities, play a critical role in funding the building blocks of our communities, and support the conditions under which innovation and community can propel us into a better future. Virginia is home to many of the people who do that work, whether directly as federal employees or as staff at private-sector federal contractors or grantees.

All of this is thrown into question when federal funding and programs are eliminated without regard to the consequences, whether due to arbitrary orders by executive branch representatives, as poorly considered cost-cutting measures to pay for tax cuts for the wealthy, or because of a partial government shutdown if Congress does not pass an appropriations act or continuing resolution by March 14.

The most immediate concerns to Virginia’s economy are executive branch actions that put people out of jobs or cut critical services and the threat of a partial government shutdown. Following that, if Congress does not pass appropriations bills by April 30, we may face automatic funding cuts across the board, known as sequestration, on May 1. Longer term, the federal funding cuts being implemented or considered for federal jobs and spending would mean serious long-term harm to Virginia families and the state budget.

Below, we explain how these threats differ and how they could impact Virginia. Ultimately, the President and Congress should end the harmful cuts to Virginia communities and instead make sure that critical resources continue to flow through our communities to support our families and our economies. Closer to home, the most recent state budget passed by the General Assembly includes some mechanisms to address potential threats. Should significant further action be needed, there are additional options that state lawmakers could consider to mitigate harm.

Importance of Federal Spending for Virginia’s Jobs and Economy

What does all this mean in Virginia? Because Virginia’s economy is deeply intertwined with federal civilian and military spending, Virginia families and communities are at particular risk from arbitrary federal cuts, whatever their source. In turn, this threatens state tax revenue, leaving fewer resources available to maintain the fundamentals of economic success and help Virginia families and communities through hard times.

- Federal spending in the state far exceeds the amount Virginians pay to the federal government in income taxes. Virginia ranks first in net benefits it receives from the federal government, according to a report of 2022 balances of payments by the Rockefeller Institute for Government.

- Federal civilian and military spending accounted for 8.9% of Virginia GDP in 2023, compared to 3.6% in the country as a whole. Virginia ranked fourth of any state in the share of our economy that’s directly due to federal spending.

- Together, the state of Virginia and companies and individuals in Virginia were awarded $188.8 billion in federal funds in federal fiscal year 2024, which amounts to $22,285 per capita.

- Virginia was the number two state (after Texas) for Department of Defense spending in federal fiscal year 2023, according to internal Department of Defense (DoD) records. Defense spending injected $68.5 billion into Virginia’s economy that year.

- About 340,000 Virginia residents work in civilian federal jobs, the 3rd highest of any state. That’s 1 in every 13 civilian workers, the 2nd highest ratio of any state.

- Virginia has 121,687 active-duty military stationed here, the 2nd highest of any state, and 25,386 members of the National Guard and reserves.

- Many of these jobs pay well: Direct federal employment (civilian plus military) accounts for 12.2% of Virginians’ compensation, compared to just 4.7% in the U.S. as a whole, according to 2023 data from the Bureau of Economic Analysis.

What are some specific things federal funding does?

Virginians aren’t only the backbone of the federal civilian and defense workforce, helping to research the next generation of technology and protect our communities. We’re also students, parents, and private-sector workers who benefit from the federal government’s investments in education, health care, and technological progress. What does this mean?

- Education investments by the federal government are equivalent to the salaries of about 8,950 K-12 teachers across the commonwealth and are particularly important for students with disabilities, students in rural areas, and low-income communities.

Cutting Federal Funding for Public Schools Would Hurt Communities Across the Commonwealth

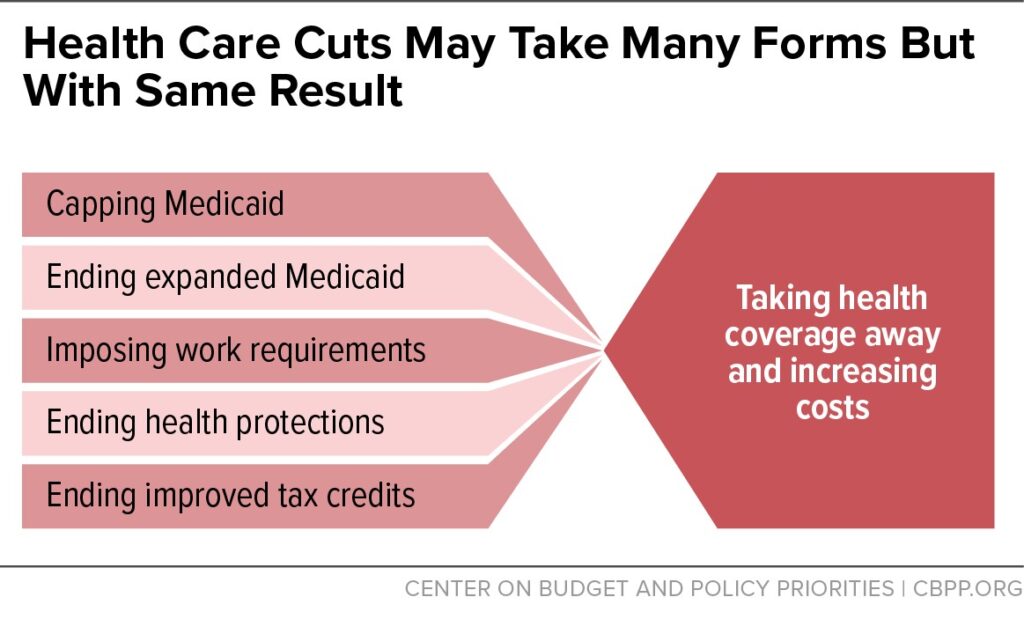

- Health care investments by the federal government help pay for health coverage and services for nearly 2 million Virginians who access health care through Medicaid/FAMIS. Proposed Medicaid funding cuts could be particularly devastating, since any reduction in the federal government’s promise to pay 90% of the costs of Medicaid expansion would mean that, absent intervention by the General Assembly and Governor, nearly 630,000 people would automatically lose health insurance. The U.S. House passed a budget resolution, or framework, on February 25, which instructs the House Energy and Commerce Committee — which oversees Medicaid — to cut at least $880 billion over 10 years, which could have a devastating impact on Virginia families.

- Federal spending touches other parts of life in Virginia and impacts family health, safety, and well-being. Federal spending in Virginia provides essential nutrition services through SNAP, WIC, and school breakfast and lunch programs, provides funds to help keep our air and water clean, helps invest in highway safety and improvement, and does much, much more.

How would a Federal Shutdown Impact Virginia?

With the March 14 deadline looming, that risk is top of mind for many people. What happens in a shutdown? Some civilian federal workers and military members would be expected to continue working without pay, while others would be furloughed without pay. Contractors would also go without pay and, unlike direct federal employees, would be unlikely to receive back pay when a funding bill eventually passes. The last federal shutdown lasted 35 days in late 2018 and early 2019. That shutdown, which was also only partial, cost the U.S. economy $3 billion.

- Unlike direct federal employees, federal contractors will not receive back pay after a shutdown ends unless their employer provides it despite not getting reimbursed by the federal government. In 2019, the Northern Virginia Chamber of Commerce estimated that the region is home to 375,000 federal contractors. While some federal contractors are well paid and may have robust emergency savings, many others, such as custodial staff, may experience significant hardship and need assistance from public and private sources.

- The partial shutdown in 2019 cost the Washington, D.C., region $1.6 billion in the short term, although some of that economic activity likely rebounded when direct federal employees received back pay.

- Additional data by county and metropolitan data is available upon request.

What won’t happen in a shutdown?

Despite the many challenges a shutdown would pose to Virginia families and communities, some federal services would continue. Social security checks would continue to be sent, and mail would continue to be delivered. Air traffic controllers and TSA employees would be asked to work without pay, so these services would continue. A long shutdown, however, might lead to some staff needing to leave for paying employment, leading to shortages and disruptions to air travel. The Supplemental Nutrition Assistance Program (SNAP) will continue to provide benefits at least through April 2025. Benefits could be impacted by a longer shutdown, and program administration could be impacted as well.

Beyond a Shutdown: What Federal Funding Cuts Would Mean for Virginia

While a federal shutdown could do short-term harm to Virginia’s families and economy, long-term cuts to federal jobs and spending would mean serious long-term damage to families and the economy in Virginia. What we experienced during the deep federal cuts in the aftermath of the Great Recession, including across-the-board sequestration cuts, is a period most Virginians would rather not repeat.

- As of early 2010, near the worst point of the Great Recession, the U.S. had lost 6% of all pre-recession jobs, but Virginia had lost just 4%. And for a time, Virginia was recovering from the recession at a similar pace to the U.S. as a whole.

- This changed in early 2013, when the federal government moved into a period of austerity, causing Virginia’s job creation to slow while the U.S. as a whole continued adding jobs. State income tax payments by federal contractors dropped, causing shortfalls in Virginia’s tax revenue.

- Sequestration, which would mean automatic across-the-board cuts, could kick in on May 1 if Congress does not pass appropriations bills by April 30. This would result in 1% cuts to defense and non-defense spending.

Options for Virginia Policymakers

Given the importance of federal services and jobs for Virginia’s families and communities, many of our elected officials are already working to respond to funding threats from federal officials. This includes votes by some in Virginia’s congressional delegation against the House budget resolution that would take away health care, food assistance, economic investments, and other federal services that help Virginia families every day. State lawmakers are also preparing for the likely but still unknown economic, fiscal, and human costs of federal changes.

The budget passed by state legislators on February 22 included several provisions to put Virginia in a position to respond more nimbly to federal changes. This includes:

- Reserving any surplus revenue from fiscal year 2025, after any constitutionally required revenue reserve deposit and a $20 million contingent reserve to offset costs to colleges for tuition waivers for some military families, to respond to impacts of federal funding changes.

- Creating a process for addressing impacts of federal tax changes that would result in revenue reductions.

- Creating a process for addressing impacts of federal grant reductions, including requiring the Department of Planning and Budget to provide estimated fiscal impact of federal grant revenue reductions over $100 million and stating that if federal grant reductions result in required General Fund expenditures that are more than 1% of the General Fund operating budget, the governor is required to consult with legislature leadership on the need for a special session.

- Mostly rescinding rolling conformity to changes in the federal tax code, thereby preserving more control by the legislature and governor over Virginia tax policy.

Additionally, the House has established a bipartisan Emergency Committee on the Impacts of Federal Workforce and Funding Reductions. They also passed changes to the rules governing the ongoing 2024 Special Session I to allow legislators to consider any “bill or joint resolution addressing the impacts upon the Commonwealth, its budget, and its services due to layoffs, firings, or reductions in force by the federal government, changes to federal government programs, actions of the Department of Government Efficiency, and other actions affecting the Commonwealth relating to the federal budget may be offered and considered during the 2024 Special Session I of the General Assembly.”

Should lawmakers need to consider changes to the state budget during a special session or Virginia’s April 2 “reconvened” session due to proposed budget amendments or line-item vetoes by the governor, they should prioritize maintaining some fiscal flexibility while preserving the things that we know help stabilize families during hard times and build a stronger economy for the long term.

More specifically, if it is clear in the next few months that federal actions will result in a significant reduction in Virginia tax revenue, disruptions in federal grants to Virginia, and/or increased need for targeted economic support for impacted Virginia families, policymakers could consider unallotting the planned non-refundable fall 2025 income tax rebates or more narrowly focusing the rebates on families who need it most. The remaining resources could then be used to strengthen the state’s revenue reserve or for short-term responses to stabilize Virginia families and communities. This should be done carefully to avoid creating a structural deficit, and might draw on the example of the 2012 Federal Action Contingency Trust (FACT) Fund introduced by then Governor Bob McDonnell that was established to flexibly respond to the impacts of sequestration and Base Realignment and Closure (BRAC).

Should the impact of federal cuts be significant enough to require additional resources, or if it appears likely to continue for several years, policymakers should use a balanced approach to closing any revenue shortfall. This could include drawing from Virginia’s existing revenue stabilization and revenue reserve funds, as well as raising new revenues by asking the wealthiest households to pay their fair share.

Whether you work as a federal employee/contractor, access health coverage through Medicaid/FAMIS, or send your kids to public school, federal funding decisions impact each and every one of our communities in Virginia. Upcoming short-term and more serious long-term threats to federal funding have an outsized impact on the commonwealth. Virginia’s congressional delegation should reject budget proposals that include funding cuts to programs and grants that so many of us rely on. Our state lawmakers have put some guardrails in place to help respond to any potential cuts, and there are still more options to consider to shield Virginia from worst-case scenarios in the event of substantial budget impacts from federal actions.