August 17, 2020

Federal Spending Likely to Continue Stabilizing Virginia’s Economy and State Revenue Through Recession

Virginia has long benefited from the federal government, largely due to the proximity of Washington, D.C. Out of all U.S. states, Virginia ranks first in federal spending per capita, according to a report by the Rockefeller Institute for Government. As lawmakers prepare to come together for a special session on August 18, where they will reconsider a number of budget items that were frozen, or “unallotted”, during the April reconvened session, they should keep in mind that Virginia’s economy is heavily influenced by federal spending. Federal jobs are providing a stabilizing effect for Virginia’s economy and state revenue, and this stabilizing effect is likely to continue for some time, reducing the need for state leaders to make pessimistic revenue assumptions and deep cuts to the state budget.

The federal government heavily influences Virginia’s economic activity. In 2017, Virginia ranked fourth among U.S. states in the share of GDP attributed to military and federal civilian activity. While the federal government’s share in Virginia’s GDP has declined over the last two decades, the federal government still accounted for about 1 out of every 5 dollars of economic activity in the state in 2018.

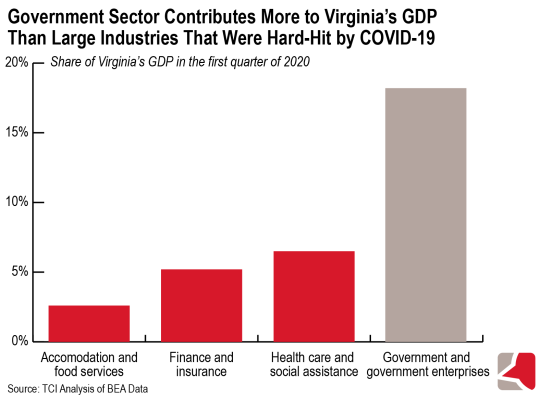

Because it relies more on federal spending than on sectors that may have been more affected by the COVID-19 pandemic, Virginia’s economy has been hit less hard by the recession than many other states. While real GDP decreased by an average of 5% in the United States in the first quarter of 2020, it decreased by only 3.8% in Virginia. The accommodation and food services, finance and insurance, and health care and social assistance industries that were hard-hit by necessary shutdowns were the leading contributors to the decrease in GDP nationally. Those sectors made up just 2.6%, 5.2%, and 6.5% of Virginia’s GDP, respectively, while government and government enterprises (which includes federal, state, and local) made up 18.2% of Virginia’s GDP in the first quarter of 2020.

Businesses and working people in the hardest-hit sectors are experiencing real challenges that Virginia policymakers should address through additional assistance. The good news is that substantial government spending, which has continued to bolster Virginia’s economy during the recession, can stabilize state revenue and help policymakers meet those needs.

As with GDP, employment in Virginia has remained higher than in much of the United States. Since the start of the economic downturn caused by COVID-19, Virginia’s unemployment rate has been consistently lower than the U.S. unemployment rate – it was 8.4% in Virginia in June, compared to 11.1% nationally. The presence of federal jobs and businesses that contract with the federal government have contributed heavily to these employment outcomes. Federal employment makes up a much greater share of jobs in Virginia than in the United States as a whole – in 2018, federal civilian and military employment accounted for 6.3% of total employment in Virginia and only 2.4% of jobs nationally. Employment in the federal civilian and military sectors made up 8.2% of Virginia’s total personal income in the first quarter of 2020, a larger share than each of the three industries that were the leading contributors to the decrease in GDP nationally. Virginia’s reliance on federal government employment, which has not been heavily impacted by the current downtown, has allowed it to maintain lower levels of unemployment than many other states.

This will not come as a comfort to the individuals and families in the accommodation and food services and other sectors heavily impacted by COVID-19, including those that have been laid off. Yet it is a positive for state revenues in Virginia – revenues which can and should be used to provide needed housing, economic security, and health care for these same individuals.

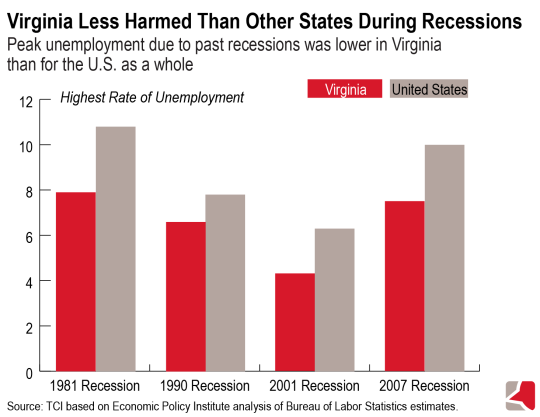

Virginia has historically out-performed other states during recessions, with the state unemployment rate generally staying below the national unemployment rate. This was also true during the last recession: Virginia’s economy wasn’t as hard-hit as the national economy until federal government cuts started after the official end of the recession. While 6.3% of jobs were lost nationally during the recession, Virginia’s rate of job loss was lower at 5%. But when the federal government moved into a period of austerity in 2013, Virginia’s job creation began to slow. The same trend occurred in Maryland and D.C., also heavily reliant on federal spending. This indicates that in the absence of significant federal government cuts, Virginia has the potential to maintain a stronger economy than most other states even through a recession.

On August 18, lawmakers will consider a set of amendments to the state budget, including whether to continue the choice in the spring to remove funding for almost all new initiatives or to take a more balanced approach. But first, policymakers must determine what assumptions to make about Virginia’s economy now and in the near future. When considering future revenue projections and whether to set funds aside in anticipation of future revenue shortfalls, lawmakers should remember that Virginia’s economy relies more on robust federal spending than on revenue from those industries most affected by COVID-19. By freezing all new state spending, policymakers would be undoing much of the important progress toward a more equitable Virginia that was made during the 2020 legislative session. Instead, they should prioritize restoring initiatives that take important steps to remove barriers facing low-income families and communities of color – and allow everyone in Virginia to move forward together.

Categories:

Budget & Revenue, Economic Opportunity