August 28, 2019

Federal Proposal Would Boost Working People throughout Virginia’s Economy

As Labor Day approaches and we celebrate the contributions and achievements of working people, we must also acknowledge the barriers that many continue to face. The current economic expansion is the longest on record, yet many working households still struggle to make ends meet and cover the basics. Nearly two-thirds of families with incomes below the federal poverty threshold have at least one adult who is working. Stubbornly low wages are a big part of the problem. Part of the solution — improving work and child tax credits — could boost the income of many who are working in occupations that are critical to our economy and communities.

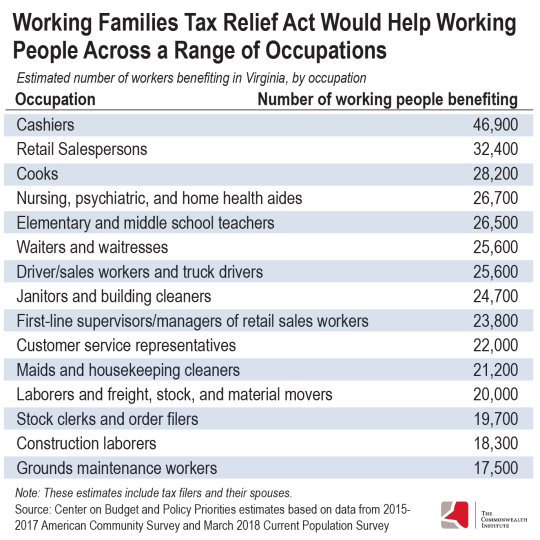

New analysis shows that a federal proposal, the Working Families Tax Relief Act, would help working people in Virginia across occupation types, particularly in the service sector, as well as teachers and health care workers.

The problem of low wages particularly affects Black and Latinx working people who often face employment barriers and other forms of discrimination. Over 50% of Black and Latinx workers in Virginia are paid low wages, and little progress has been made over the past decade. Black workers were paid only $0.95 more per hour in 2018 compared to 2008, and Latinx workers were actually paid less compared to 2008 (adjusted for inflation).

Lawmakers have policy tools available to boost family incomes. Refundable tax credits — like the federal Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) — are among the most effective anti-poverty policies on the books. That’s because refundable credits allow filers to receive some or all of the value of the credit, even if the value exceeds their federal income tax owed. About 600,000 of Virginia’s working families receive the federal EITC, and over 400,000 families receive the portion of the CTC provided to families with low incomes. At the federal level, Virginia’s congressional delegation has an opportunity to do more to support families in Virginia by backing the Working Families Tax Relief Act, which would substantially strengthen both credits.

The Act would make needed improvements to both credits like eliminating strict age and income requirements under current law. The proposal also makes the CTC fully refundable and provides an additional amount for children under the age of six. Expanded eligibility for the EITC and a fully refundable CTC would boost incomes for working people across Virginia. Roughly two-thirds of Virginia households with incomes less than $24,500 would see, on average, an income boost of almost $1,800.

Under this proposal, a single mom of two kids who works as a cook (income of $20,000) would get a $3,700 boost. And a retail worker and a home health aide who are married and have two children under the age of six and family income of $45,000 would get a $3,500 boost. That means more financial security for working people and their families.

Strengthening the EITC and CTC would give an income boost to the working families who often aren’t the winners of big tax policy decisions. And there has been positive momentum in Congress. In April, Sens. Warner and Kaine announced that they had signed on as co-sponsors of the Senate version of the legislation. The House version of the proposal was introduced earlier this summer. We ask that every member of Virginia’s congressional delegation support the Working Families Tax Relief Act.

Category:

Budget & Revenue