July 16, 2025

Virginia Impact Report: How the Congressional Reconciliation Bill will Impact Our Communities

We all want to live in a place where people have enough to eat and can access medical care when they are sick. When people are paid too little to afford healthy food and their jobs don’t offer health insurance, programs like Medicaid and SNAP help families meet their basic needs. Leaders in Congress rushed through legislation to make major cuts and add red tape to these programs. For Virginia families who need help accessing health coverage and paying for healthy food, the changes are alarming. Still, it’s important to remember that most changes won’t take effect right away. People should continue to access the help they need to care for themselves and their families. Looking ahead, state lawmakers should prioritize investments in programs that mitigate the harm of federal choices, help families meet their basic needs, and make Virginia a place where everyone can thrive — no exceptions.

Health Care

- Medicaid helps individuals and families with low incomes access affordable and comprehensive health coverage.

- The reconciliation bill signed into law cuts more than $1 trillion from Medicaid over 10 years, and the bill as a whole would result in 11.8 million people losing health insurance by 2034. Federal lawmakers also did not extend enhanced premium tax credits on the ACA marketplace, which, together with a rule the Trump administration recently finalized, is estimated to result in another 5.1 million people losing health coverage and becoming uninsured. This results in approximately 17 million people being kicked off of Medicaid and ACA health coverage nationally, leaving them uninsured.

- Recent analysis estimates roughly 323,000 people in Virginia would lose Medicaid or ACA marketplace coverage due to provisions in the bill and the failure to extend the enhanced premium tax credits. Policies included in the House bill – similar but not identical to the final bill – were expected to result in coverage loss for children, people with disabilities, and adults aged 65 and older.

- The reconciliation bill includes new and onerous work reporting requirements for individuals accessing health coverage through Medicaid expansion. These are set to go into effect no later than December 31, 2026, or earlier if states choose. The Secretary of Health and Human Services may exempt states from complying with this provision until December 31, 2028, if the state demonstrates a good faith effort toward complying.

- Nationally, 92% of adults under 65 who are enrolled in Medicaid and do not receive SSI or SSDI work for pay, attend school, care for family members, or have a disability.

- During each eligibility check, people must prove 80 hours of work, community service, or education in a given month. The proposal contains carveouts for parents of children under 14, people taking care of a disabled adult, those experiencing severe illness, and more.

- Unfortunately, previous experience with Medicaid work requirements has shown that even those who should be exempt can be denied coverage due to administrative errors or barriers.

- In Virginia, 187,000 people could lose coverage due to the work reporting requirement provision. That’s almost 1 in 3 (32%) of all adults currently accessing coverage through Medicaid expansion in Virginia.

- The bill requires states to impose new cost-sharing for certain services. Over 147,000 people would have to pay new out-of-pocket costs to access certain health care services.

- New co-pays of up to $35 will be charged to access certain health services for individuals accessing health coverage through Medicaid expansion and earning above the federal poverty limit, capped at 5% of the family’s income.

- For a family of three just above the federal poverty limit (101% of FPL =$26,916), this new provision could cost them up to $1,345 a year.

- The new cost-sharing provision goes into effect October 1, 2028.

- The bill includes increased frequency of eligibility checks for people enrolled in Medicaid expansion coverage. Instead of once per year, the bill would require redeterminations every six months. This will increase already-strained Department of Social Services caseloads by requiring over half a million additional renewals a year. This is set to go into effect January 1, 2027.

- Beginning October 1, 2026, the bill newly excludes several groups of immigrants with lawful status, including refugees and asylees, from Medicaid, Medicare, and subsidized ACA marketplace eligibility.

SNAP

- SNAP helps families pay for their most basic needs.

- The GOP reconciliation bill will take money out of the pocket of every Virginia family who gets help paying for food, making it harder to make ends meet at the end of the month. It will:

- harm every family who gets help from SNAP by ignoring evidence of the growing cost of a healthy diet beyond regular inflation,

- impose new paperwork burdens, including making calculations of utility deductions more complicated and expanding the harsh work requirement to families who are currently exempt because they have teenage children, live in areas with few available jobs, or are at an age when working many jobs becomes physically impossible, and

- remove all help from many lawful permanent residents, including refugees, people who have been granted asylum, and victims of certain serious crimes (people without lawful residency are already ineligible for SNAP).

- These changes to SNAP that harm families could go into effect as soon as the U.S. Department of Agriculture issues guidance and Virginia DSS makes the relevant changes to their processes and systems.

- The GOP bill would also likely shift $352 million of federal costs onto the state of Virginia, making it harder for Virginia to meet the needs of its residents at the very time that the Trump administration’s arbitrary firings of federal workers is hurting the Virginia economy. About $89 million of this cost shift onto the state of Virginia will begin October 1, 2026, with the remaining beginning October 1, 2027.

- Families with children are 2 out of every 3 Virginia families who use SNAP to help buy food.

- Families with children who are struggling to make ends meet typically receive $506 a month in SNAP benefits. That’s money that makes a real difference for families. SNAP lifted 104,000 people above the poverty line in Virginia, including 42,000 children, per year between 2015 and 2019, on average.

- Children whose families receive SNAP are more likely to graduate from high school and have lower rates of heart disease years after their families received help buying food.

- Over 133,000 Black families in Virginia receive SNAP to help pay for food. That’s 1 in every 5 Black families in our state.

- Many families across the state need SNAP to help put food on the table. This includes:

Tax

- Tax policy affects our shared resources, and some tax policy choices can provide needed support for individuals and families struggling to make ends meet on a paycheck-to-paycheck basis.

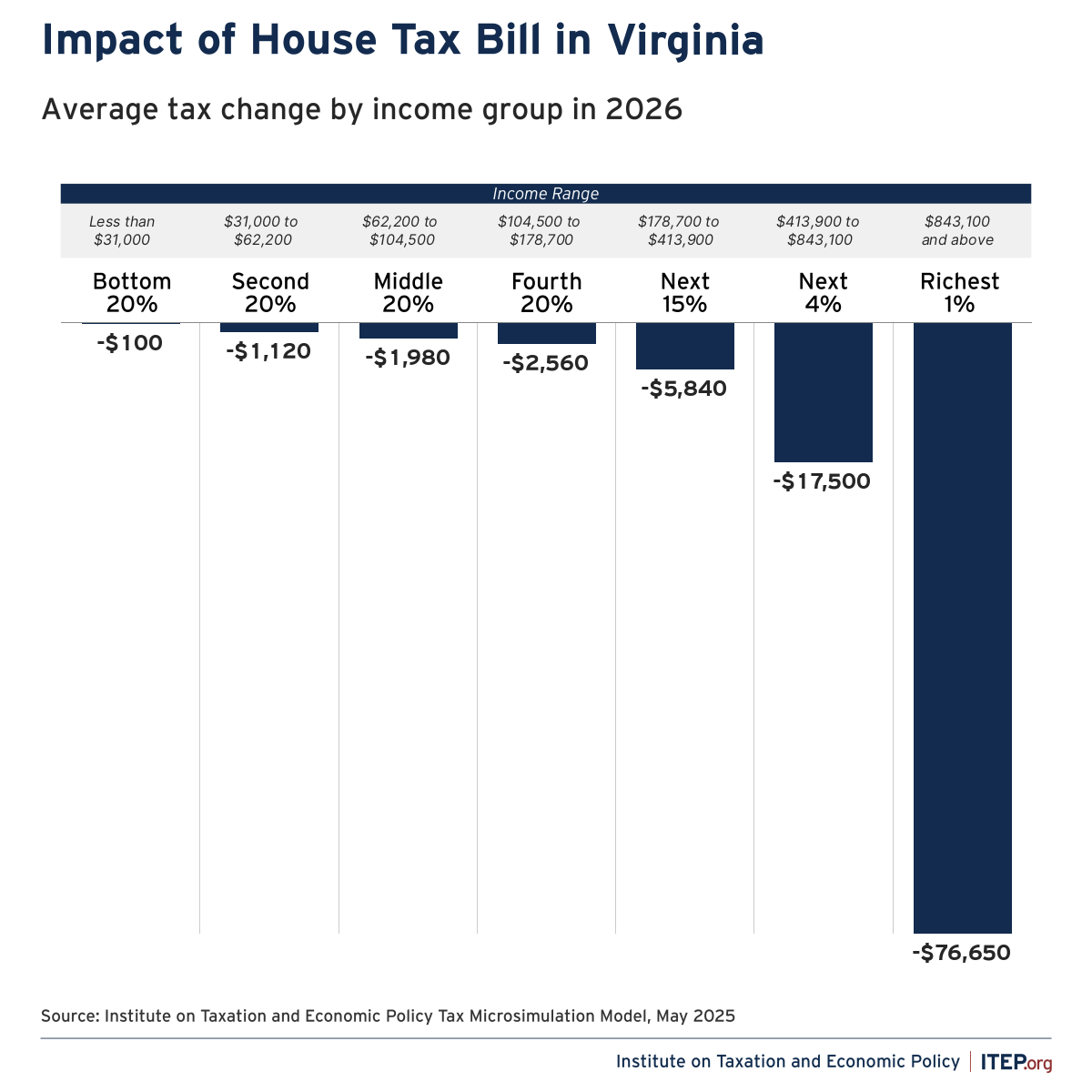

- The GOP reconciliation bill will further concentrate wealth into the hands of the already rich, giving huge tax cuts to millionaires and billionaires.

- New analysis by ITEP of the final bill shows that in 2026, over 70% of the GOP’s tax cuts will go to the richest 20% of households in the country. Less than 1% of the cut will go toward families in the bottom 20% of incomes.

- In Virginia, families in the bottom 20% of incomes, making less than $31,000 a year, will see, on average, no tax cut. Those with the highest incomes, making $843,100 or more a year, will see an average tax cut of $78,530. That’s about 4.8 times the average annual income for a family in the bottom 20% of incomes ($16,300).

- The GOP bill increases the maximum federal Child Tax Credit by $200 per child.

- However, this excludes the 342,000 children in Virginia who are already left out of the full Child Tax Credit, including 127,000 who are Black and 57,000 who are Latino. Their families will get nothing from the proposed increase, simply because their incomes are already too low to qualify for the current full credit, despite families with higher incomes being able to benefit.

- The bill will exclude children who are currently eligible for the Child Tax Credit (CTC) by requiring that at least one parent have a Social Security Number (SSN), in addition to the current requirement that the child have a Social Security Number. An earlier estimate found that requiring parents to have a SSN would exclude 87,000 U.S. citizen and lawfully residing children in Virginia from the CTC.