February 13, 2024

Tax Policy in Virginia

When we invest together in the foundations that benefit all of us, our communities thrive. Intentional policy decisions made over generations have maintained a society where a few thrive while many do not — the results of these choices were magnified by the COVID-19 health and economic crisis. By choosing a better path, where sufficient public resources are invested into our communities and families, state policymakers can help to advance equity and opportunity across Virginia.

Black and Latino people face tremendous barriers in areas like employment, education, and housing. These barriers include explicitly racist policies like school segregation as well as policies that appear “race-neutral” yet reinforce or exacerbate racially inequitable outcomes. Virginia’s upside-down tax code is no different.

A more progressive and racially equitable tax code — one that closes corporate loopholes and ensures that the wealthy pay their fair share — would help people of color in the state, especially Black and Latino Virginians, and provide resources to achieve our shared goals.

Flipping Virginia’s Upside-down Tax System

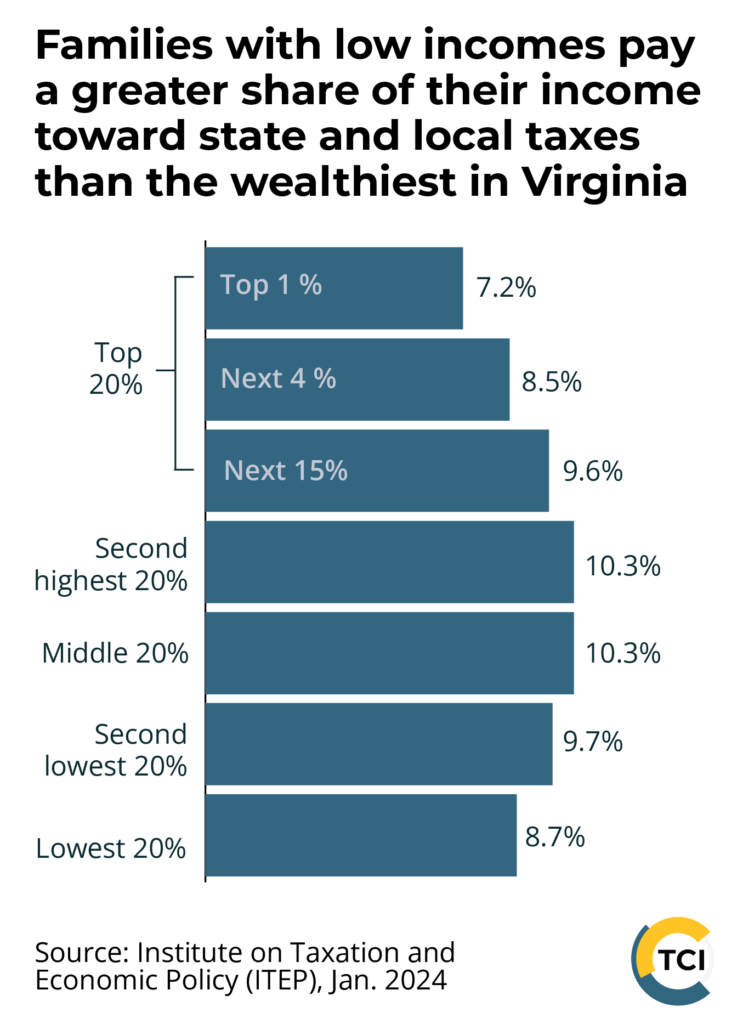

Virginia’s state and local tax system is upside-down, or regressive, where those with less pay a greater share of their incomes in taxes. The current tax code worsens existing racial inequality.

With a progressive tax code, people pay a higher tax rate as their ability to pay increases.

State Tax Policy

Income tax

Individual income tax accounts for nearly 70% of state General Fund revenues, the main flexible funds in the state budget that legislators can allocate (unlike federal or state funds that are dedicated to certain purposes).

Virginia’s individual income tax resembles a flat tax, because most taxpayers are in the same tax bracket. Virginia’s current income tax brackets and corresponding rates were enacted in the late 1980s and phased in over several years. The top rate of 5.75% begins at taxable incomes above $17,000, which means millionaires are in the same tax bracket as millions of Virginians with low and moderate incomes.

Virginia prohibits local income taxes. Localities must rely on regressive taxes such as sales and property taxes and on state and federal funds.

Sales and excise taxes

Sales taxes apply generally, while excise taxes apply to specific items like cigarettes or fuel. These are key revenue sources in Virginia, but because households with low and moderate incomes tend to spend more of their income on basics like food, gas, and clothing, these taxes tend to be regressive. Meanwhile households with higher incomes can save more of their income or spend on untaxed services, and so pay a lower share of their income on these taxes. Sales and excise taxes in particular exacerbate existing racial income inequality for Black and Latino taxpayers in Virginia. A modernized sales tax that applies to services and digital products would cover a broader, more balanced mix of consumer spending.

Corporate income tax

Virginia currently taxes corporate profits at a flat 6%. However, the current state tax code allows large, multi-state corporations to use accounting maneuvers and loopholes to reduce their state income tax liability by shifting profits to other states. Corporations also have access to various federal and state tax breaks that reduce their tax bills, sometimes to zero.

63%

of Virginia corporations pay zero corporate income tax

Combating corporate tax avoidance would likely also reduce racial inequality because white households receive outsized benefits from the status quo due to greater likelihood of owning stock (and in larger amounts) than Black and Latino households. Research suggests that state corporate income taxes are, in large part, taxes on shareholders based on who ultimately pays the tax. Median wealth among white households is 8 times greater than median wealth among Black households and 5 times greater than that of Latino households according to recent Federal Reserve data, which pre-dates the impacts of COVID-19.

Refundable credits for families

The federal Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) are proven tools to boost family incomes.

Virginia provides a state EITC up to 20% of a family’s federal EITC, with an option to fully access up to 15% of the federal credit through a refund. Making the credit partially refundable in 2022 will put hundreds of dollars on average into the pockets of eligible families who need it most, helping families keep the lights on and put food on the table. Research has shown that refundable credits, in particular, have long-term benefits for education and health outcomes.

Improving the state’s EITC is one step toward a more equitable tax system. Increased refundability will help to boost incomes for working families across the state, particularly Black and Latino families, and help to address long-standing wage gaps that persist for Black and Latino working people.

Virginia can further improve the EITC and could also enact a refundable CTC to boost family incomes even further and help families better afford basics like child care, transportation, and food.

Data note: TCI strives to disaggregate data by race and ethnicity to the greatest extent possible. Due to small sample sizes and other limitations, disaggregated data is not always available for all races and ethnicities. We acknowledge that this poses problems and can mask additional inequities, and that lack of data occurs within a broader context of cultural erasure. TCI is working to improve internal data practices within the organization while also advocating for better and more inclusive data practices at government agencies and other entities.