January 8, 2019

Better Together: Virginia Should Help Make Work Pay by Strengthening Both the Minimum Wage and Earned Income Tax Credit

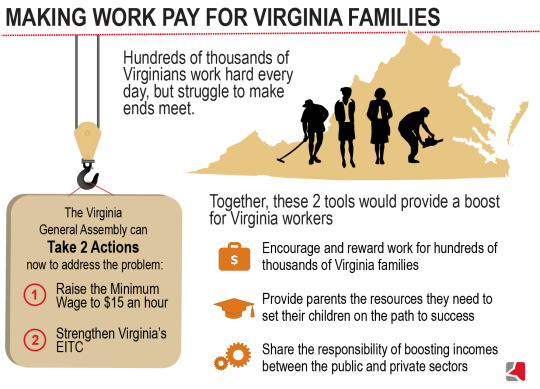

Every child in Virginia should go to sleep at night without worrying about whether there will be food for a full day’s meals, and every Virginia parent should know that if they go out and work a full-time job they’ll bring home enough to feed their family and keep a roof overhead. But for too many families, that isn’t the case – not because they’re not trying hard, but because their job doesn’t pay enough to make ends meet. Two of the most-discussed ways to help make sure work pays for every family are raising the minimum wage and improving the earned income tax credit. These proposals, rather than being alternatives, have been shown to work better together by complementing and strengthening the income-boosting and work-encouraging aspects of each. Together, strengthening the minimum wage and earned income tax credit would boost incomes, widen the path into the middle class, and put children on a path to a better life.

Work Isn’t Paying Enough to Make Ends Meet for Too Many Virginia Families

While some people in Virginia are poor because they don’t have a job, almost two-thirds of Virginia families with incomes below the poverty threshold – $20,780 for a family of three – have at least one adult in the household who is working. And there are around 273,000 working adults living in Virginia households with incomes below the poverty threshold. Hundreds of thousands of additional families in Virginia have incomes that are above the official poverty threshold, yet they struggle to make ends meet due to the high cost of living in so many parts of Virginia.

And the problem of wages that are too low to make ends meet is particularly acute for families of color who have faced barriers such as under-resourced schools and discrimination in the job market. While wages for Black and Hispanic workers in the United States (let alone Virginia) have never matched white wages, in recent years it’s actually gotten worse. The typical white worker made almost $22 an hour in 2017, $0.82 more per hour than in 2007 after adjusting for inflation, while Black and Hispanic workers typically made only about $15 an hour, $0.58 and $0.31 less, respectively, than in 2007.

Making work pay is particularly important for families with children because research shows that when working parents are better able to meet the needs of their children, those children go on to do better in school and earn more in adulthood, setting all of us up for a brighter future.

Raising the Minimum Wage Would Increase Take-Home Pay for Hundreds of Thousands of Working Virginians

Virginia’s current minimum wage, set at the federal minimum of $7.25 an hour, is the lowest in the country compared to both the statewide median hourly wage and the typical cost of living in the state as measured by the MIT living wage index. As a result, while Virginia is a high-wage state for people at the high end, we’re a below-average state for wages for workers at the lower end.

Raising Virginia’s minimum wage to $15 an hour by 2024 would directly boost wages for about 786,000 working Virginians who would otherwise make under that amount, and would indirectly increase wages for another 524,000 working Virginians who would benefit from employers seeking to continue rewarding seniority, according to an April 2017 report by the Economic Policy Institute. (Because Virginia saw some real wage increases among lower-income workers during 2017 and likely will again in 2018, the number of people expected to directly and indirectly benefit from increasing the minimum wage to $15 will be somewhat lower than those estimates.) In total, about one in three working Virginians would see their wages increase through raising the minimum wage to $15 with a reasonable phase-in schedule.

The vast majority of working Virginians (nine out of 10) who would benefit are not teenagers, the majority (60 percent) work full-time, and almost half (49 percent) have at least some college education.

More than one in four Virginia children has at least one parent who would benefit from increasing the state minimum wage to $15 an hour. And between 40 and 50 percent of Black and Hispanic workers are expected to benefit.

And most academic literature on the impact of raising the minimum wage shows that reasonable increases have little to no impact on employment levels and positive impacts on total income for working families, including reducing poverty rates. The importance of raising the minimum wage – or at least restoring it to its 1968 level – is particularly striking for communities of color. Nationally, Black and Hispanic poverty rates would be almost 20 percent lower had the minimum wage remained at its 1968 inflation-adjusted level.

Strengthening the EITC Would Provide a Targeted Boost for Low-Income Working Families with Children

The Earned Income Tax Credit (EITC) helps 600,000 hardworking Virginia families with low and moderate incomes get the resources they need to get to their jobs, keep the lights and heat on, and put food on the table. And this added stability helps set children on a path to a successful adulthood. In general, families in Virginia who qualify for the federal EITC also can claim the state EITC, and many do. But Virginia unnecessarily restricts its current work credit, preventing many families from receiving the full value that they’ve earned, leaving many hard working families economically unsteady. Strengthening Virginia’s EITC by making it refundable would go a long way to boosting the economic security of working Virginians, particularly working families with children.

An extensive body of research shows the EITC rewards and encourages work. Past EITC expansions increased work rates among unmarried mothers and helped them enter or remain in the workforce. Earnings also grew faster for women who were eligible for previous EITC expansions relative to similarly situated women who were not. In addition, the increased time spent in the labor force results in greater Social Security benefits for women, which reduces poverty among women later in life. Making the state EITC refundable would also help balance out Virginia’s upside-down tax system.

Better Together

Improving the minimum wage and earned income tax credit, rather than being a one-or-the-other choice, works best when done together. While strengthening the earned income tax credit would primarily benefit families with children, including many working parents who make above the minimum wage yet struggle to make ends meet, raising the minimum wage would primarily benefit the lowest-wage workers, including many working adults who do not have dependent children. And both would benefit working parents who currently have very low wages, providing an extra boost to the families who need it the most. That’s because for many low-income working parents, the value of a family’s EITC grows as their wages increase. For example, a mother who works 25 hours a week while her two children are in school would see her Virginia earned income tax credit grow from $832 to $1,108 as her wages grew from $8 an hour to $15 an hour, but would only get the full benefit of the $1,108 if Virginia’s EITC is strengthened through refundability.

Raising the minimum wage and making the earned income tax credit refundable also represents a balanced, shared-responsibility model of making sure work pays for every Virginian. While employers of low-wage workers would primarily pay the cost of a reasonable increase of the minimum wage, the state would pay the cost of making the earned income tax credit refundable. (There would also be some public savings from both proposals due to reduced need for public services such as help with putting food on the table.) And the two proposals work on different schedules, with a higher minimum wage providing families a boost every payday to help with covering regular bills while the earned income tax credit provides a once-a-year tax refund that can be used to pay off car repair bills or cover a security deposit to move into more stable housing.

Strengthening either the minimum wage or earned income tax credit would help move Virginia toward a commonwealth with real opportunity for every Virginian. Doing both would be even more powerful – encouraging work and raising incomes for hard-working Virginians, providing an extra boost for the lowest-wage working parents and their children, helping work pay for today’s parents, and setting their children on a path for success.

Category:

Budget & Revenue